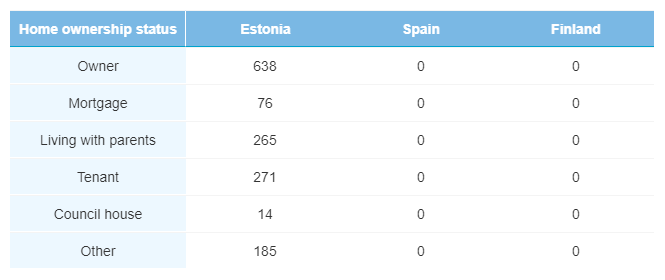

Given the current state of the global economy, Bondora has made a conscious decision to scale back originations as a whole, and temporarily suspend loan originations in Spain and Finland. This ensures that costs are not spread across different marketing activities and overall expenses for the company are kept low. Meanwhile, in Estonia, Bondora has a superb reputation and relationship with its customers and therefore does not need to spend money on marketing in order to continue originations in the country. It’s able to generate organic web traffic and interest without spending on marketing to attain new customers, and can continue to operate in Estonia with little costs incurred.

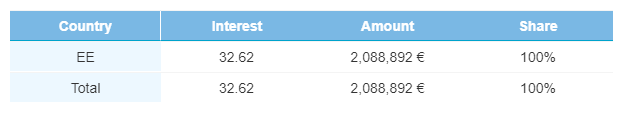

As a result, even though loan originations in April were significantly lower than in March, this decrease was planned. In total, €2,088,892 were originated in Estonian loans over the month.

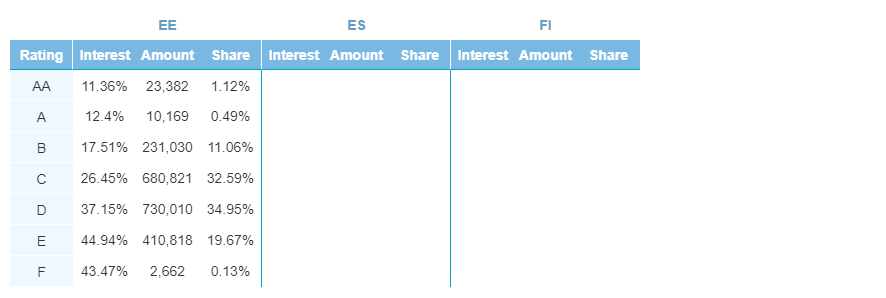

Consistent with last month, D rated loan in Estonia had the highest originations, garnering 32.59% of all originations. In April, more E rated loans (€995,765) were originated than C rated loans (€680,821), a trend change from March.

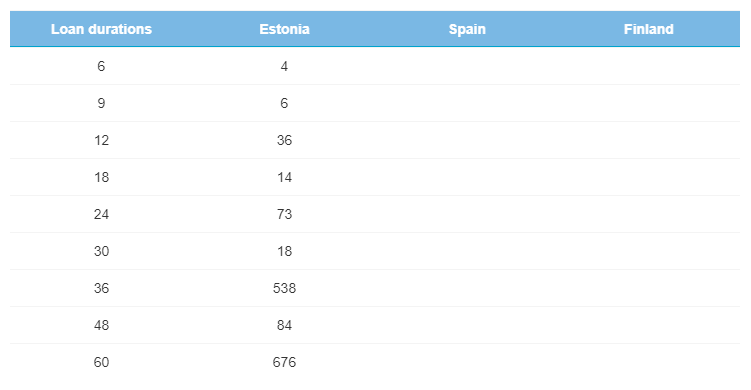

Loan amounts and durations decrease

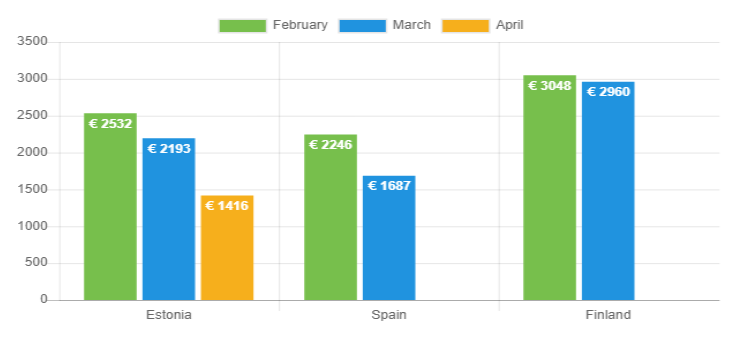

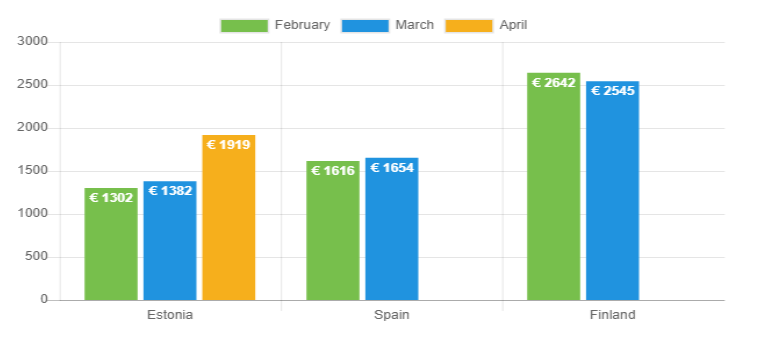

Borrowers were provided less, on average, than a month ago. Estonian borrowers, who averaged €2,193 per origination in March, averaged €1,416 this month, a decline of 35.4%.

