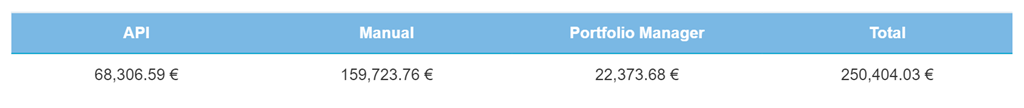

After picking up slightly again in November, Secondary Market transactions fell to €250,404. This is similar to what we saw happening in December 2020, perhaps indicating a longer-term trend of investors opting not to buy and sell loans in December actively? Despite the decline, Manual transactions shined with increases. Let’s take a more detailed look:

In contrast to November, the API and Portfolio Manager transactions decreased, and Manual transactions increased. The latter increased by 25.9%, while the API activity decreased by 26.9%, and Portfolio Manager transactions declined by 39.3%. Manual transactions retain the highest value, totaling €159,723 in transactions. In total, Secondary Market transactions declined by 2.6%.

Current loans

Once again, current loan transactions made up most of all transactions, with €164,116.

Manual transactions had the overwhelming majority, with a 51.3% share. They’re followed by the API (35.1%) and Portfolio Manager (13.6%). In contrast to November, transactions done at par were the most popular, making up 48.7% of all transactions. However, loans sold at a premium were close, coming in with 42.4%.

Overdue loans

In December, Secondary Market overdue loan transactions totaled €35,311—up 38.9% from the previous month, jumping back to numbers similar in October. This increase mainly comes from overdue loan transactions at a discount, increasing by a whopping 202.0%. Transactions at par declined by 53.2%, while transactions at premium remained very similar to those in November, increasing only 4.6%.

Manual transactions also had a massive increase in the discount department, nearly doubling from €15,695 transactions in November to €27,117 in December. On the other hand, API transactions had a slight downward trend, declining by 15.7%.

Defaulted loans

Once again, defaulted loan transactions increased, this time by 60.8%. In December, defaulted loan transactions at a discount took over, increasing by 145.5%. In contrast to November, transactions at par fell by 97.8% to €292.7. Transactions at premium skyrocketed from €60’s worth of transactions in November to €5,510 in December.

Manual transactions increased impressively by 45.5%, while API transactions held steady with a slight 5,0% increase.

Secondary Market ends off 2021 at a slow pace

2021 was a slow year for the Secondary Market, with regular ups and downs in activity but ending lower than one year ago. This is no coincidence, as more investors opt for the hands-free Go & Grow investment method rather than buying and selling on the Secondary Market themselves. But one relatively consistent thing is that manual transactions have been the category with the highest value of transactions, throughout the year, except for August.

Let’s see what this year will hold in store for the Secondary Market.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.