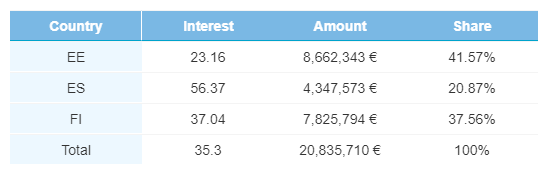

The fourth quarter of 2019 started off with a bang for Bondora. With €20,835,710 in originations this month to 7,363 borrowers, Bondora shattered the previous monthly origination record set in September.

Country Breakdown

Estonian originations were the biggest contributor to the record origination numbers. Total originations in Estonia were up by 58.7% to €8,662,343. Spanish originations also increased to €4,347,573 in October, a gain of 33.2%.

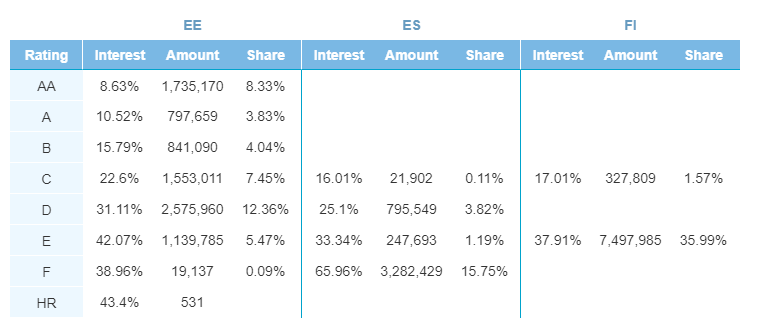

There was a change in the distribution of Bondora originations in October. Estonian AA rated originations grew to €1,735,170. Finish originations consolidated to C and E rated loans, with E rated loans accounting for 36.0% of all originations, the highest category across the platform. In Spain, HR rated loans were not issued in October, while D, E, and F rated loans saw increases in their originations.

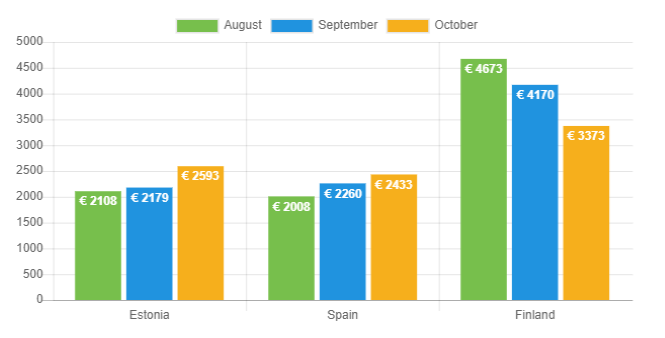

Loan Amounts

The average loan amount in Finland decreased. Finnish originations averaged €3,373 in October, well below the average for the previous two months of €4,170 and €4,673. However, this trend was not shared across the board. Estonian loans averaged €2,593, up 16.0%, while Spanish originations were, on average, up by 7.7% to €2,433.

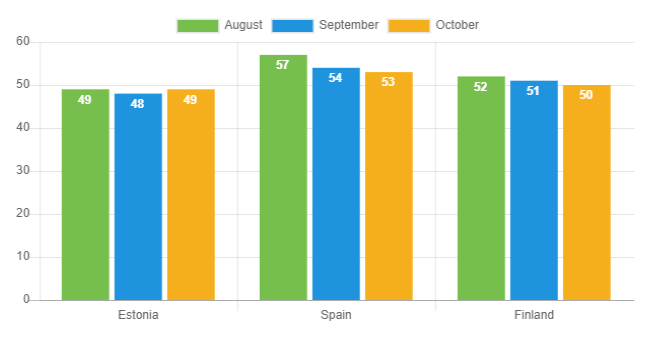

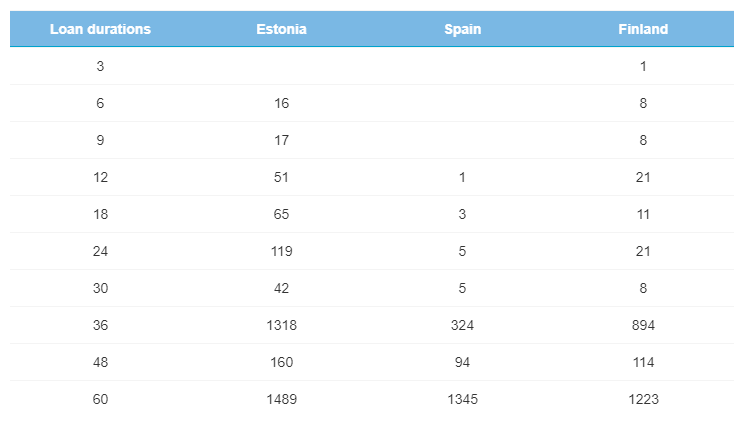

Loan Duration

The average loan duration in Spain and Finland both fell by one month to 53-months in Spain and 50-months in Finland. Alternatively, Estonian loans averaged 49-months in duration, up one month from September.

