A new year is right around the corner. And while it might be time to put up your Christmas tree and get ready for the holiday season, it’s also time to start thinking about your financial goals for 2021 and beyond. Budgeting is a crucial aspect of maintaining financial freedom, and it’s never too early to start thinking about your budget for next year and how you can ensure that you are saving enough money.

When it comes to budgeting, there are two main approaches: micro budgeting and macro budgeting. Both approaches will provide insight into your current financial situation and improve how you set realistic future goals. Using both approaches together can lead to a better understanding of your current and future finances.

Micro budgeting

The idea behind micro budgeting is to examine your finances on a granular level. How much money do you spend daily or monthly on recurring expenses like food, utilities, rent, and other similar expenses? Concurrently, what is your monthly income, and is it steady or variable? Factoring in all these numbers, you can more easily create a reasonable budget for you to maintain.

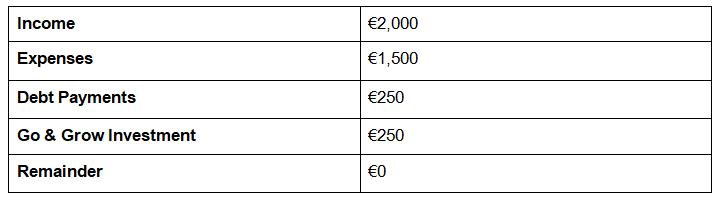

One strategy for micro budgeting is zero-based budgeting (ZBB). You might remember we discussed this in a previous blog post. In ZBB, all of your expenses are categorized into either expenses, savings, debt payments, investments, or other related categories. This way, you can account for all of your monthly income so that your income minus all expenditures on the month always comes out to zero.

Let’s look at an example of ZBB. Say you earned €2,000 per month. Over that time, you spent €1,500 on expenses like rent, food, and the like, and paid €250 in debt payments over the month. Using ZBB, we can see that you had €250 remaining to invest in your Bondora Go & Grow account, where you can grow that wealth even more over time. All of your money for the month is accounted for, and there is €0 leftover.

One of the biggest benefits of micro budgeting is using this information to help you make better choices. Imagine you budget €500 per month for food, but last month you notice that you spent €700 on food-related expenses. This is a signal for you to examine the food expenses from last month to see where your spending went overboard. There might have been an out of the ordinary circumstance that required you to spend more money, like a Christmas party, or it’s possible you found several expenses that can be cut. Maybe you went out to eat a few more times than you usually do, and if so, you can cut those expenses by making meals at home instead.

If you are intimidated by making your budget and following every expense, there are various tools to help you. Apps like Mint, You Need a Budget, and Personal Capital, are all technology tools you can use to build budgets and track all of your spendings in one place.

Macro budgeting

Instead of working deep into the nitty-gritty of your finances, you can also take a more top-level approach by way of macro budgeting. With macro budgeting, you aren’t looking at every single expenditure, and instead, looking at your long-term finances. Macro budgeting is most often analyzed every year but can also be looked at over an even longer time horizon.

Macro budgeting doesn’t worry itself about individual expenses so much as the overarching themes around spending and savings. Some macro budgeting questions to ask yourself are:

- What are my long-term financial goals?

- Did my spending last year exceed my budget?

- How much do I need to earn/save for retirement?

- What are my investment goals?

- Do I have any major upcoming expenses?

By planning for the long-term, macro budgeting keeps everything in perspective, helping you achieve your ultimate financial goals.

Micro and Macro, working together

For most people, budgeting on both a macro and micro level will be of the most value. Let’s see how these two budgeting techniques can work together to help you in your financial decision-making:

Let’s say at the beginning of the year you identify two big upcoming expenses: Replacing an old refrigerator and throwing a birthday party for your son. When the year starts, you use your macro budgeting skills to identify these large expenses. You do your research and budget the refrigerator’s cost at €1,000 and the birthday party at €200. Therefore, you can already see that you need to budget for an extra €1,200 during the entire year to afford these added expenditures.

Next, using micro budgeting, you figure out how you can save for these expenses. You calculate that you will need to save an extra €100 per month (€1,200 of added expenses x 12 months) to have the refrigerator and party paid in full. Next, you look at your past budgets and expenses to identify where your spending could be cut back. You notice that you can reduce the amount you spend on eating out by €50 per month, and can also save on your water and electricity bills by a combined €50 if you start to dry your dishes by hand instead of the dishwasher and hang out the laundry instead of running the dryer.

By first using macro budgeting to identify large expenses for the year and then using micro budgeting to figure out how you can save for those expenses over time, you have found a way to pay for added expenses without having to worry.

Planning ahead

Budgeting is all about planning. Whether you are using micro budgeting to plan for your spending on every purchase or using macro budgeting to plan for the next 30 years until retirement, both these tools will provide you with invaluable information to make better financial decisions.

Which approach will you take in 2021?