Bondora secondary market transactions pulled back from previous highs in February, totaling €838,166 on the month, down 12.1% compared to last month. Declines were consistent across all secondary market categories, with API transactions falling the most, down by 16.7% to €191,945.

Current Loans

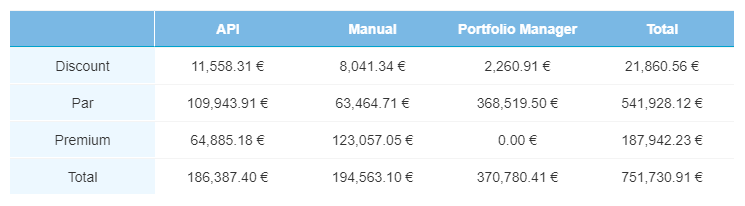

A drop of 11.2% in current loan transactions was similar to the 12.1% overall decrease in transactions on the secondary market. Of all current loan transactions, 72.1% were made at part value, compared to 70.0% last month.

Overdue Loans

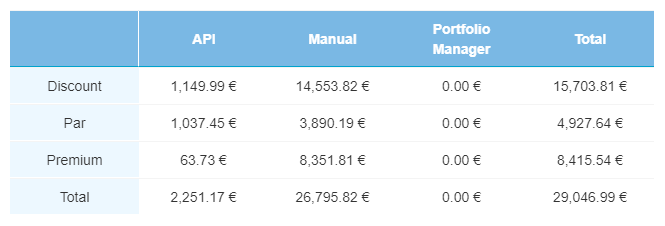

There was a total of €29,046 in overdue loan transactions in February, down 26.4% from January. API transactions were down by almost half, while manual transactions fell to €26,795.

Defaulted Loans

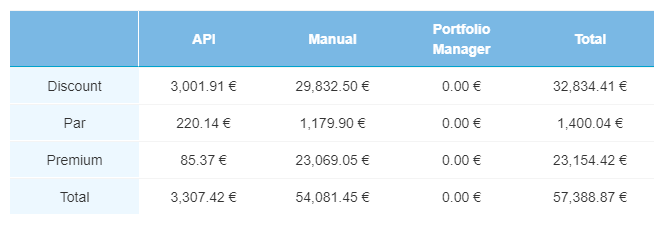

Defaulted loan transactions continued to outpace overdue transactions on the secondary market. There was a total of €57,388 in defaulted transactions on the month, down from €67,840 a month ago. Contrary to the decline in all secondary market transaction categories, API transactions actually rose by 6.7% to €3,307.

Secondary market leveling-off

The Bondora secondary market leveled-off in February after several months of steady increases. Current loans continue to maintain the vast majority of secondary market transactions, with 89.7% of all transactions on the market.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at investor@bondora.com.

*As with any investment, your capital is at risk and the investments are not guaranteed. The yield is up to 6.75% p.a. Before deciding to invest, please review our risk statement or consult with a financial advisor if necessary.