We’ve been seeing a decrease in secondary market transactions since April, but a rebound might be on the horizon. The decline rate has halved from what it was last month, coming in at 14% compared to May’s 29.5%. These numbers are very encouraging and could perhaps point towards positive growth in the near future.

The lower decline rate is thanks to a better rate in Portfolio Manager activity (-21.5%) than in May, and to the sharp rise in API transactions (42%). The total monetary value of secondary market transactions for May are €530,378.

Current Loans

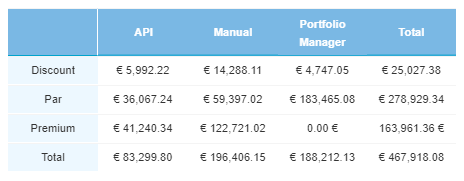

API is the rising star in current transactions for June, going from €62,407 in May to €83,299. This 33.4% increase is a welcome jump after it fell by 40% in May. Manual transactions saw the biggest decline, going down by €118,295 in transactions. Portfolio Manager on the other hand, saw a decrease of only 21.5%—a far better figure than May’s 40.8%. Overall, the decline rate for June transactions was 5.3% better than May’s decline rate of 29.5%.

Overdue Loans

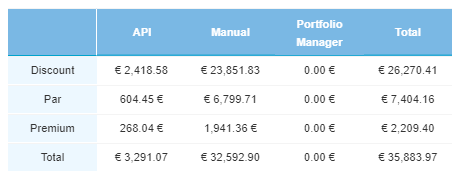

After the significant rise from the last couple of months, overdue loans have gone in the other direction with a 38.7% decline, now sitting at €35,583. Exactly as last month, the majority of overdue loan transactions came from manual transactions at a discount, taking up 73.2% of the category.

Defaulted Loans

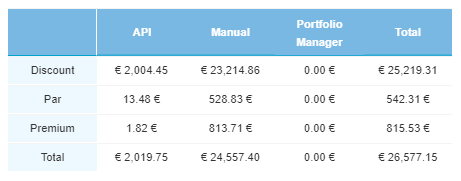

Contrasting to last month’s decline of 36.6%, we saw a sharp increase in defaulted loans, going back to almost the same level as in April with a 34.1% increase. Manual transactions saw a 6.3% increase and also makes up 92.4% of all defaulted loans. The rest are made up of API transactions, which saw a 6.3% decrease to €2,019.

Secondary market transactions still slowing down, but for how long?

June marks the third month of less activity in the secondary market after it boomed in March. Overdue loan transactions outpaced defaulted loan transactions, bucking the trend we’ve come to see in the first quarter for a second month in a row. After three months of consecutive overall decline, we’re eager to see when the rebound will occur and we’ll see a rise in secondary market transactions.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here.