Last week we talked about how to get more out of our Portfolio Manager by using the various settings to customize it according to your needs. The customizable settings allow investors to execute their chosen portfolio strategy better, ensure that their money is invested and not sitting idle on their account (i.e cash drag). This has been one of the concerns raised by our investors and we aim to improve this.

In the upcoming releases we will make changes to the Portfolio Manager and its settings with the purpose of further improving the Portfolio Manager performance and meet the expectations from our investors to reduce cash drag.

Summary of Portfolio Manager improvements

The changes to the Portfolio Manager are highlighted here below:

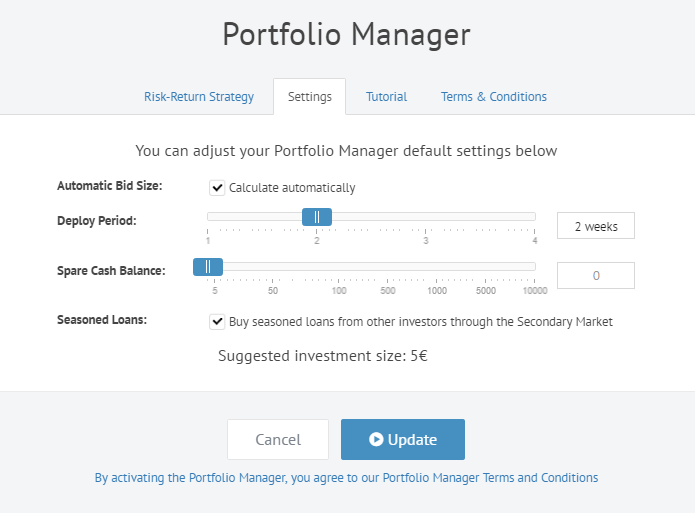

- Diversification setting “Min loans in Portfolio“ in the “Automatic Bid Size” option will be removed from the Portfolio Manager default settings (see the image below) because

- a) it is conflict with the deployment period setting (for example if investor sets a long deployment period and low diversification then those conditions are not compatible)

- b) less than 5% default Portfolio Managers use these settings.

The default diversification value will still be set to 200 loans in portfolio but the user will not be able to change it from settings anymore. For users who already have set a custom diversification level, the setting will be kept until the next Portfolio Manager setting update. Then it will be automatically set to default value (200 loans in portfolio). Investors who would like to set bid sizes themselves and not use “Automatic Bid Size” option, we encourage using advanced settings of the Portfolio Manager.

- We will now start running the Portfolio Managers as soon as the loans reach the market instead of running them periodically once in an hour. This way the funds will be allocated faster.

- Every loan will be evaluated in terms of which portfolios are the most suitable for it.

- Investors bids will be made into loans which have a lower or equal risk profile than the risk profile of that investors whole portfolio.

- Investors bids will be made into loans that have higher risk profile only in the case when, after making the investment, the risk level of investors’ whole portfolio does not increase (i.e making the investment does not change portfolios risk profile).