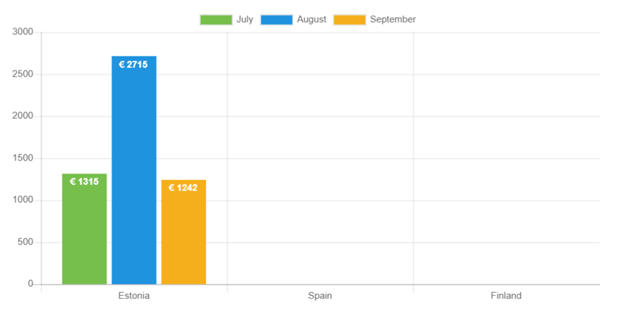

After the dip in loan originations in August, September rebounded with a solid 7.4%. It’s a pleasant change after August’s 9.0% drop. The total value of new loans in September was €2,968,622. It’s just shy of July’s impressive €3,037,495 mark.

The Estonian loan interest rate declined slightly by 0.3% to 35.7% but is the second-highest interest rate we’ve seen for Estonia in 2020. Originations are still being done only in Estonia to mitigate risks during the turbulent financial situation posed by the international health and economic crises.

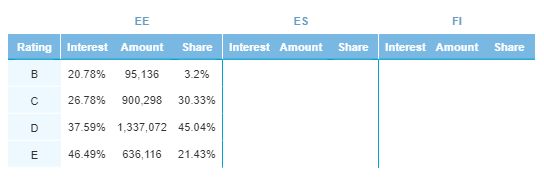

D-rated loans continue to take the biggest share

D-rated loans still make up the bulk of the loan originations, with 45.0%. This equals € 1,337,072’s worth of new loans. In the second place, we have C-rated loans taking up 30.3% of the percentage of loans.

In contrast to August, C-rated loans’ percentage of the market rose in September, as well as E-rated loans. They rose by 2.8% and 1.1.%, respectively. B- and D-rated loans, however, decreased somewhat. B-rated loans now take up 3.2% of the new loans for September, remaining the category with the smallest percentage of the market.

Changes in interest rates were minimal as they stayed relatively stable and very close to August’s numbers. This month, the most significant increase was with C-rated loans, reaching 26.8—a meager 0.4% increase from August.

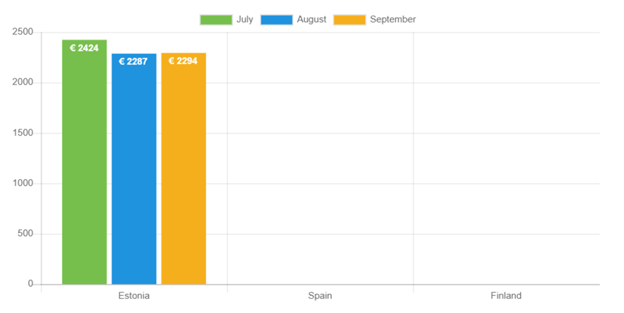

Average loan amount increased

In August, the average loan amount decreased for the first time since April. In September, it rose again slightly to €2,294.

