Nothing beats Go & Grow when it comes to simple investing. Released to investors a little over two years ago, it’s our most popular product, and used by all kinds of investors. From beginners looking for a simple, hands-free experience, to more seasoned investors who want to diversify their portfolios and be hands on with their investments. It’s a one-size-fits-all solution that is loved by over 92,000 happy investors.

But what exactly is it that makes Go & Grow work so well? What’s the ‘secret formula’ that makes it investors’ preferred way to grow their money? It’s all thanks to portfolio distribution. In this post, we’re breaking down and explaining all the details of the Go & Grow portfolio, so you can understand exactly where your money is going, and how it’s growing 🌱

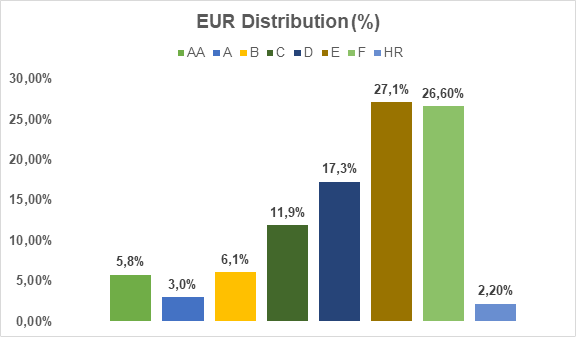

Bondora risk ratings

Diversification is Bondora’s middle name. That’s why Go & Grow spreads its claims across eight different risk ratings—ranging from AA to HR.

At the moment, HR is the rating with the lowest representation (2.2%), followed by A (3%) and AA (5.8%). The largest distributions are in E and F rated loans (27.1% and 26.6% respectively), followed by D (17.3%) and C (11.9%) rated loans.

🧩 Did you know that Go & Grow consists of over 109,000 loan claims? That’s what you call next level diversification.

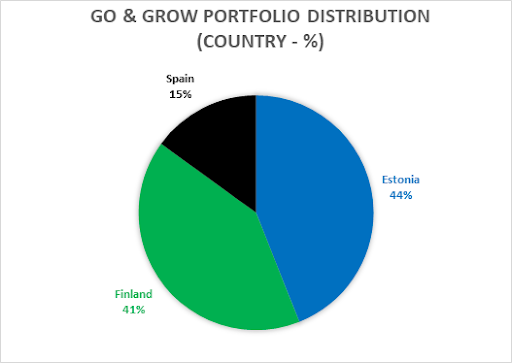

Distribution by country

Estonia continues to gain territory, holding the largest share of the loan origination total with 44%. Finland is only 3% behind, taking second place with 41%. Spain accounts for the minority of the distribution, with 15%. However, we expect Spain to take on a much more prominent role in our originations in the future.

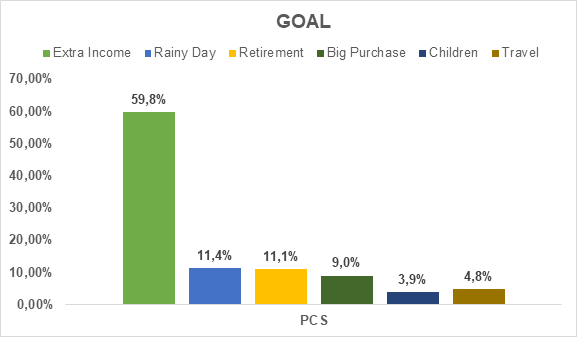

What are people investing for?

We’ve used the data from the investment goal feature to determine what people are investing for. 59.8% of investors aim for extra income, but seeing as this is our default goal option, these numbers should be taken with a grain of salt. The second most popular goal is Investing for a Rainy Day (11.4%), with Retirement (11.1%) coming a close third.

Go & Grow’s great diversification is just one of its many benefits. Here are even more reasons why investors love Go & Grow:

Top 5 reasons why everyone loves Go & Grow:

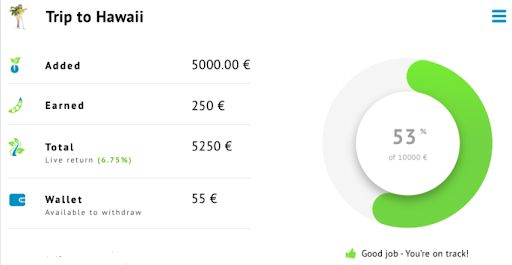

⭐️Up to 6.75%* p.a. net return

⭐️Incredibly easy to use – great for beginners!

⭐️Start with as little as €1

⭐️Pay zero annual management fees

⭐️Create a goal and receive updates on your progress

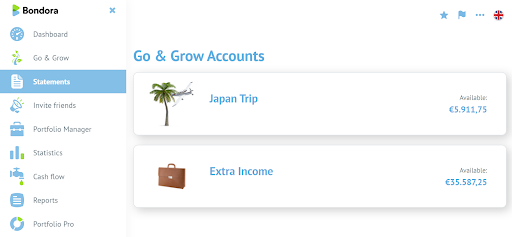

Go & Grow returns are added Every. Single. Day.

Nothing beats the smell of fresh yields in the morning! You can easily track the returns that are added to your account every day. Login to Bondora, then head to the “Statements” section on the left-menu panel on your account to see your returns.

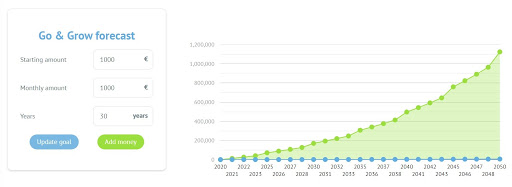

Forecasting your financial future

Go & Grow is super easy to use, yes, but that doesn’t mean you can’t go do some kick-ass financial planning! Use our Forecast tool to plan ahead and see your financial strategy in action. Click on the burger icon on the top-right corner of your Go & Grow account to try it out. Don’t be shy! Use it to see how different investment scenarios will play out to find your ideal plan. Plan your financial future with Go & Grow Forecast.

And speaking of financial future…

We’ve been covering the topic of financial and investment planning on our blog. Want to find out how to create an investment plan? Or how to become financially independent? Our blog has the answers! Click on the articles below to learn more:

➡️ Next stop: Financial freedom

➡️ 3 investment plans you could follow to be a millionaire

➡️ How to create your very own investment plan

➡️ Working your way up the 6 levels of financial independence

New feature—coming soon!

We live for simplicity and we’re always looking for new ways to improve our products. That’s why we’ll release a new, simplified Go & Grow user interface to all our investors, soon. The new feature, called Wallet, will allow you to quickly check your investments and available funds at a glance. The design is streamlined, cleaner and self-explanatory. It’s a welcome change and we think you’ll love it. Check out the sneak peek below:

And we have a few more surprises up our sleeves 😎 Read our latest Bondora Highlights post to see what we have been up to…

Got more Go & Grow questions? We’ve got the answers: Click here.