One of our most common questions is about using the Secondary Market. More specifically, how to sell a loan on the secondary market?

Here it is in a nutshell:

- Research and select investments to sell

- Add investments to Sales Cart

- Sign Sales Agreements

- Checking the investments you listed in Secondary Market

- Tracking sold loans

Research and select investments to sell

In the Public Reports -> “Secondary Market Transactions History” you can see all the data points we track in the secondary market transaction. This report provides some useful data to analyse and understand the patterns or trends present in Secondary Market transactions.

The first data point you want to look at to understand how the secondary market works is the “Result” data point where you can search for all transactions or only the successful ones. Successful means the loan was sold on the market. Maybe there is something to learn from the “Failed” ones too, which are the sales that didn’t go through. Failed loans might leave clues for you as to why those loans did not sell so you can successfully sell yours. For instance, too big of a price markup may have meant no sale as the price was too high.

Bondora cannot give any investing advice, but according to the statistics it is more probable to sell the non-performing part of your portfolio using discount. It usually requires a more active approach and experimenting with different discounts, to see what works best.

Add investments to Sales Cart

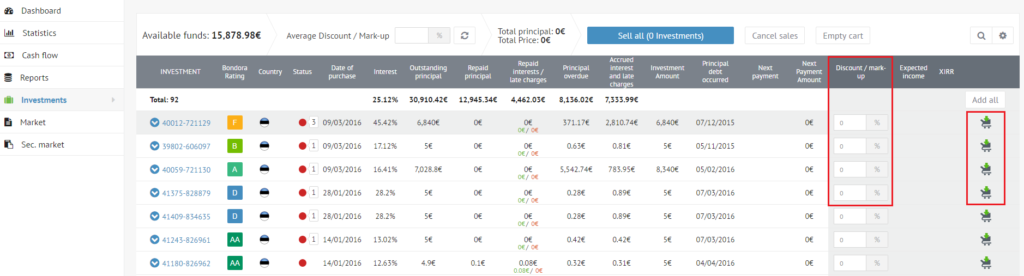

In the Investments page, you go over almost all the way to the right of your screen to the “Discount/Markup” column, for example, using a discount of 5% simply mark -5 to “Discount/Mark-up”. Here you list by percentage how much you want to discount or markup the remaining “Outstanding principal” of the loan and then go to the right and click on the cart to add that loan to the cart at your specified discount or markup.

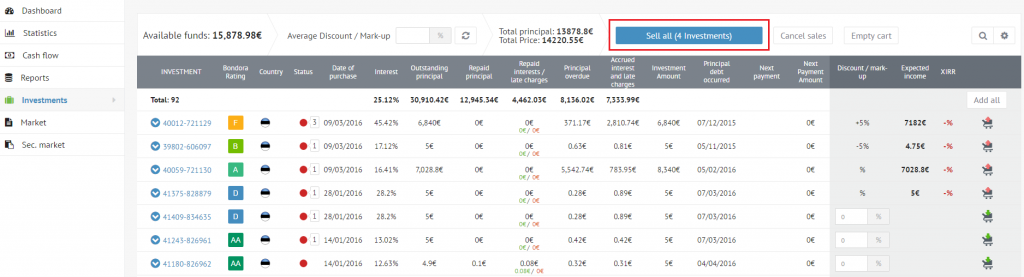

Now that you have added your loans that you want to sell on the Secondary Market to your cart, you need to go up towards the blue button “Sell all … investments” in the table heading and click on it to actually list the loan for sale.

So you have chosen to list a loan for sale, discounted it, put it in the cart and clicked the big blue button. What’s next?

