If recessions were easy to anticipate, they wouldn’t be so devastating. But the truth is, economic recessions strike fast and hit hard, leaving many out of work and financially distressed as a result. And while the recent coronavirus-induced recession is seemingly coming to an end, that doesn’t mean you should rest on your laurels.

Take note of these things you can do to ensure a future economic recession doesn’t burn you.

Recessions in a nutshell

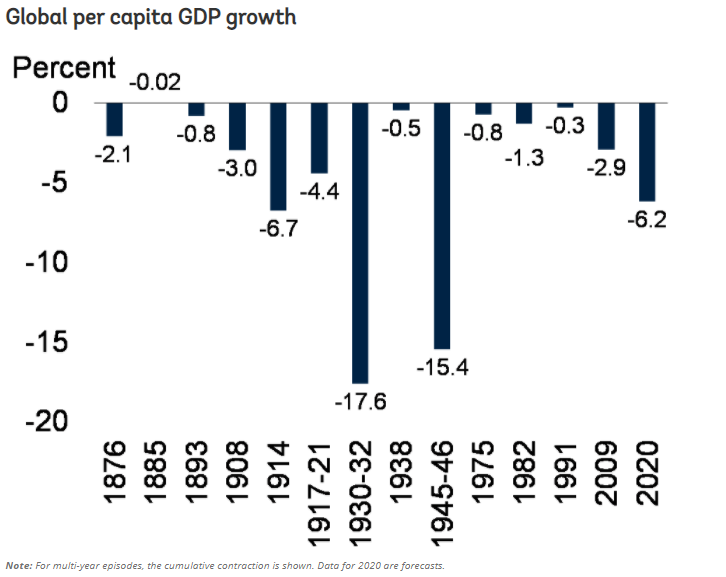

An economic recession is defined as two consecutive quarters of economic decline, usually measured in GDP. According to the World Bank, there have been 14 global recessions since 1870. These recessions range from mild, like in 1885, to severe, as in the great depression from 1930-1932. However, all of these recessions have the same characteristics: high-interest rates and/or inflation, decreasing wage growth, high unemployment, and increases in government spending.

Recessionary periods will continue to be a part of the global economic cycle, whether you like it or not. So, instead of hoping they never come, you can instead be prepared for the next recession by taking note of these recession-proof ideas.

Emergency fund

If you’ve heard this one before, it’s probably because an emergency fund is paramount to financial security, no matter the economic conditions. An emergency fund is one of the few ways to guard against layoffs caused by recessions and any other expenses that might come up unexpectedly. Unfortunately, surveys have shown that less than half of all people have an emergency fund. So, make sure you have a rainy day fund handy in case an economic recession rears its head once again.

Learn new skills

The world is changing faster than ever, and those who aren’t keeping up will be left behind. In a recession, employers shrink their workforce and seek to cut back unnecessary expenses. In this situation, employees with a broader skillset are more valuable to a company and less likely to lose their jobs during a cut. If your employer sees you as someone who can perform various tasks, it will only make you more valuable to keep around.

Learning new skills can also be vital because you’ll be more suited to get a new one or even find a new career path if you lose your job. For instance, if you are competent at previous versions of Microsoft Office and other software but are unfamiliar with newer versions that are being used today, it will be hard for you to land a job during a recession when employers don’t have the resources or time to train you on these new tools. Therefore, keeping your skills up-to-date should be a part of your recession-proof plan.

Know your risk tolerance

People often talk about investing to grow your wealth without thinking of the risks involved in the process. Whenever you invest money, there is a risk of loss involved, and this risk increases exponentially in times of economic recession. Recessions generally cause investments like stocks, bonds, and real estate to lose value. So, before investing in these assets, understand the risks and what to expect.

Your risk tolerance will likely be a result of your life situation and wealth. Older people are usually advised to take less risk because they have already worked hard to save money and have less time to earn it back if they should lose it. On the flip side, those who are young and without families can afford to invest in more high-risk, high-reward investments because if they lose value, these people have many years to work and make that money back.

Diversify your income

Those with just one income source are left in a precarious situation when they are unexpectedly laid off. And while it might seem inconceivable to lose a steady job you have held for many years, this is precisely the kind of thing that happens during periods of economic recession. Companies reduce their budgets and contract their staff to survive. This could mean a job loss for you and your family.

However, if you maintain several different income sources, a job loss resulting from a recession doesn’t have to be so devastating. Ways to diversify your income include:

- Job income – Doing odd jobs or freelance work to increase your overall income.

- Investments – Everything from baseball cards to stocks can bring additional income—as long as you know what you are doing.

- Interest – Money paid out to you from a checking, savings, or another account can provide you regular payments over time.

- Rental income – Renting out real estate is one of the best streams of income you can find.

- Royalties – A passive income stream that will pay you for your creation (music, product, design, etc.) well into the future.

Recession ≠ Doomsday

With so much emphasis put on economic recessions, you might think they are doomsday scenarios. But as long as you are adequately prepared for the next economic downturn (whenever it may happen), it doesn’t have to affect you in such a negative way. Successfully riding out recessions is the only way to make it to prosperity; when the economy grows again and allows you to surf that wave of opportunity.