Investment returns on Bondora originations showed signs of positive growth in May. The return rate for 2021 was higher this month than in April. This is a great sign for investors as we move into the summer months.

As always, country-specific performance charts are broken down by the number of loan issuances over the given period, with Orange representing < 50 loans, Blue 51-200, and White > 200.

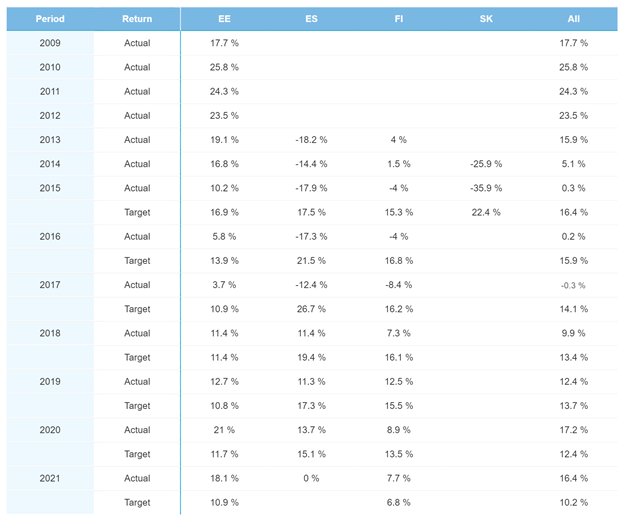

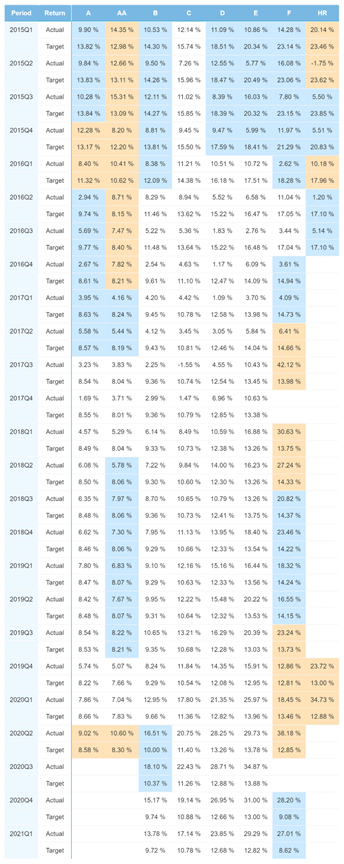

Yearly return rate performance

The yearly return rate for 2021 came in at 16.4%. This is 1.3% higher than in April. This growth spurt was led by Estonian originations, which returned 18.1% compared to 16.7% last month. Finnish returns also increased, totaling 7.7% compared to the lower 6.7% in April.

Meanwhile, even though the 2020 return rate fell, it still came in at 17.2%, which is 4.8% higher than its target rate. Estonian originations proved to be the strongest here and fell only 0.1% to 21.0% in total.

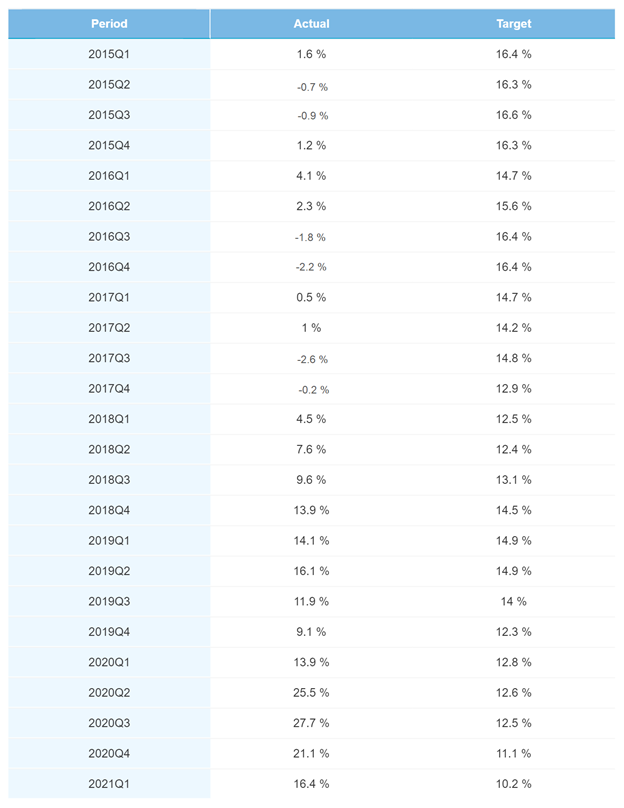

Quarterly return rate performance

The last two quarters showed a boost in returns for investors. 2021 Q1 returns came in at 16.4% compared to 15.1% last month, while 2020 Q4 returns totaled 21.1% in May, up 0.1% from the month prior. Still, all quarterly return rates for 2020 remain above their target rates.

