After forecasting growth in last month’s post, Bondora originations increased exceptionally in May. After totaling €9,224,428 in April, originations came to €10,421,636 over the month, a strong 13.0% growth rate.

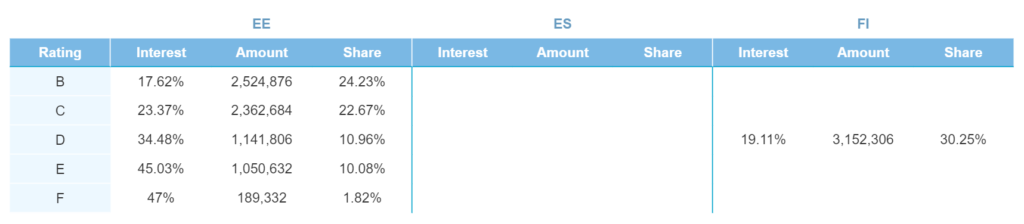

Breakdown by country

Bondora continues to only provide originations in Estonia and Finland in 2021, although we’re anticipating reopening the Spanish market soon. Both countries’ origins rose proportionally over the month, with Finnish originations hitting €3,152,306—a 23.4% growth rate. Meanwhile, Estonian originations totaled €7,269,330—up 9.0% on the month.

In May, Estonian originations shifted toward higher-rated categories; B-rated originations (24.2% share), C-rated originations (22.7% share), and D-rated originations (11.0% share) all increased in total share of Bondora originations. Finnish originations still comprised only D-rated loans, which grew to 30.3% of all originations—up from a 27.7% share last month.

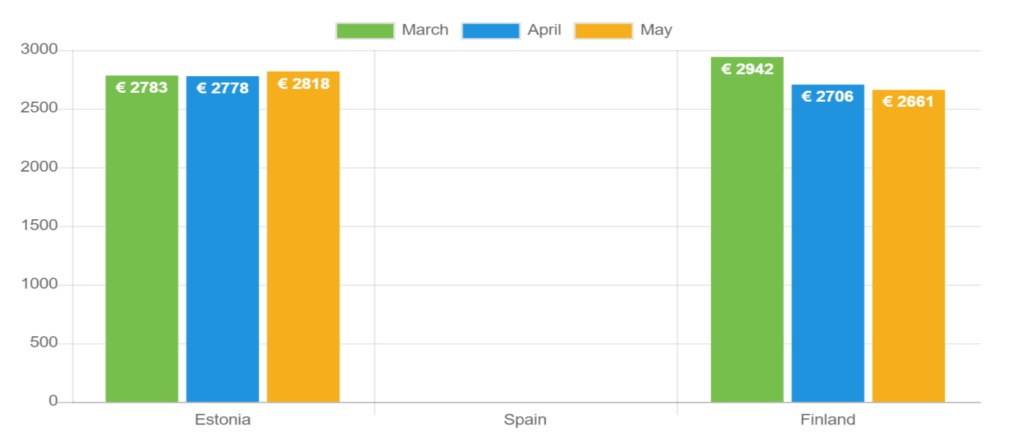

Loan amounts

The average Finnish loan amount decreased for the second consecutive month, totaling €2,661 in May, down 1.7%. Alternatively, Estonian loans changed course and rose to an average of €2,818 from €2,778 last month. This is a 1.4% increase month-over-month.

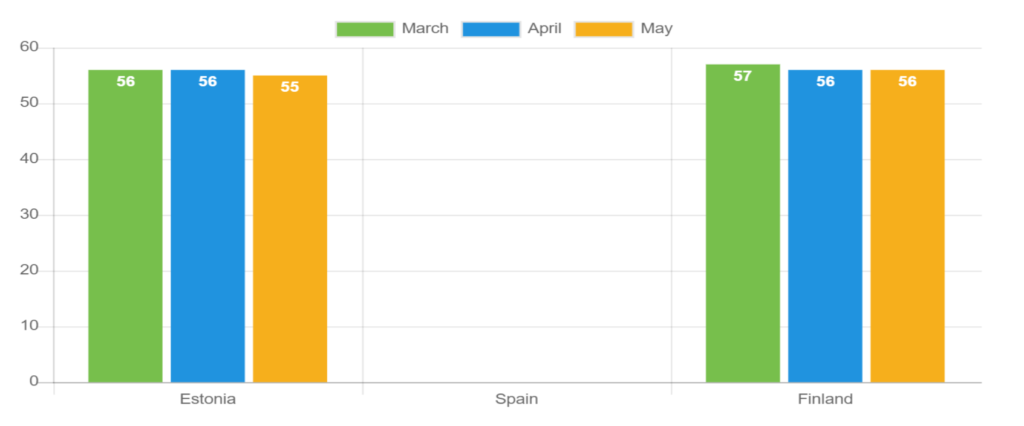

Loan duration

After maintaining a 56-month loan duration for several months, this streak was broken in May, when Estonian loan durations averaged 55-months. Finnish durations averaged 56-months, which is consistent with last month.

There was a sizable 20.0% increase in 24-month originations in Estonia. This, along with increases in 6-month, 12-month, and 18-month originations, resulted in the average duration being pushed lower in May. Proportionally, Finnish loan duration lengths rose across the board. 60-month durations are still the most common, accounting for 87.1% of all originations out of Finland.

