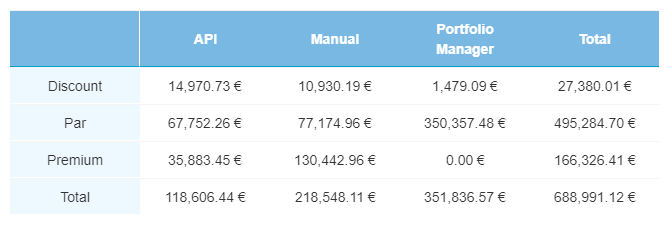

Secondary market transactions on Bondora decreased compared to the previous month. Transactions on the secondary market totaled €741,068 in the month of February, down 11.3% from January. The biggest drop came from manual transactions, which were down to €266,135 from €323,843 a month prior. Portfolio manager transactions were also lower by about 10.5% to €351,836. Meanwhile, transactions via the Bondora API were actually up on the month to €123,096, representing a 3.6% increase month-over-month.

Current Loans

Current loans remain the largest segment of secondary market transactions, accounting for 93.0% of all transactions conducted. While most segments of current loan purchases were down on the month, more manual purchases were made at a premium than in January. This slight increase, up to €130,442, signals Bondora investors willingness to pay a premium for loans which they deem as solid investments.

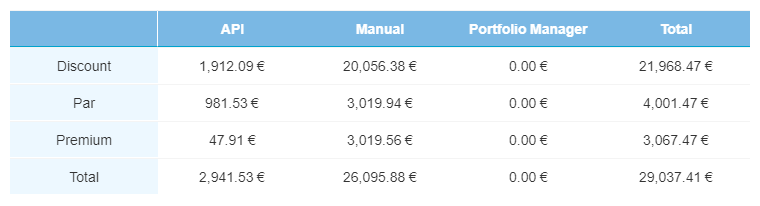

Overdue Loans

Purchases of overdue loans dropped by 14.1% to €29,037 in February. Once again, almost all overdue loan transactions were conducted manually, with a very small percentage coming via API transactions.

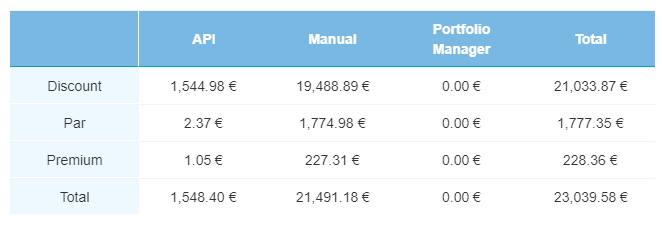

Defaulted Loans

After dropping by 85% to start the year, defaulted loan transactions once again decreased significantly. Defaulted loan transactions totaled €23,039 in February, down by 45.3% compared to January. This month’s number also dropped defaulted loan transactions below overdue loan transactions on the secondary market. It appears investors are becoming more cautious of these higher risk investments and shying away from transacting on defaulted loans via the secondary market.

The Cyclical Secondary Market

The secondary market gives investors the opportunity to obtain liquidity quickly for loan holders, while allowing potential purchasers more loan buying options. This is why Bondora offers its investors a market on which to transact which can provide this benefit to all parties involved.

The way in which investors utilize the secondary market is cyclical, and dependent on a number of factors such as current economic climate, season, and interest rates. After a surge in transaction volumes toward the end of 2018, the Bondora secondary market has experienced two consecutive months of transactions decreases. Nevertheless, Bondora will continue to provide investors this liquidity via its secondary market for anyone in search of more transacting options.

As always, investing in the secondary market can be risky, and you should always learn as much as possible before attempting to buy and sell loans on the secondary market. Investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at investor@bondora.com.