Loan durations did not change significantly this month in proportion to September. The majority of loans across all Bondora origination countries remain at 36 or 60 months in duration, while 3-month originations were all but eliminated in the month.

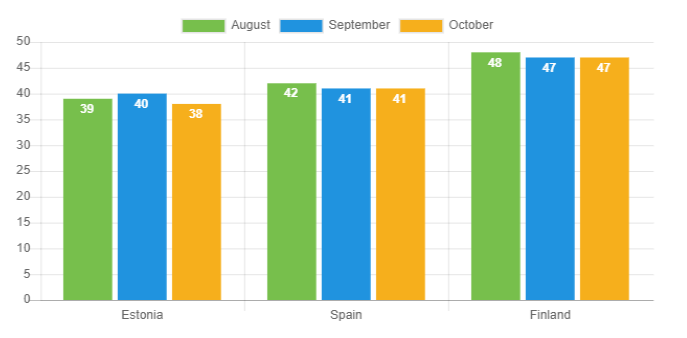

Average Age

Bondora borrowers in Estonia were younger than previous months, coming in at an average age of 38-years old. Spanish and Finnish borrowers were, on average, the same age as in September.

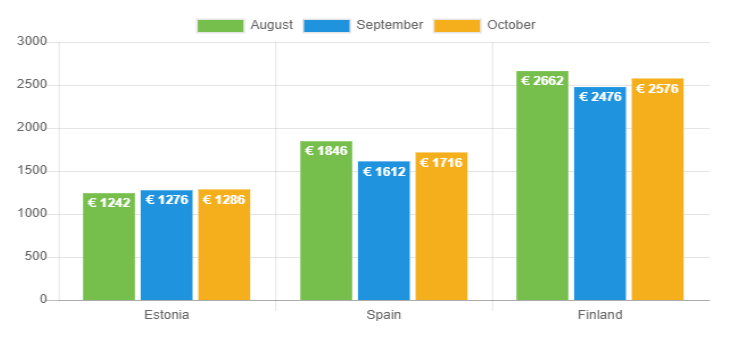

Income

Spanish incomes rose the most in October, gaining 6.5% to €1,716. Finnish incomes were also higher, up to €2,576, while incomes in Estonia were relatively unchanged, sitting at €1,286.

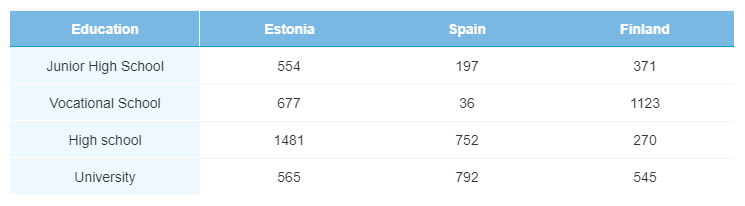

Education

The increase of vocational school education from Finnish borrowers held steady in October. More Spanish borrowers (44.6%) had a university education than last month.

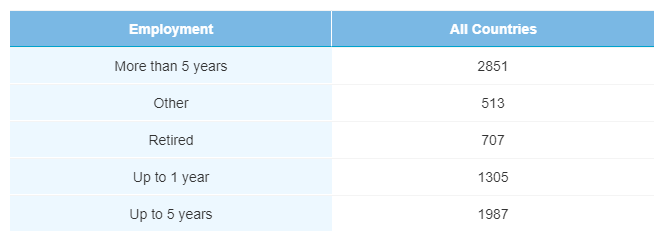

Employment

38.7% of all Bondora borrowers have been employed more than 5-years, and when including borrowers who have been employed up to 5-years, that number jumps to 65.7%.

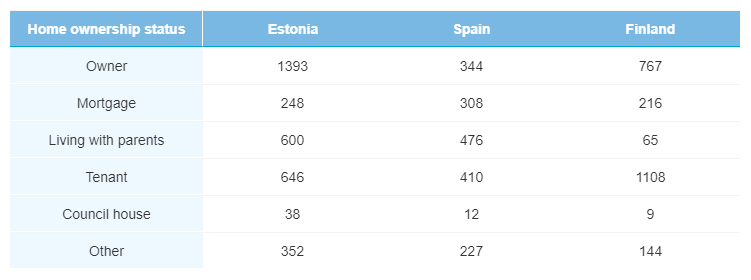

Home Ownership Status

For the second straight month, a higher ration of borrowers in Finland (48.0%) were tenants. Homeownership continues to remain the most common in Estonia, where 42.5% of all Estonian borrowers are homeowners.

Verification Status

Out of all Estonian borrowers, 46.6% were verified, an increase of 2.1% from September. Alternatively, there was a slight decrease in the verification of Finnish borrowers, which totaled 66.5% compared to 69.1% last month.

Surpassing €20 million

With over €20 million in originations in October, Bondora not only broke its previous monthly origination record, but it also grew originations from last month by a whopping 27.7%. Originations were even consolidated in Finland and Spain to less rating categories while still maintaining the same quality of origination data for Bondora borrowers.

Learn more about Bondora investment products here.