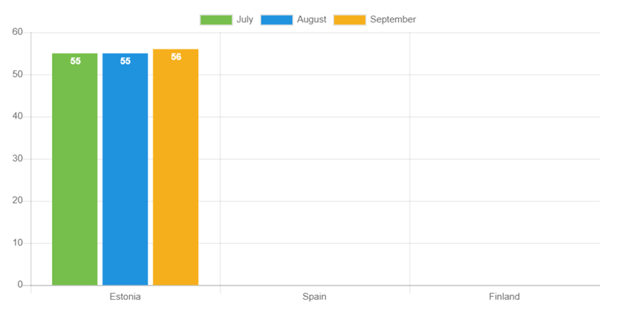

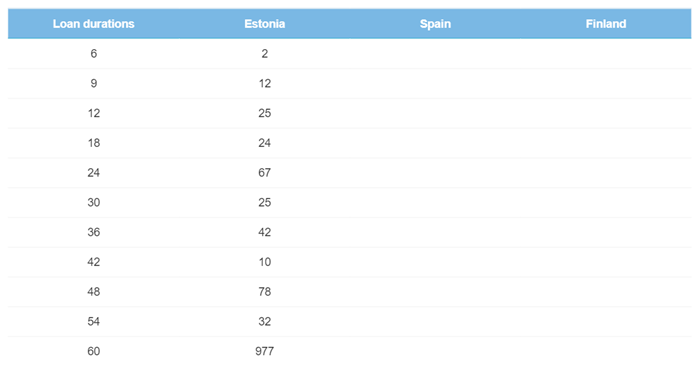

After increasing consistently for three months, then remaining stable in August, it seems that the average loan duration is now rising again. In September, loan durations averaged 56 months, up one month from August.

In contrast to August, demand for short-term loans dwindled slightly. When added together, all the loans for 6-, 9- and 12-month loan periods only amounted to 39 originations – down five from August. The more extended duration loan option of 60-months picked up again, increasing 8.3% from August to 977 loans. It’s the most popular choice amongst Estonian borrowers by a landslide.

Borrower net income restabilizes in September

In August, the average net income of borrowers skyrocketed by 106.4%. Now, in September, it rebalanced to an average similar to two months’ prior, €1,242. It fell by more than half—54.3%, to be exact.

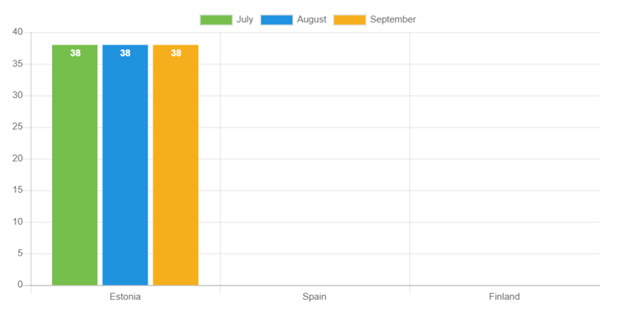

For the fourth consecutive month, the Estonian borrower’s average age remains constant at 38 years old.

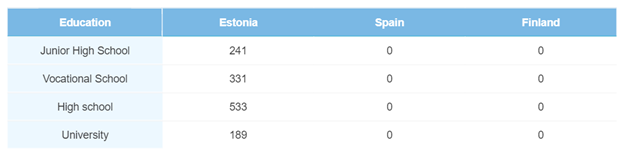

The majority of borrowers are high school graduates

High school graduates still make up the majority of Estonian borrowers. In September, it accounted for 533 borrowers or 41.2%. The most significant change in September was the increase in vocational school graduates. It increased by 71 borrowers—accounting for a 4.1% increase to 25.6% of the market share.

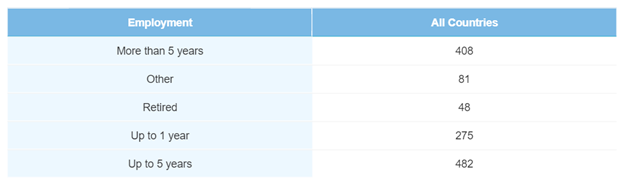

Long term employees fall slightly

The biggest change in September was that the number of borrowers who are employed for more than five years decreased slightly by 2.9%. All the other categories increased, with <5 years gaining the most (+59 borrowers). Other than that, things remained reasonably constant.

Homeownership percentages remain stable

Homeowners continue to make up the biggest numbers for Estonian borrowers, 43.1%, to be exact. It’s followed by Tenants (20.1%), and Living with parents (18.2%). The biggest change was with the last-mentioned category, increasing from 13.9% in August to 18.2% of the borrowers’ total percentage.

Verification status

For the first time in months, the percentage of verified originations decreased. It fell from 92.3% to 91.5% of the total share. This is still an outstanding balance to maintain between verified and unverified borrowers.

September shows promise

After falling slightly in August, September’s numbers can indicate promising increases. By maintaining stable growth, Bondora focuses on sustainable expansion while providing people with the means to achieve their financial goals.

Start investing today! See how you can invest your money here.