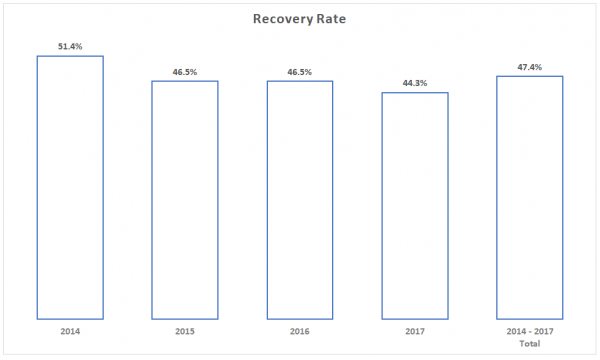

Welcome to our monthly blog post on the performance of recoveries, below we look at the percentage of principal and interest retrieved between 2014 – 2017.

Why is 2017 showing the lowest recovery rate?

On first glance, this may appear to show that the success of our recoveries process has slightly decreased since 2014. However, it is important to note that the latest year will almost always show the lowest recovery rate. Quite simply, this is because the loan is moving through our 3-step collection process and is not yet generating a cash flow or has only recently started generating a cash flow.

What has changed?

Recently, we published a post covering our 3-step collection and recovery process which explains exactly what happens when a borrower stops making their payments. In Finland, once the borrower defaults the case is then automatically filed with the courts and this will soon be the same process in Estonia and Spain thanks to access to new technology.

Interested to learn more about recovery rates?

You can find more information related to our recovery process below:

- How are recovery rates measured?

- How to find recovery rates using Bondora statistics?

- Why don’t you calculate the recovery rate on the principal balance?