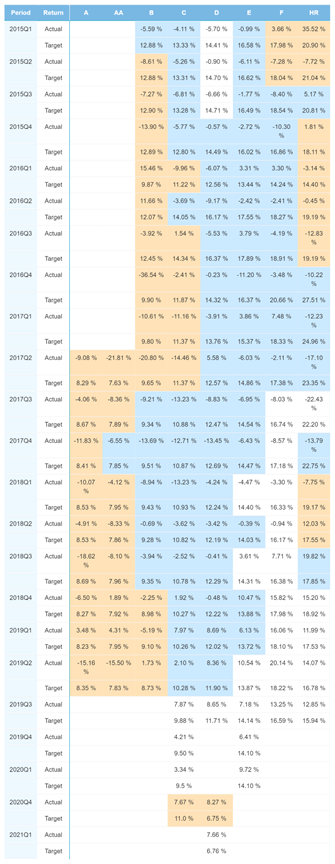

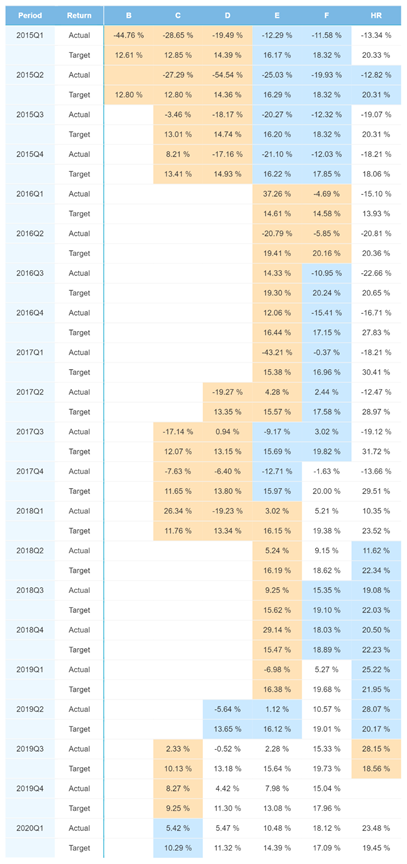

Finland

The most recent quarter’s D-rated originations saw their returns jump above their target rate, ending the month at 7.7%, a full 1.0% month-over-month gain. For 2020 Q4, both C-rated (7.7%) and D-rated (8.3%) originations were higher than last month as well.

Estonia

All 5 rating categories of Estonian originations in 2021 Q1 were not only higher than their target rate but grew month-over-month compared to April:

2020 Q4 returns were also quite positive, with B- and C-rated loans higher on the month.

Spain

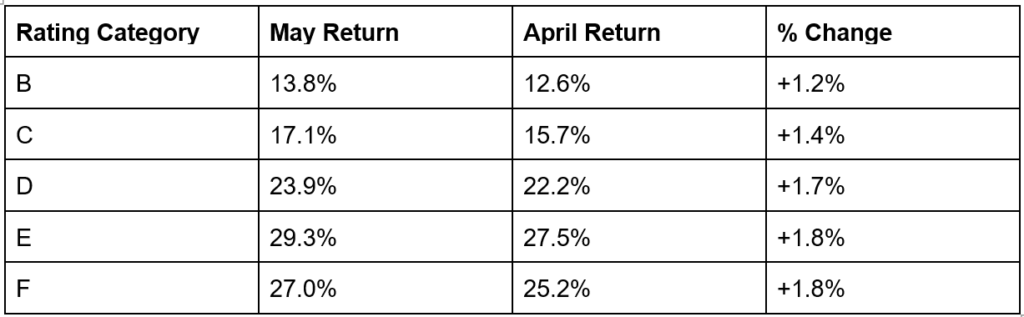

For 2020 Q1 — the most recent quarter where Spanish loans were originated — return rates predictably fell by about 1% across all five rating categories. However, both F- and HR-rated originations still returned higher than their target rate, coming in at 18.1% and 23.5%, respectively. The same trend can be seen in the previous few quarters. One thing that stands out is that D-rated originations from 2019 Q3 turned in a negative return rate, at -0.5% in May.

Key takeaways

- While return rates generally trend downward over time, May ended with a return rate 1.3% higher than in April

- The two most recent quarters, 2021 Q1 and 2020 Q4 saw an increase in return rates

- Estonian originations led the charge, higher in all five originating categories and up a cumulative 1.4% month-over-month

- Lower-rated Spanish originations (F and HR-Rated) are still returning above their target rates