Welcome to March’s Secondary Market statistics blog post. Recently, we talked about the most common methods used to purchase current, overdue and defaulted loans and whether these transactions were made at a premium, discount or par value.

Below, we are going to do the same based on the statistics received in February.

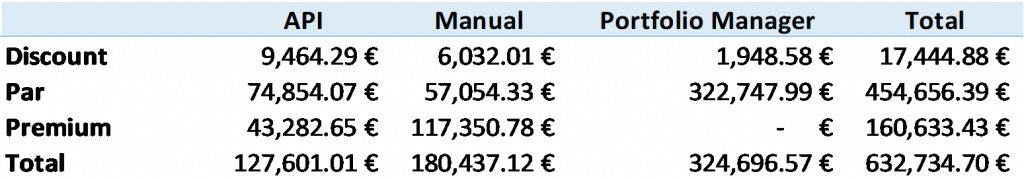

Total Volume

In February, the total amount of investments purchased through the Secondary Market reached totaled €685,485.36, a decrease of approximately 31% since last month. Whilst the order of the most popular methods for making the purchases did not change, the total share and distribution saw some variances compared to previous months. In February, the percentage of manual investments made decreased by nearly 18% since January although the share of the total increased by 5% to 33%. Similarly, the amount of investments purchased via the API on the Secondary Market decreased by over 22% but the total share for the month increased to 19%. Along with the increases in investments purchased manually and via the API, the Portfolio Manager saw a reduction of over 7% to approximately 47% of the total share.

Current loans

In line with previous months, the Portfolio Manager still leads the way in purchasing current loans at a par value. On the other hand, the API was the most successful at purchasing current loans at a discounted value. While there is essentially no priority given to the Portfolio Manager tool for any loans, it is very fast and is still the most popular investment method among all of Bondora’s customers. As a reminder, no priority is given to any method (including the Portfolio Manager) and is not biased based on an investor’s portfolio size.

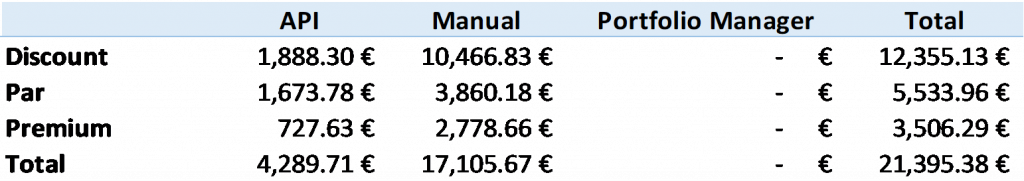

Overdue loans

In February, we saw a very small reduction of 8% in the total amount of overdue loans purchased through the Secondary Market. The majority of these transactions were completed manually and at a discount.

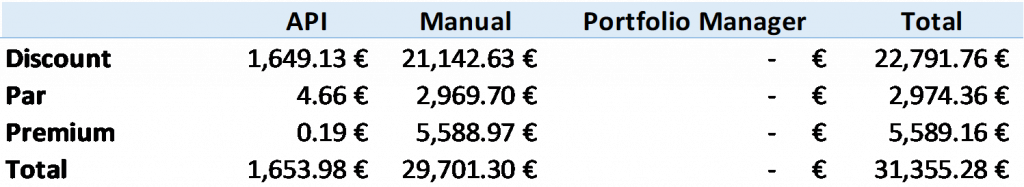

Defaulted loans

Overall, the total amount of defaulted loans purchased through the Secondary Market decreased by over 24% in February compared to the previous month and even more so since December. The most notable change here in February is the amount purchased at a premium, in January this figure stood at only €18 where as in February this increased to €5,589, nearly all of which was completed manually. Approximately 99.7% of defaulted loans purchased via the API were done at a discount. A unique strategy used by a small number of investors is to purchase defaulted loans with a significant discount with the plan to reap the rewards once the collection and recovery process begins to generate a cash flow.

Good to know

Selling your loans can result in a loss of the original principal, as the secondary market typically does not provide a high enough premium for current loans to compensate for the non-performing part of the portfolio. Therefore, we advise to proceed with caution and not to try and sell everything at once if you see a percentage of your portfolio in default. It is likely that you will quickly sell the performing part of your portfolio and be left with the loans in recovery, significantly damaging your expected return.

The speed of the sales process depends on the market demand. In general, current loans are more liquid and will usually be sold within a day if sold at par value or a slight premium. Delinquent loans may take more time or the sale can be unsuccessful. As soon as another investor has purchased your loan, you will receive the funds directly to your Bondora account.

If you’re still unsure how to sell your loans, you should always get in touch on investor@bondora.com and have a chat with one of our experienced Investor Relations Associates who will walk you through it step by step.