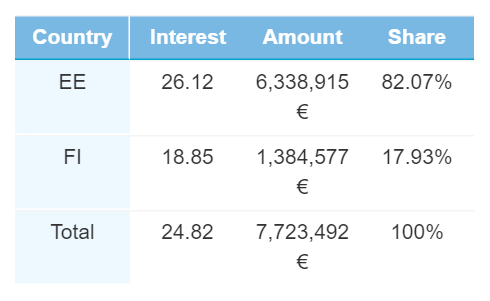

Bondora originations grew for the third consecutive month in March. Totaling €7,723,492, originations climbed €1,260,760 compared to February, which translates to a 19.5% growth rate.

Country breakdown

Once again, Bondora limited originations to Finland and Estonia, both of which grew on the month. Estonian originations rose by 22.8% to €6,338,915, while Finnish loans were higher by 6.4% to €1,384,577 over the month. The increase in Estonian originations brought its total share of all Bondora originations up to 82.1% from 79.9% last month.

Origination by country – March 2021

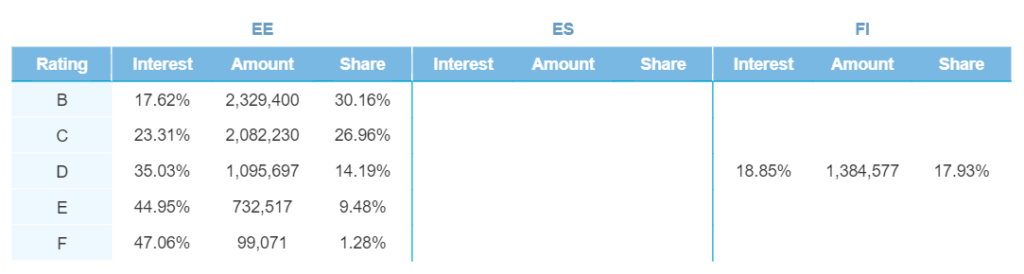

D-rated loans continued to be the only originating category for Finnish loans, accounting for 17.9% of all Bondora originations, compared to 20.1% last month. They also had a similar interest rate to February (18.9%).

Meanwhile, all Estonian categories increased their origination amounts in March by the following percentages:

- B-rated: +11.1%

- C-rated: +19.0%

- D-rated: +38.6%

- E-rated: +48.3%

- F-rated: +231.9%

However, unlike last month, only E-rated loans’ interest rate rose by 1.0% to 45.0%.