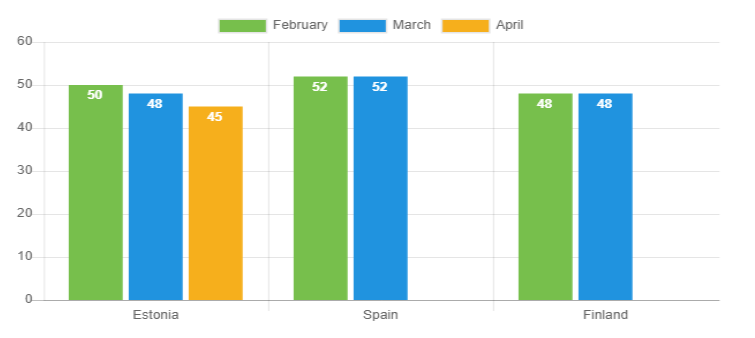

The same trend can be seen in loan durations, as the average Estonian origination came in at 45-months compared to 48-months in March.

The decrease in duration time can be attributed to a 29.4% decrease in 60-month originations, and a 30.7% decline in 36-month originations.

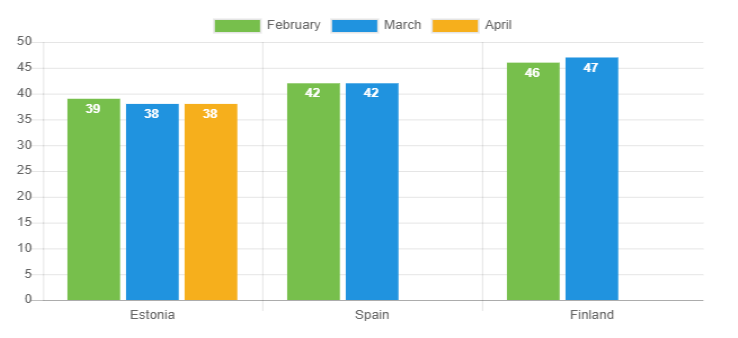

Average Age remains consistent

One area that did not see any change from the previous month is the average age of borrowers. Estonian borrowers maintained the same average age, 38-years old, as in March.

Incomes on the rise

It was average incomes that saw the biggest increasing trend over April. Estonian borrowers made an average of €1,919 per month in April compared to €1,382 a month ago, a jump of 38.9%.

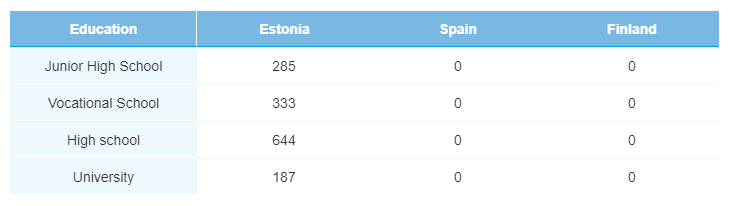

Education

The education level of Estonian borrowers was in-line with March. The largest category was of borrowers with a high school education (44.4%), followed by vocational school, (23.0%) and junior high school (20.0%).

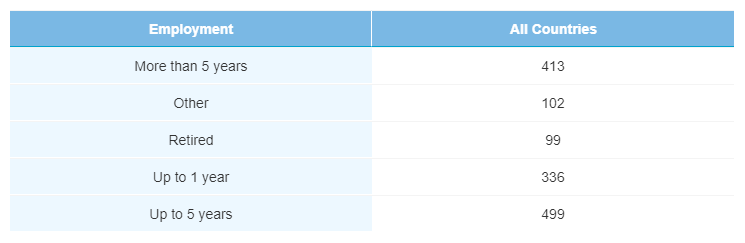

Employment and Home Ownership

Employment statistics were similar to last month, with 34.4% of borrowers employed up to 5-years, and 28.5% employed more than 5-years. The number of retired borrowers dropped to 6.8% of all borrowers over the month.

Borrowers in Estonia continue to have solid home ownership statistics. 44.0% of all Estonian borrowers are home owners, with another 5.2% having a mortgage.

More Estonian borrowers verified

As a consolidation of Bondora loans has begun, there was a sizable increase of verified borrowers. All told, 87.6% of the 1,449 Estonian borrowers were verified in April compared to 60.0% last month.

A planned consolidation of originations

Bondora understands the economic uncertainty surrounding the current global crisis. As a result, the decision to consolidate originations and focus solely on Estonia was a carefully thought out strategy and took into account sustainability and continued profitability for investors. Bondora will continue to monitor the economic situation and restart lending activities in Spain and Finland when local economics are restored.

While other financial markets might be reeling, Bondora continues to provide its customers with solid p2p loan options in a time of need, and is focusing on business strategies that will allow the company to have sustainable growth for years to come.

Learn more about Bondora investment products here.