Many investors discover marketplace lending when they’re looking for stronger profitability. The benefit of the P2P lending world is that investors can incrementally adjust their risk exposure in pursuit of aggressive returns. Our secondary market allows investors to do just this.

The secondary market offers plenty of options for those willing to incur greater risk for a higher return. In this post we’ll look at ways to optimize the filters and find profit opportunities in the Secondary Market.

Optimizing filters for return and risk management

Initially, investors may avoid the secondary market in fear of loss. Why? These loans exhibit greater probabilities for default. However, with careful use of the search filters it’s possible to isolate loans with fewer risk factors. Here are some ways to leverage the 29 different criteria available for high return investments.

Look for recent payments

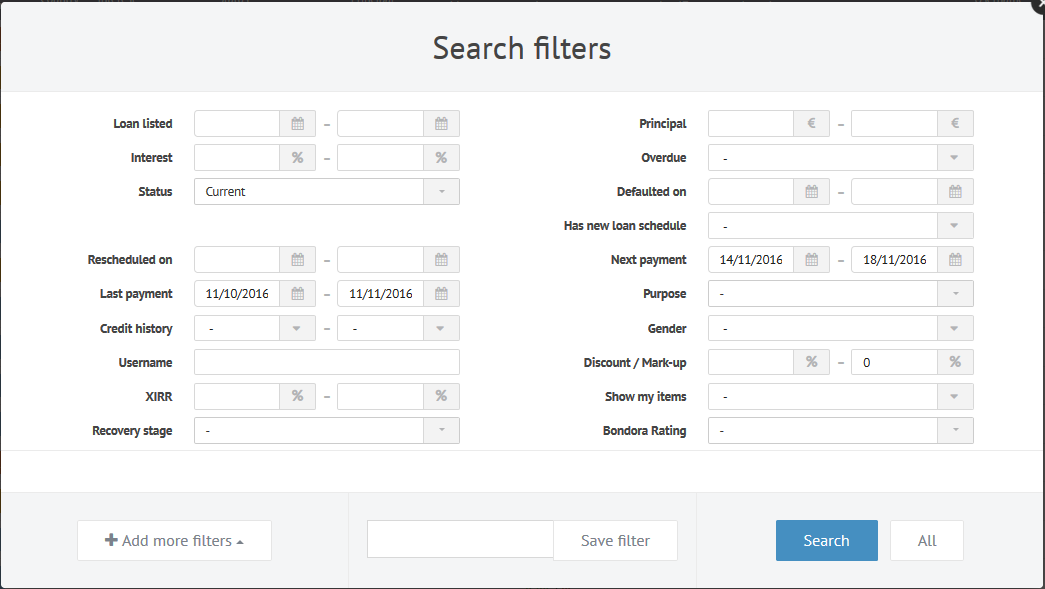

Choose “Next payment” on the “Search filters” pop up box and enter a narrow range of upcoming days. This will result in loans that have a payment scheduled to occur soon. At the same time, focus on loans that have already made payments and carry a “Current” status. You may buy and hold these loans for longer but it is also possible to earn profit by holding these loans for less than a month and still receive a full months worth of interest.