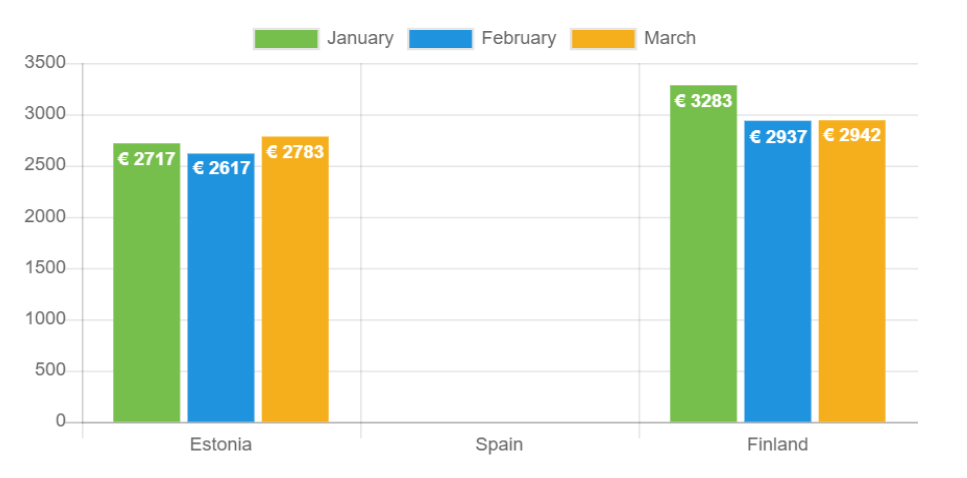

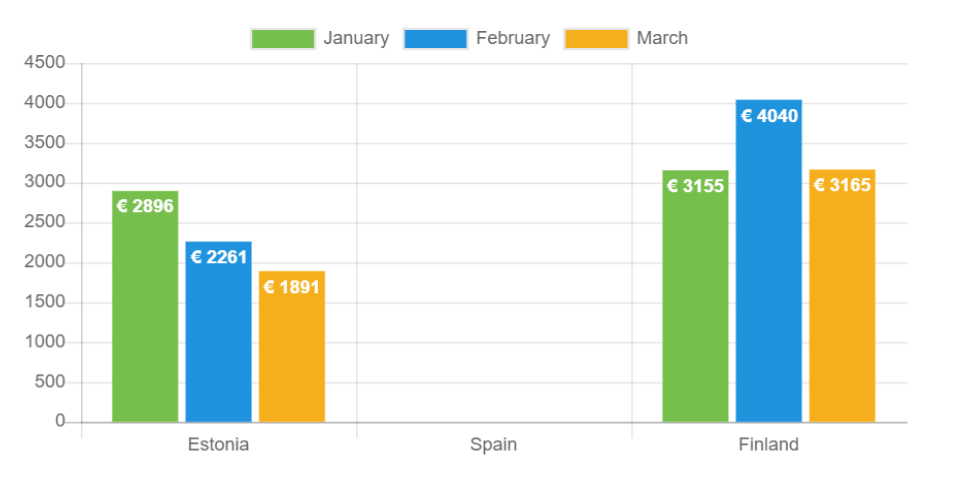

Loan amounts

Estonian loan amounts grew from €2,617 in February to €2,783 in March. This is a reversal of the downward trend we’ve seen over the past two months. Finnish loan amounts were also higher, averaging €2,942 in March.

