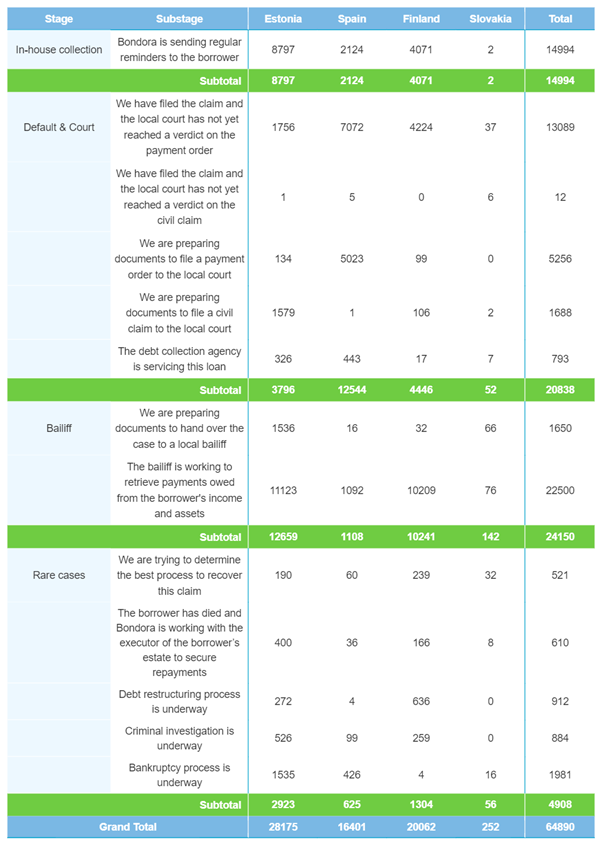

For the 8th month in a row, Bondora successfully increases the recoveries & collection of unpaid loans. This consistent growth shows the efforts to ensure all investments are secure is sufficient. There were 64,890 successful recovery cases last month, a 2.4% growth compared to August’s 63,355.

Nearly all the categories saw a positive increase, except for in-house collections (-1.9%) and Slovak recoveries (+0%), which have been constant for nearly the whole year. Even though it’s normal for some numbers to decline every now and then, the overall trend shows robust growth.

The Bailiff stage saw the most significant increase (+4.6%), accounting for 24,150 recovery cases, which translates to 37.2% of all recoveries. The Default & Court stage takes second place (32.1% share), followed by In-house collections (23.1% share), and Rare cases (7.6% share).

Estonia remains the country with the highest increase, continuing on last month’s trend. It’s numbers increased by 3.2% to 28,175 cases. Spain follows suit with a 2.3% increase and 16,401 cases. Finland had a 1.5% increase, which translates to 20,062 cases. Slovakia brings up the rear with 252 cases. Estonian cases take up 43.4% of the total number of cases, which is a significant percentage.

