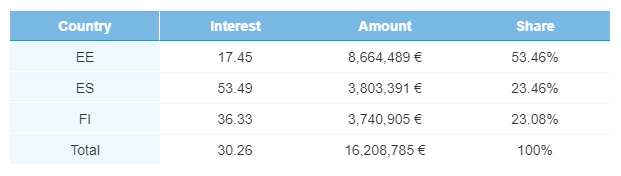

Bondora ended the year with €16,208,785 in December originations, an 8.1% decrease compared to November. Points of note on the month were growth in Spanish originations and changes to Finnish duration and average loan amounts.

Spanish originations come in strong

Even with the overall decrease, Spanish originations grew on the month, up by 13.8% to €3,803,391. This increase put Spanish originations at a higher total share (23.5%) of Bondora originations than Finnish originations (23.1%).

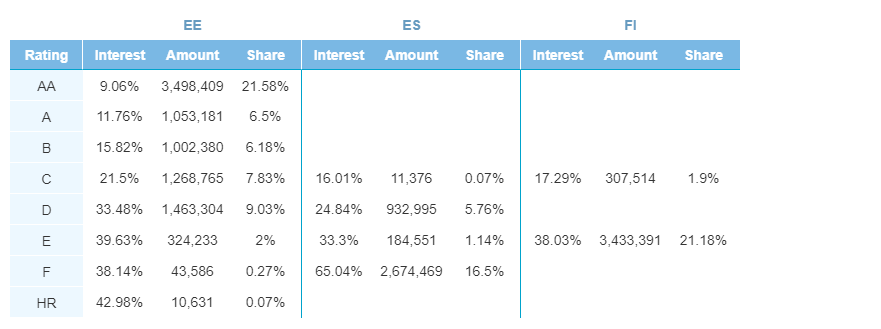

In Spain, F and D rated loans accounted for 94.8% of all originations in the country. Even as Estonian originations decreased in December, several of its rating categories saw an increase in originations. This was seen the most in Estonian B rated loans, which grew by 23.3% to €1,002,380.

Finnish loan amounts reverse course

After three straight months of declines in average loan amounts, Finnish borrowers, on average, had higher originations in December. The average loan amount for Finland was €3,114, an increase of 3.7% over November. Estonian loan amounts saw the biggest decrease, down by 8.1% to €2,825.

Shorter Finnish durations

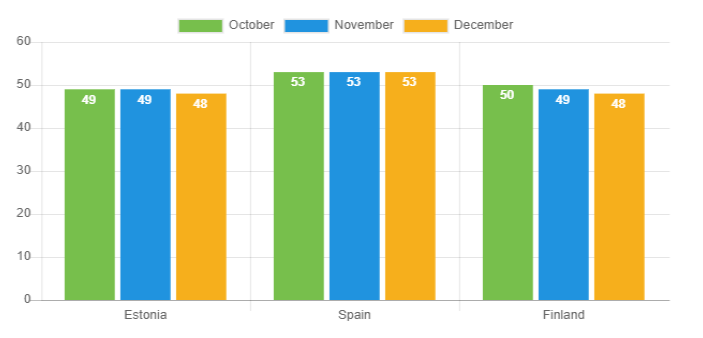

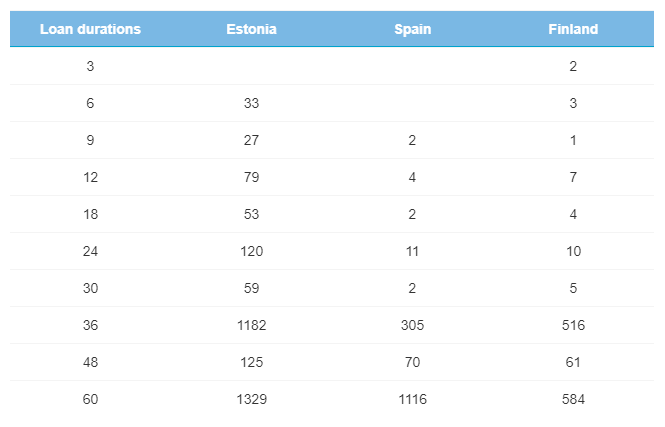

For the third straight month, the average Finnish loan duration has shortened, this time down to 48-months. Spanish durations remained constant, at an average of 53-months, while Estonian originations averaged 48-months, slightly lower than in November.

The 60-month Finnish originations dropped by 20.9% on the month. Still, the total number of Finnish originations at 36-months or longer to 97.3%.