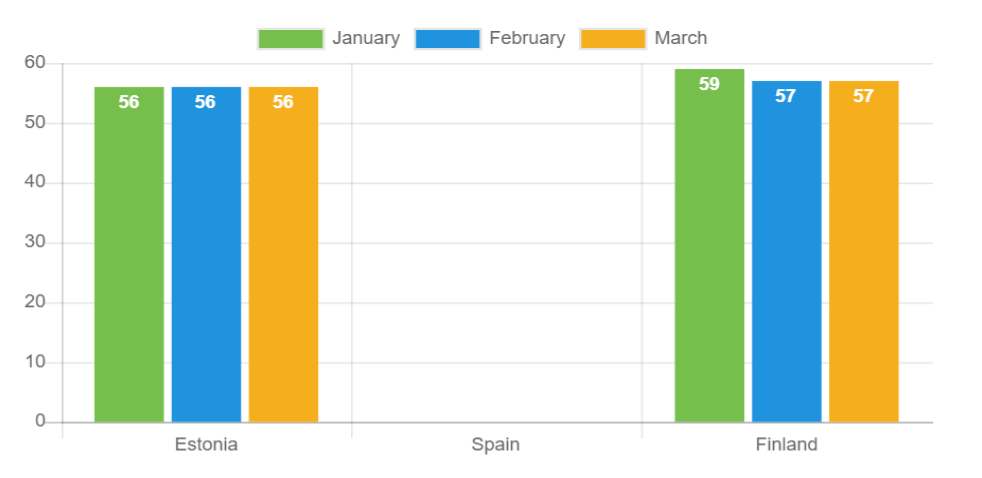

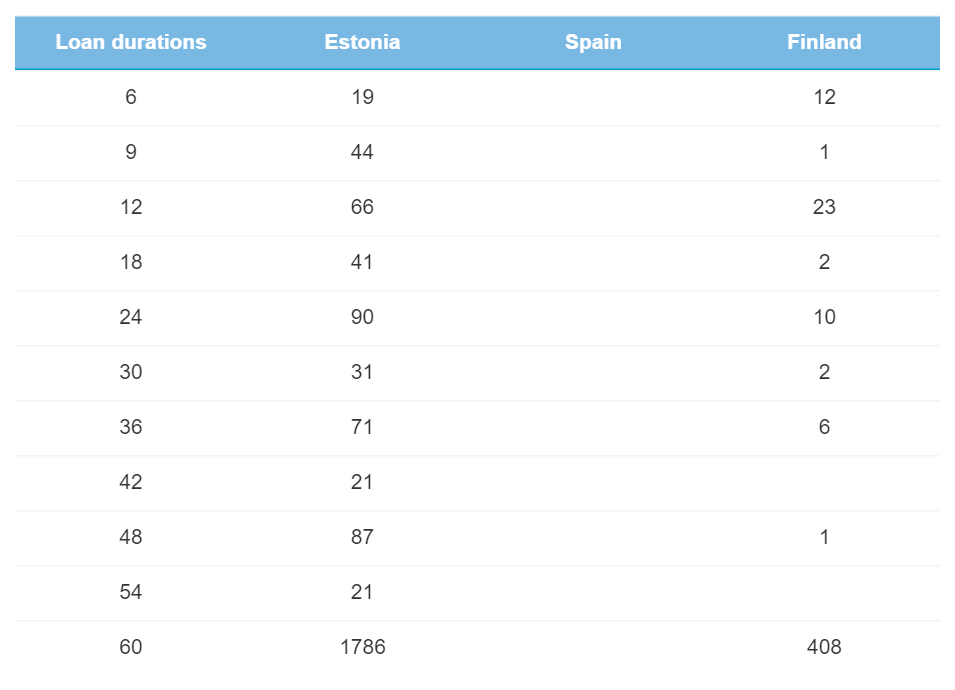

Loan duration

As expected, Estonian originations came in at the same 56-month average as the past year. Finnish loans were also consistent compared to last month, maintaining a 57-month average.

Estonian originations skewed toward the top and bottom of duration lengths. This means there was an increase in originations at 6-, 9-, and 12 months and increases at 42-, 48-, 54-, and 60-months. These figures did balance themselves out, which is why the average duration remained at 56-months. Finnish originations saw a similar trend, with increases in 6-, 12-, and 60-month originations.

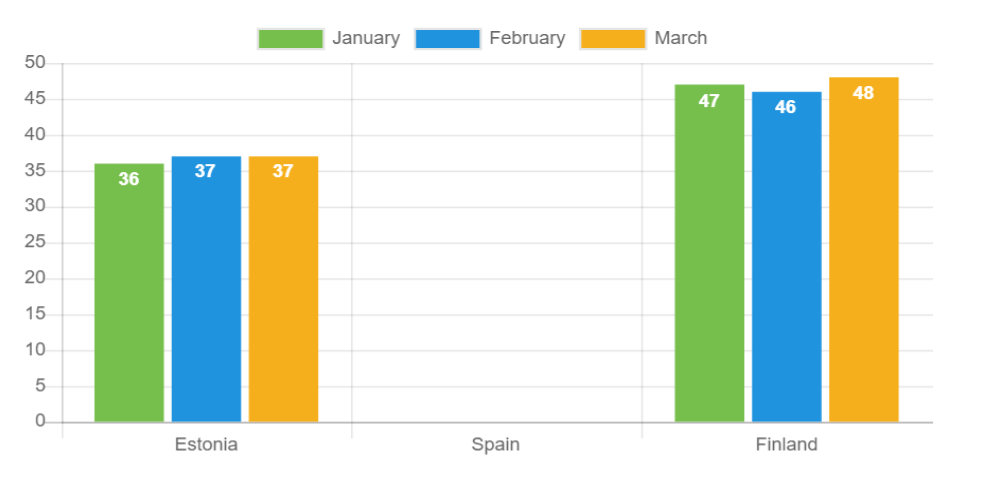

Average age

The average age of Estonia borrowers came to 37 years old for the second month in a row. On the other hand, Finnish borrowers were, on average, older this month, averaging 48 years of age—up two years from last month.

Income

Estonian borrowers’ income was sharply lower, down by 16.4% month-over-month, averaging €1,891 compared to €2,261 in February. Finnish borrowers also saw their income decline in a statistically significant way. Finnish borrowers averaged €3,165, a 21.7% decline in the month.

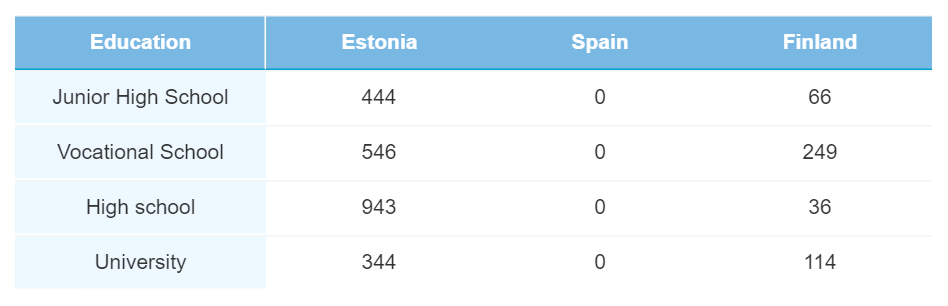

Education

The number of Finnish borrowers with a high school (36) and university (114) education was lower on the month, even as total originations rose. This brought the ratio of Finnish borrowers with a vocational school education even higher, garnering 53.5% of all Finnish originations, compared to 47.0% last month.

