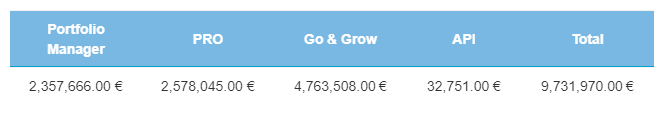

It’s amazing what a difference one month can make. After a drop of total investment in Bondora loans in February, investors were back at it again in March, this time investing the highest monthly total in history! Total originations in March came to €9,731,970, up an astonishing 28% from just one month prior. What’s more, at the time of writing Bondora now has 60,184 investors. Wow!

Investments surged in every area on Bondora. API investing almost tripled, while both Portfolio Manager and Portfolio Pro saw sizable absolute gains in invested amount compared to February. But it was Go & Grow which experienced the highest total increase, with €1,562,780 more invested in March.

Go & Grow Builds Again

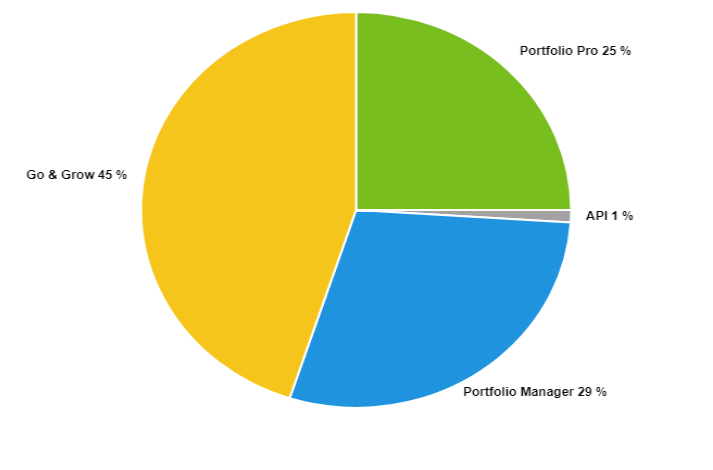

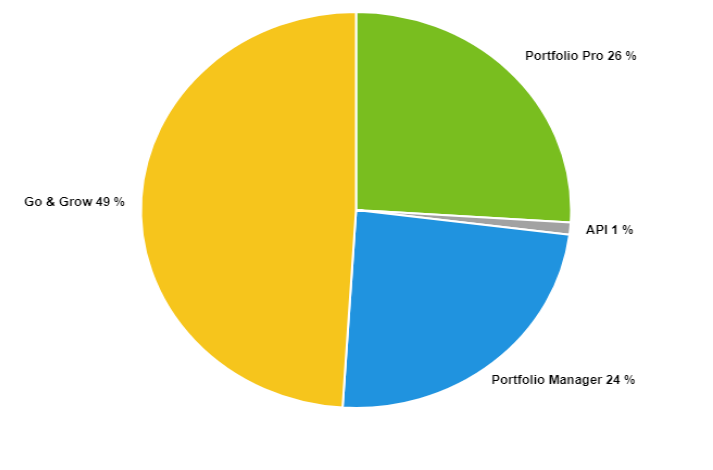

After a month of investors moving funds to Portfolio Manager and Pro, March investment saw a trend shifting back to Go & Grow. On the month, Go & Grow represented 49% of the total investment in Bondora loans, up 4% from the previous month. Yet, investment in Portfolio Pro still gained share of the total investment on the platform, up 1% to 26%. It was Portfolio Manager which saw its total investment share decrease in March, down from 29% to 24% of the total funds invested. Even after almost tripling its total, API investments still accounted for only 1% of the total funds invested on the platform.

Investors Flock Back to Solid Returns

Overall, Bondora saw a seismic shift from just one month ago. What might have looked like a downturn in investment after a contraction in February turned out to be an aberration, as March brought back sizable investment from the Bondora community.

The stable, solid returns* of Go & Grow are appealing to many, where the hands-off style of investing gives you more time to focus on what’s important. The rise in popularity of Go & Grow could also be due to an influx of new investors who are learning about peer-to-peer loans for the first time, and getting their feet wet with investing in a new, alternative investment for their portfolio. As always, investors should do their due diligence before investing in peer-to-peer loans on the Bondora platform.

Learn more about the different Bondora investment options here.