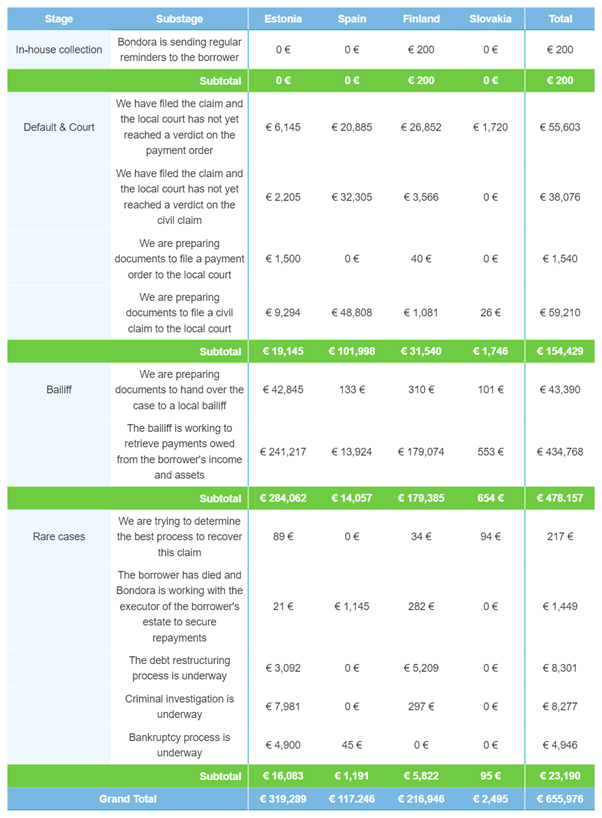

Cash recoveries on the rise again

After the slight dip in August, cash recoveries are showing positive signs of growth again. We recovered a total of €655,976—an increase of 3.8%. Rare cases had a massive boost—a whopping 49.4%! The Bailiff stage was the only one to decrease—even though it was just a minuscule -0.2%. Despite this decline, it still makes up the biggest part of cashflow recoveries, having a 72.9% share.

When looking at all the countries individually, it’s an exact reversal from August when all countries decreased except Finland. In September, Finland was the only country to decline in cashflow (-11.2%). All the other nations had great growth rates, with Slovakia having the most impressive increase (36.3%). Estonia, however, still leads the pack with €319,289 recovered from the Baltic state.

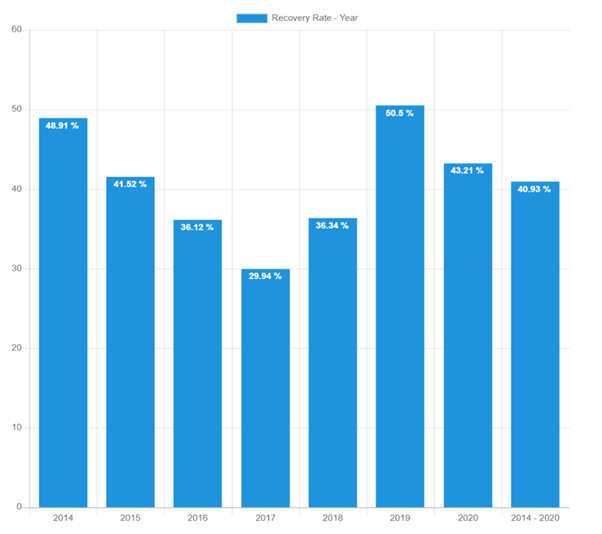

Yearly recovery rate underperforms slightly

When comparing the last two months’ data, September’s numbers are slightly lower than August’s. The cumulative seven-year recovery rate is still, however, at a comfortable 40.9%. 2020 saw a tiny decrease of 0.7% to 43.2%, and 2019, the leader in the last seven years, dropped with 0.6% to 50.5%. Despite these declines, the numbers for the previous two years, and overall, are still looking good.

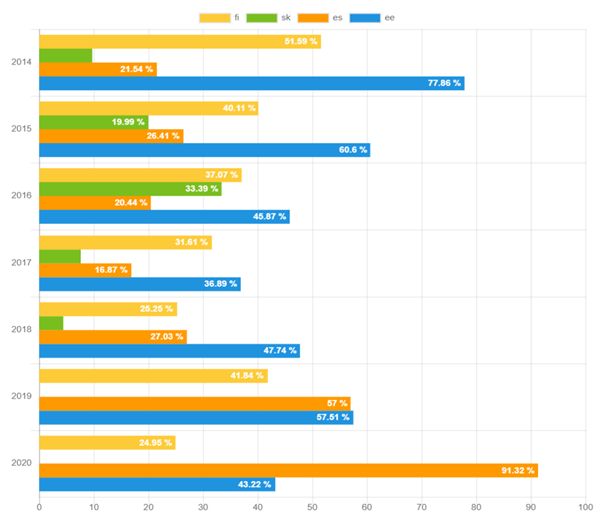

Estonian recoveries still growing

Estonian recoveries in 2020 have been rising every month, and September continues that upward trend. Starting at 25.2% in May, it has continued to increase, now sitting at its highest with 43.2% in September, 3.3% more than in August. Estonian originations take the largest share within the Bondora portfolio at the moment, so this consecutive growth is a welcome sight.

Recoveries looking good in 2020

Having continuous growth for eight months is quite spectacular, and that’s something we’re not taking for granted. We continue to make our already efficient recovery and collection process even better, so investors can continue to feel at ease with Bondora.

Are you interested in following recoveries closely? We have a real-time statistics page where you can view data on missed and recovery payments and stats on returns, profitability, and more!