There was an increase in all categories of education for Estonian originations as follows:

| Feb | March | Percent Increase | |

| Junior high school | 382 | 444 | +16% |

| Vocational school | 460 | 546 | +19% |

| High school | 833 | 943 | +13% |

| University | 297 | 344 | +16% |

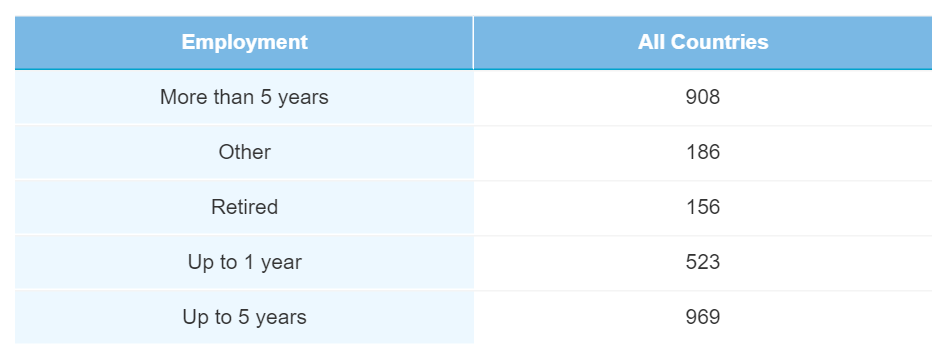

Employment

Borrowers employed up to 5 years (969) overtook those employed for more than 5 years (908), garnering a 35.3%. Those with the employment status of Other or being retired continue to be the least common employment statuses for Bondora borrowers.

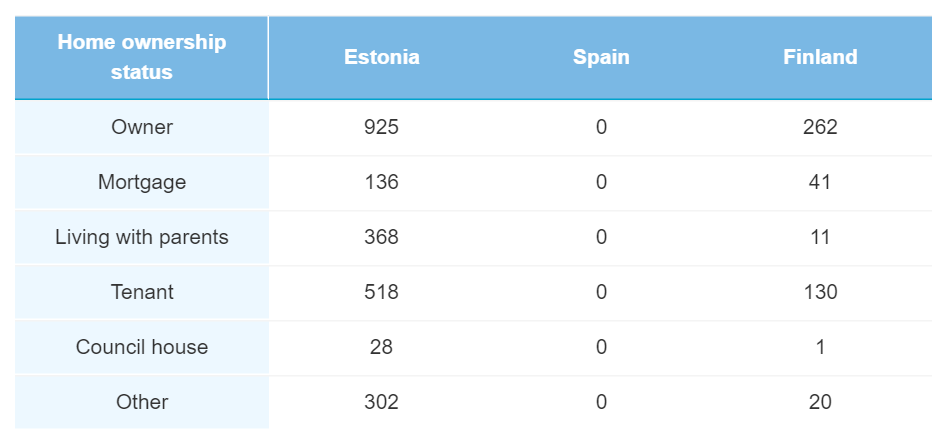

Home-ownership status

Of all Estonian borrowers, 40.6% were homeowners, down from 43.2% in February. This was followed by Estonian borrowers living as tenants at 22.7% of borrowers in the country. Finnish borrowers had fewer homeowners this month and more of a shift to those with a mortgage (41) and living as tenants (114).

Verification status

The verification rate for Finnish borrowers once again hit 100% after failing to do so in February. Meanwhile, Estonian borrowers were slightly less likely to be verified, but only by a negligible amount. 98.1% of Estonian borrowers were verified in March, down only 0.4% from a month prior.

Originations surge

Bondora originations surged higher by 19.5% in March. This surge was mainly led by Estonian originations, which totaled €6,338,915 on their own. March was the third month of growth for originations on the Bondora platform. It’s a positive trend that investors hope will continue as we turn toward spring and into summer.

Find out more about Bondora investment opportunities here.