🎉August was another record-breaking month at Bondora Group. After investors made the most out of the One Billion Celebration campaign, investments sky-rocketed once again to set a brand-new record. On the individual credit market level, the Netherlands and Latvia also exceeded their previous loan origination records.

Discover more exciting information about our August stats and numbers.

Monthly new investors

In August, 1,843 more people created investor accounts with us. Do you have friends who could also benefit from simple online investing? Refer them using your unique code from your Dashboard so you and your friends could each get an investment bonus.

Investments

Thank you to everyone who joined our one billion celebration. During the entire campaign, Bondora investors added €40.2 million to their Go & Grow accounts!

This leads us to the total amount you invested during August: a grand €28,478,639. This breaks the record that was set in July and is now the highest invested amount per month.

Returns earned by investors

Our Bondora investor community earned a total of €2,481,252 in returns in August. As we mentioned in another article recently, it’s essential to celebrate your milestones as you continue on your financial journey to achieving your goals.

Investor question of the month

“Can you tell me more about the Go & Grow return rate?”

With Go & Grow, the annual return rate is up to 6.75% p.a. for investments up to the monthly limit and up to 4% p.a. for amounts exceeding the limit. As of 9 September, you can now earn up to 6.75%* p.a. on your entire Go & Grow portfolio PLUS any extra amount you invest over the monthly limit! (Read more about this news here)

While returns are not guaranteed, investors have consistently received the full possible return on their investment since the launch of Go & Grow in 2018.

The returns you earn are paid into your Go & Grow daily.

And, because Go & Grow has a compound interest rate, you receive interest on the returns you have already earned.

Here’s a small example:

Let’s say you invest €700 every month for a year and earn returns at a rate of up to 6.75% p.a. Your investment will grow thanks to daily compounding interest, and by the end of the year, you’ll have added €8,400 in total (€700 x 12 months).

With the 6.75% annual return, your total balance will be approximately €8,800—meaning you’ve earned around €400 in returns. For amounts exceeding the monthly limit, you would receive up to 4% p.a.

And over time, the compounding effect will grow your returns even more significantly as your returns continue to compound.

If you would like to know more or have any questions about Go & Grow, please feel free to write to our support team.

Loan originations

In August, €27,541,887 was originated in loans across all our active markets. After breaking our overall record of loan originations in July, we are celebrating two new records on the individual market levels in August.

€6,859,008 worth of loans were originated in the Netherlands. This is a 5.7% increase from July and a new record for the highest monthly loan originations figure in the Dutch market.

In Finland, loan customers originated €15,524,047 worth of loans, a 25.1% decrease from July.

In the Estonian market, there were €4,853,948 in loan originations—a 15.4% decrease from July.

Once again, Bondora Group’s most recently launched credit market, Latvia, is showing promising growth, with originations increasing by 36.5% to €304,884 in August. This is now Latvia’s highest-ever origination statistic.

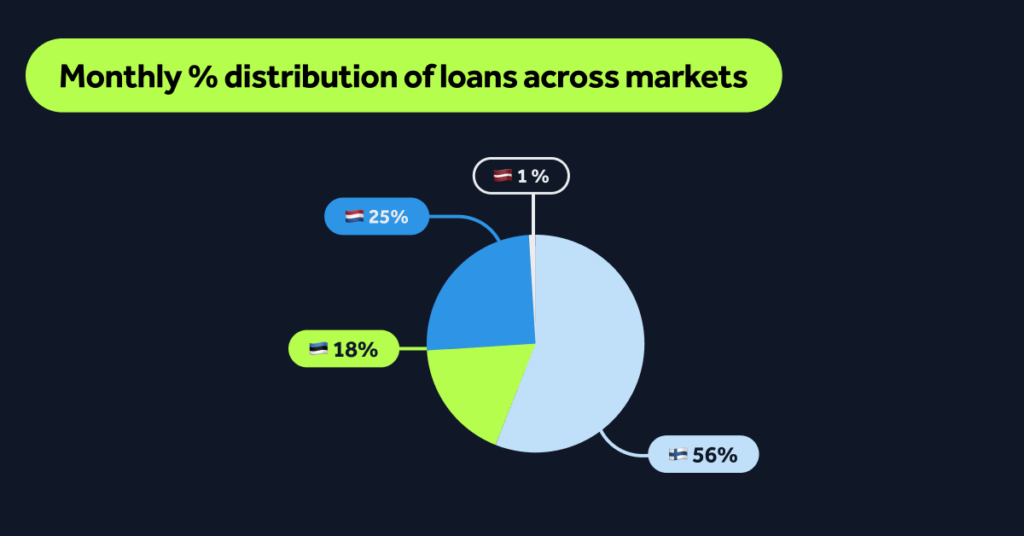

See from which markets the most originations came in August:

Finland continues to hold the title as the market with the largest share of loan originations, 55.9%.

For the second month in a row, the Netherlands holds its position as the second-largest credit market, with 25.2% of all originations, while Estonia has a 17.8% share.

Latvia continues to be in fourth place with a 1.1% share of originations.

Instagram community

At the time of writing, our Instagram community consists of 14,716 followers. If you aren’t already following us, this is your invite to join us on Instagram! You can find regular updates, fun and educational content, and exclusive behind-the-scenes moments.