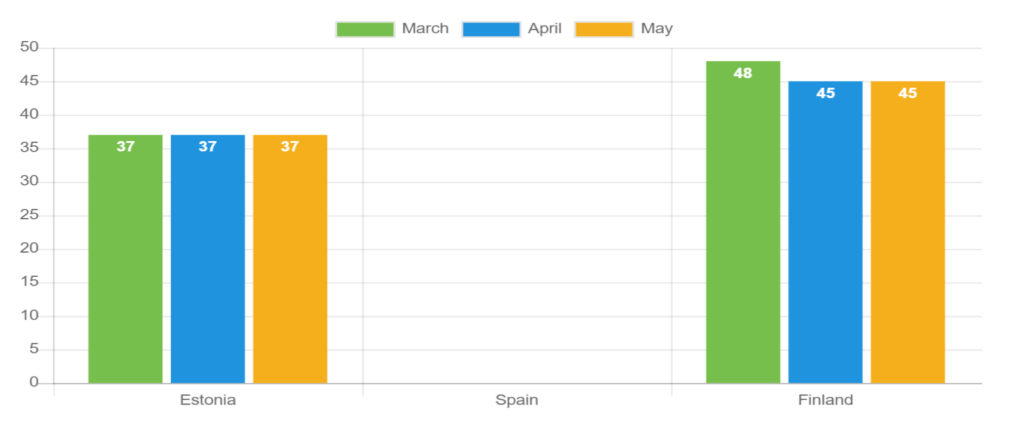

Average age

Finnish borrowers maintained their average age of 45-years after dropping last month. This is a number to watch moving forward to see if the average age of Finnish borrowers reverts to the higher numbers seen in previous months. Meanwhile, Estonian borrowers continue to average 37-years of age.

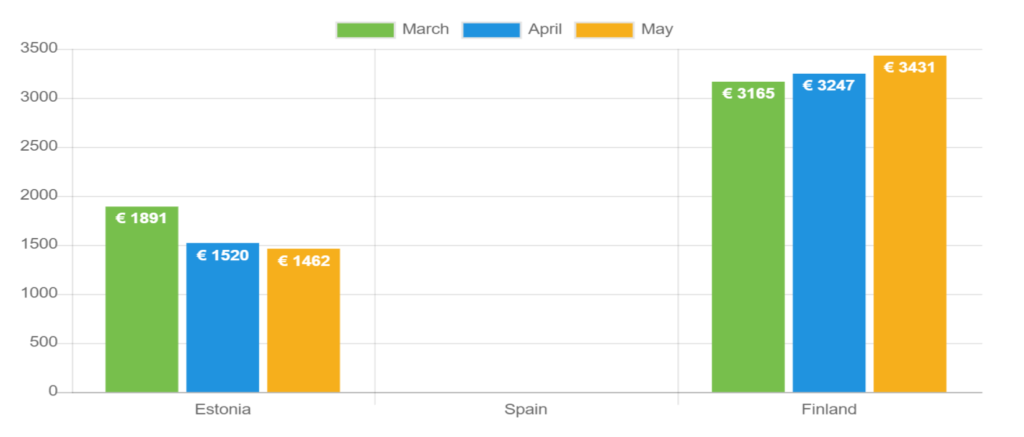

Income

Estonian borrowers continue to see their average income decrease. This month, Estonian borrowers only averaged €1,462 per month in income, down 3.8% from last month and a decrease of 22.7% compared to March.

Finnish borrowers are experiencing the opposite trend. It was the second consecutive month that Finnish incomes rose on average, up 5.7% to a total of €3,431.

Education

Estonian borrowers skewed more toward lower education levels this month. Junior high school graduates accounted for 20.7% of all Estonian borrowers, up from 19.0% last month. Meanwhile, vocational school education numbers for Finnish borrowers had a big jump, rising by 35.2% and accounting for 50.0% of all Finnish borrowers.

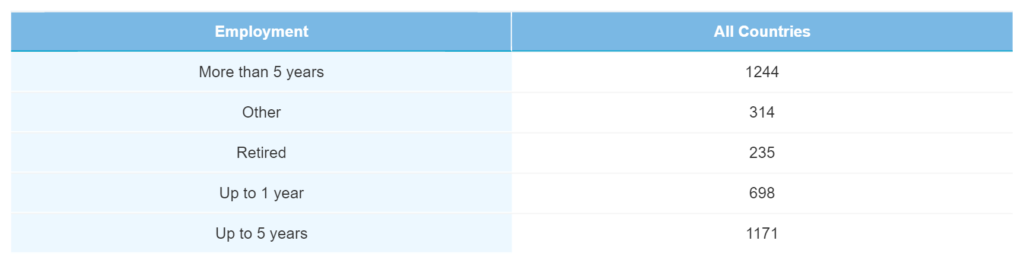

Employment

Employment trends for Bondora borrowers remained consistent. 33.9% of all borrowers were employed for more than 5 years (compared to 33.1% last month), while 32.0% of borrowers were employed up to 5 years (compared to 32.2% last month).

Homeownership status

The only category of Estonian borrowers to decrease was borrowers with a mortgage, which fell by 12.3% from last month. Most Estonian borrowers are still homeowners, with the overall rate increasing to 44.1% of borrowers out of the country. In Finland, however, more tenants originated loans on the month. Tenants accounted for 38.0% of all Finnish originations, up from 33.6% last month and 28.0% in March. This is an interesting multi-month trend to watch for June.

Verification status

Once again, only 1 Finnish borrower was unverified in May, putting the verification rate in Finland at 99.9%. However, the verification rate for Estonian borrowers dropped to 96.7% from 98.2% in April.

Originations pass €10 million

With a 13.0% growth rate in May—and the fourth consecutive month of double-digit growth—Bondora originations hit above €10 million for the first time in 2021. This was mainly led by Finnish originations that climbed 23.4% and more Estonian originations in high-rated origination categories.

Learn more about Bondora investment products here.