Look for discounts

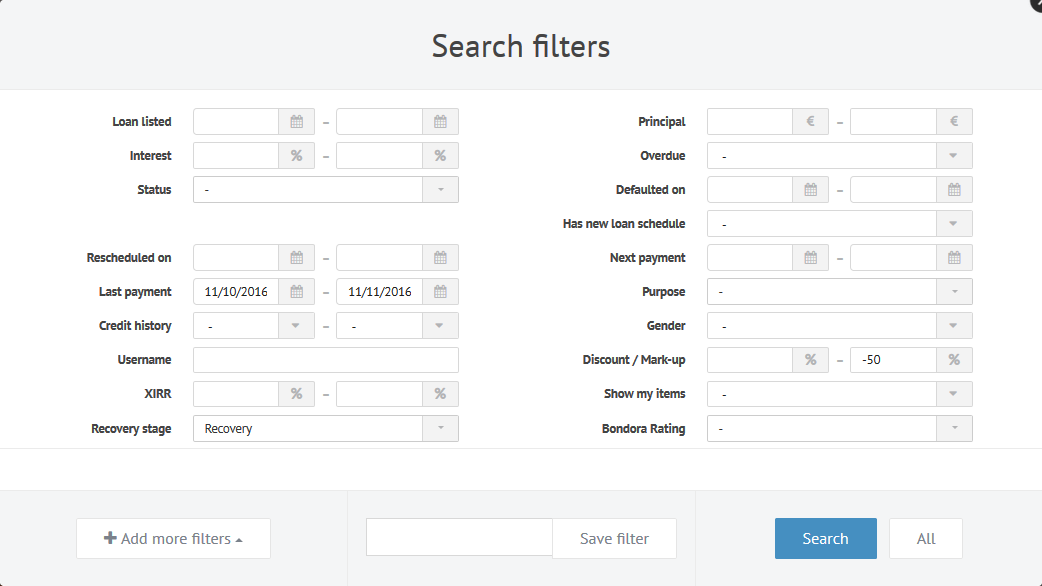

Investors can also source opportunities by choosing loans with a “Recovery” status. Next, enter dates in the “Next payment” fields that are within the last month to ensure the borrower is repaying. Finally, enter “-50” into the “Discount/Mark-up” field so you can benefit from a substantial discount.

Look for better credit

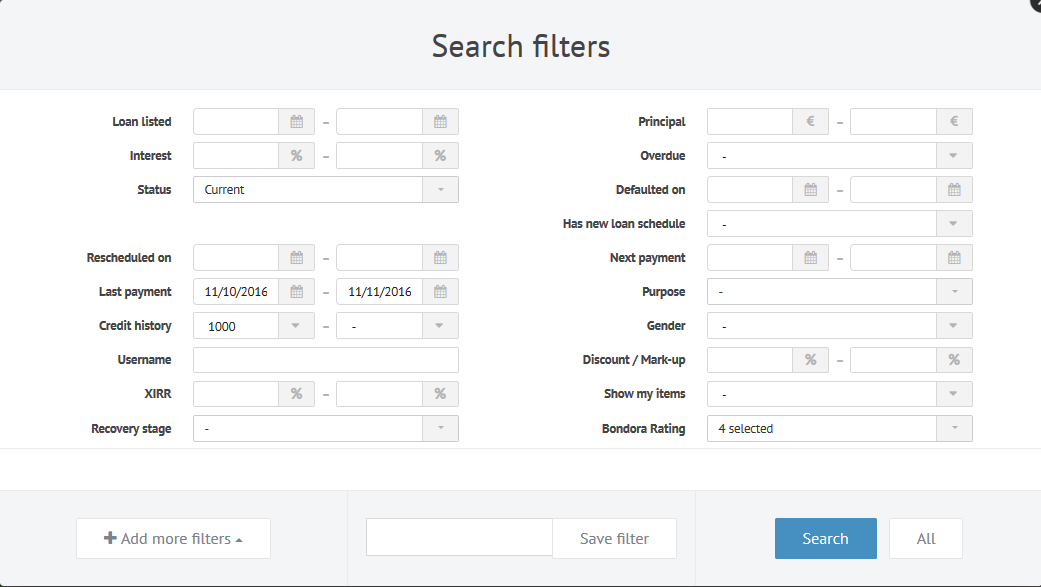

Lastly, investors can try to find loans with high credit scores (1000) or lower risk Bondora Ratings (AA,A,B,C) where potential returns can be as high as 50% (XIRR) in some cases. These investments come from choosing a “Current” status with a “credit score” (which is the scoring data from Experian) of 1,000 or Bondora Rating and a payment made in the last month. While such borrowers may carry the more riskier Bondora rating, investors may be more assured by the recent payments.

The best way to find great offers is to try one filter over another until you find a listing of loans that represents your acceptable level of risk.