Sign Sales Agreements

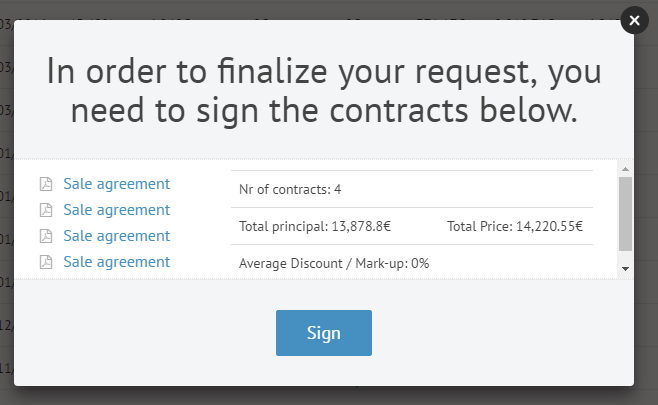

A popup box comes up showing what to do next.

In order for your investment to list on the market, you have to digitally sign the sales agreements. One agreement for each claim (of the whole loan). So by selling 3 loans you also sign 3 agreements. All the sales agreements are signed in one batch.

Agreements are signed. Now we want to check to see if your investments are properly listed in the Secondary Market.

Checking the investments you listed in Secondary Market

After putting some of your loans for sale on Secondary Market, you may want to see and check the loans you listed. You can do that by going to the Secondary Market page.

Here you can see all the investments that have been listed for sale.

In the far right column where the cart is located you will notice all the loans are available for you to put in your cart to buy EXCEPT for the ones that you have listed yourself (they are marked differently in red). Those cannot be repurchased on this screen. If the sale fails, then you get them back, otherwise they are sold. Depending on the rating, discount/markup and history of your investment, it may be sold quite quickly or it may take a while to be sold in the Secondary Market. This is where the discount/markup feature may come in handy.

In order to buy loans from Secondary Market and include them in your portfolio, you simply select the loans you want, add them to the cart and press the blue “Buy all” button. You can buy one, multiple or in principle all the loans available depending on your risk, selection and balance of cash available.

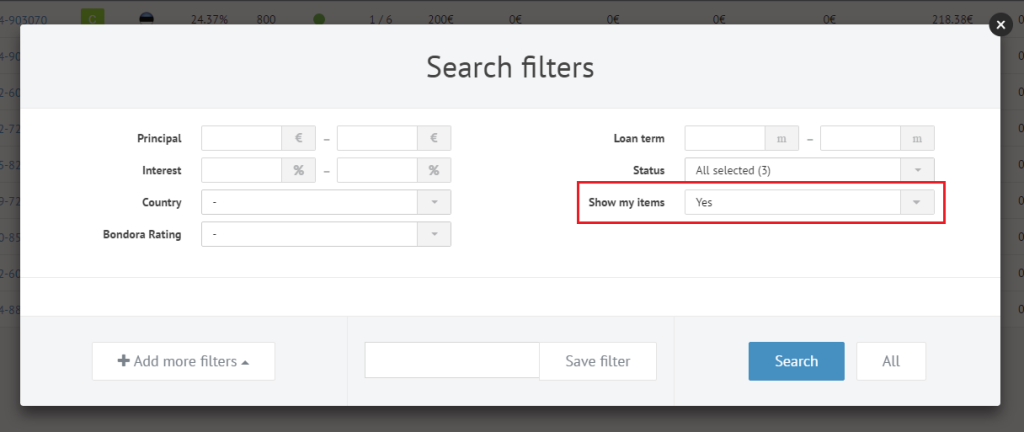

The Secondary Market has search features and if you want to be sure to see that your loans for sale are properly listed, then you have to make sure in the search settings that the “Show My Items” says “Yes“. When that is enabled, you see every loan listed by you.

Tracking sold loans

By now, you have used the Investments page to place your investment for sale, listed it and now some of them are hopefully sold. Congratulations! Now what?

You can track the sold investments in numerous places including the Investments page, the Reports page, the Cash flow page and your Account Statement. Since every loan and loan claim has a unique id attached to them, it is possible to track your sold investments from the pages and reports mention above.

Loans will be kept on the Secondary Market for 30 days. Those ones that have not been bought during the time period, will be automatically called back. If you wish to continue with the sales process, you would simply need to re-add them.

Please be aware that based on your jurisdiction, your sale of your loan may have tax consequences. Please consult a tax professional in your local market so you are sure you stay compliant.