For the second straight month, Secondary Market transactions decreased. While a total of €311,848 was transacted on the Secondary Market in September, transactions totaled €252,126 in October.

Secondary Market transactions declined by 19.2% overall. Manual transactions, which accounted for 60.6% of all transactions, were lower by 31.1% on the month. Portfolio Manager transactions were higher on the month, increasing by 30.1% to €18,533.

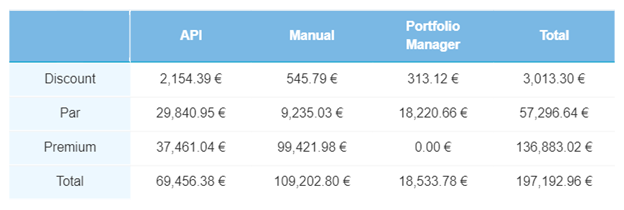

Current loans

Unlike the overall trend of the Secondary Market, current loans grew by 4.7% to €197,192. This month, investors were more likely to purchase current loans at a premium, which grew by 8.9%. It also accounted for 69.4% of all current loan transactions. In contrast, transactions done at par value and at a discount were down by 1.7% and 32.3%, respectively.

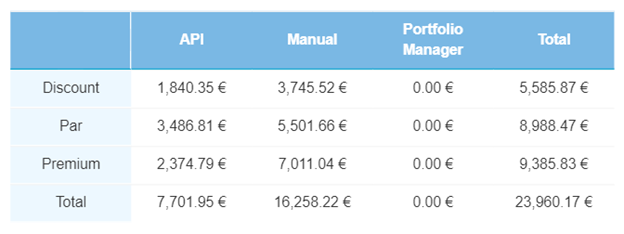

Overdue loans

Secondary Market overdue loan transactions totaled €23,960 in October, down 43.7% from the previous month. This was primarily due to a decline in loans transacted at a discount, which were 78.3% lower. Contrary to the rest of the overdue loan transaction categories, API transactions were higher, up from €6,069 to €7,701.

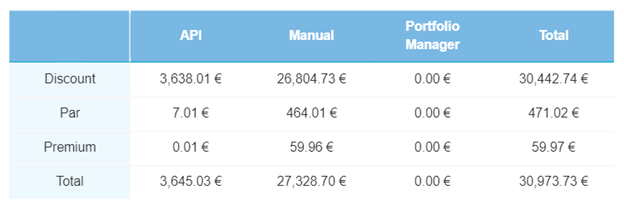

Defaulted loans

Defaulted loan transactions were down by 61.7% to €30,973. This month, investors were less likely to purchase defaulted loans at par value, with only €471 in par value transitions conducted, a decline of 89.2%. Manual transactions also saw a significant decline, down by 64.9%.

Some ups, some downs

Overall, the Bondora Secondary Market saw a decline of 19.2% in total transactions. However, there were some areas (like current loans) that were higher when compared to September. This up-and-down month may be hard to analyze for deeper trends, and it may be wise for investors to take note of the Secondary Market over the next several months to see if longer-term trends emerge.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora Secondary Market here, or contact an experienced Investor Relations Associate over our support page.