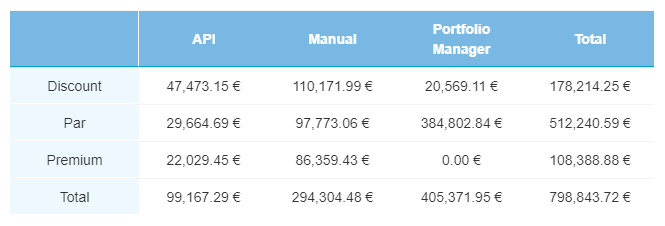

After March saw a striking rise in secondary market transactions, April’s numbers came back down in-line with historical figures. Secondary market transactions totaled €874,996 on the month, a decrease of 34.3% compared to last month. Portfolio Manager transactions accounted for most of the decline, dropping from €714,256 in March to €405,371 in April. Yet, manual transactions went against the grain, actually increasing by 4.9% over last month.

Current Loans

Those who transacted in current loans on the month were able to make purchases at better prices than last month. Of all current loan transactions, 22.3% were conducted at a discount price, compared to 16.2% last month. All told, transactions for current loans were down 36.8% on the month.

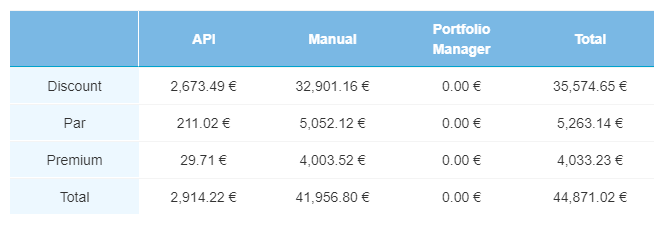

Overdue Loans

Transactions of overdue loans were higher by 14.1%, up to €44,871. The majority of overdue loan transactions (73.3%), came from Manual transactions at a discount. Meanwhile, API transactions fell by 40.0% to €2,914.

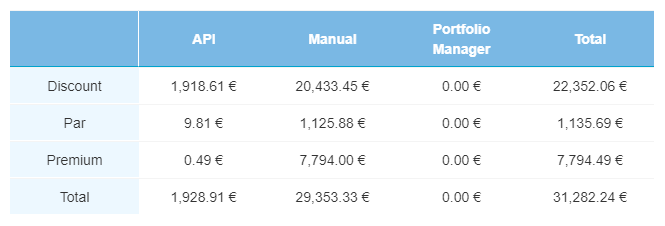

Defaulted Loans

Defaulted loan transactions were also higher, rising by 9.8% month-over-month. API transactions shrunk to almost zero, coming in at a total of €1,928, while Manual transactions actually rose by 24.2% to €29,353.

The secondary market levels off

After March saw a drastic increase in secondary market transactions, April’s numbers came in more consistent with historical figures, as current loan transactions fell. While overdue and defaulted transactions were higher, they still only accounted for a combined 8.7% of all secondary market transactions.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at investor@bondora.com.