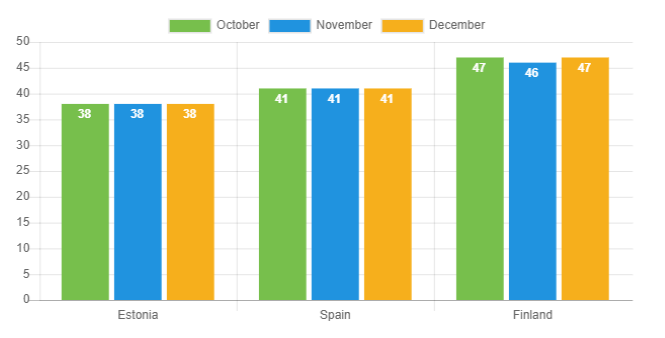

Average Age

The average age of Estonian and Spanish borrowers remained constant, while the average age for Finnish borrowers was slightly higher to 47-years old, the same as the average in October.

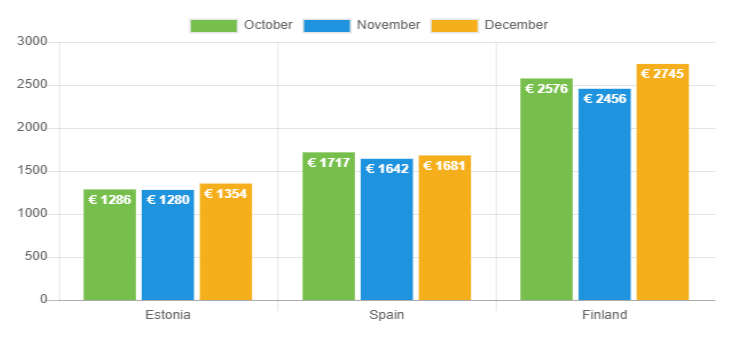

Income

The average Finnish borrower made a higher income (€2,745) in December than the previous three months, an 11.8% increase over November. Estonian and Spanish incomes ticked up slightly higher to €1,354 and €1,681 respectively.

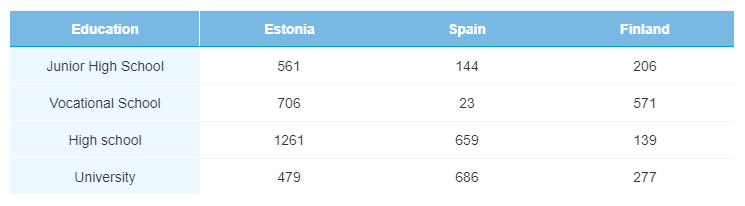

Education

A higher ratio (45.4%) of Spanish borrowers held a university education in December. Education levels across Finland and Estonia remained fairly constant compared to last month.

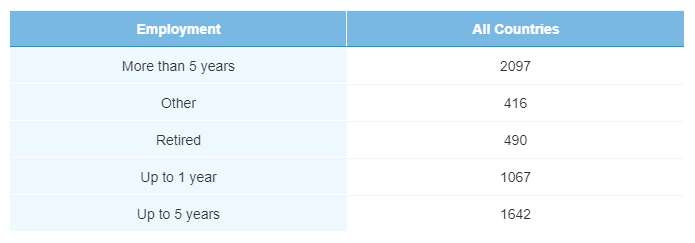

Employment

The number of Bondora borrowers employed for more than 5-years declined to 36.7%, while the same ratio of borrowers (28.7%) was employed up to 5-years.

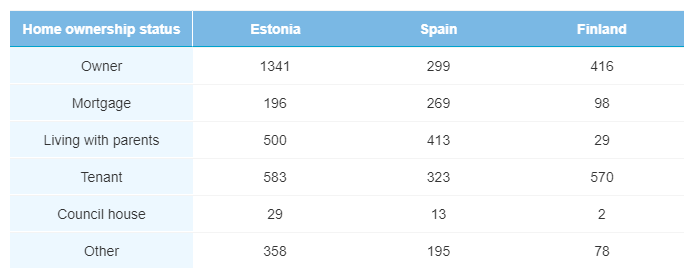

Home Ownership Status

There was an increase in Estonian tenants in December, up to 19.4% of all Estonian borrowers. Meanwhile, more Spanish borrowers (27.3%) are living with their parents than in previous months.

Verification Status

The uptrend in Estonian borrowers income being verified continued, with 60.3% of borrowers in the country obtaining their verification status. All told, 73.9% of all Bondora borrowers were verified in December, up from 69.9% in November.

The end to a strong year

Looking at the year in total, Bondora originations showed positive signs across the board. There was significant origination growth in the latter half of the year, and origination statistics like verification status and employment duration were encouraging. These statistics bode well for the growth of Bondora originations in the coming year.

Learn more about Bondora investment products here.

*As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75% p.a. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.