If you’re interested in how Go & Grow works, and learning more details about our portfolio, then this article is perfect for you. You can get more insight into what makes Go & Grow successful: its portfolio distribution.

Below, we detail how the claims added to the Go & Grow portfolio are distributed, the percentage division amongst loan ratings, the number of Go & Grow Unlimited investors, and more.

So, let’s take a closer look at Go & Grow’s 2022 Q3 portfolio:

Bondora’s Go & Grow is our investors’ favorite way to invest. Over 234,000 investors have opened a Go & Grow account! And there’s a good reason it’s so popular: people want to build their wealth and don’t want to waste valuable time figuring out complicated investment funds. Go & Grow is the simple solution!

The Unlimited tier of Go & Grow and the Go & Grow App (with even more exciting new features) give investors more reasons to love Go & Grow.

Credit ratings

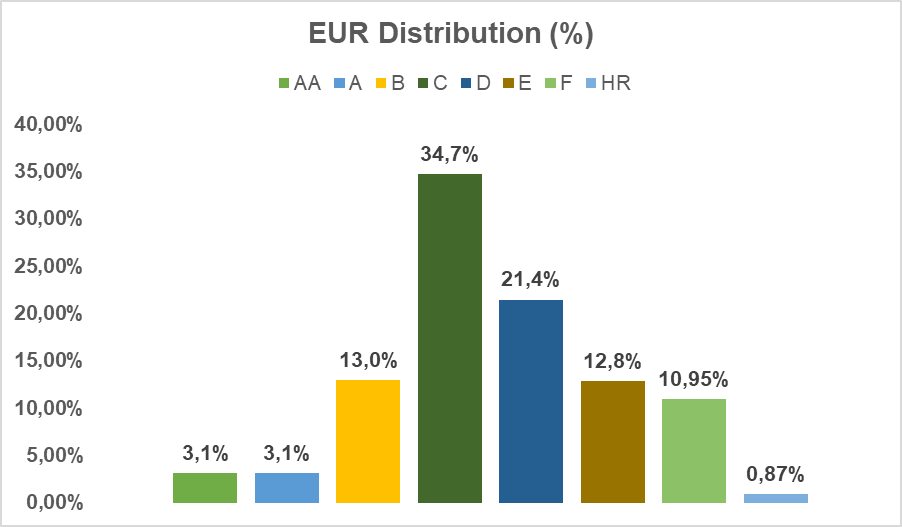

Diversification is at the core of our business, and the Go & Grow portfolio is no exception. Instead of investing everything in only one credit rating, we spread investments across all 8 ratings, from AA to HR. By investing in several different loan pieces across multiple ratings, the Go & Grow portfolio helps you get the most out of your investment.

As we saw last quarter, B and C-rated loans were again the only risk ratings to increase. C-rated loans maintain the most significant share and growth, increasing from 29.1% at the end of Q2 to 34.7% in Q3.

D-rated loans dropped slightly from 22.3% to 21.4% but remain the 2nd most prominent category in the Go & Grow portfolio.

B-rated loans traded places with E-rated loans, garnering the 3rd largest share with 13.0%. E-rated loans obtained 12.8%, a close 4th place. F-rated loans follow in 5th place, with 10.9%.

HR-, A- and AA-rated loans remain the outlier with the lowest distribution figures. HR-rated loans still have the smallest share, dropping from 0.9% to 0.8%. AA and A-rated loans decreased by 0.5% and 0.2%, respectively (the same as in Q2).

This risk-rating split is mirrored in the overall Bondora portfolio (as shown below in the Total Bondora origination by rating and country chart).

Country of origination

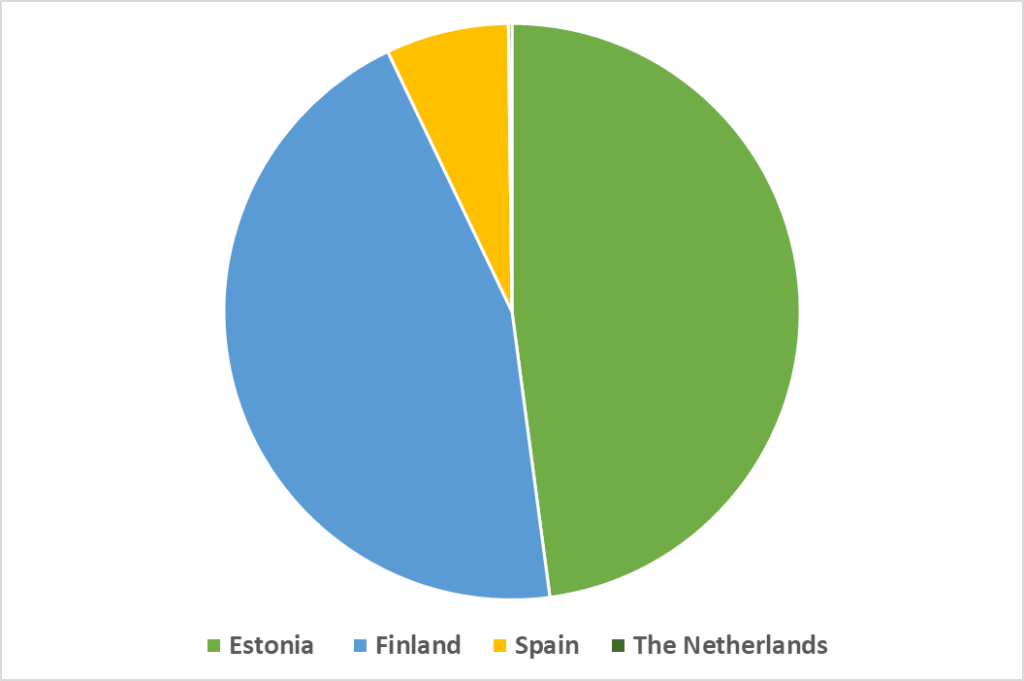

Even though originations declined somewhat in September, it remained an exciting month as the Bondora loan market opened for customers in the Netherlands. The Spanish loan market originations also exceeded €1M for the first time since March 2020. In total, our loan originations were €12.5M in September (compared to €14.7M in June).

For another quarter, Estonia’s share declined and now totals 47.9%. Despite this decline, it still has the largest share, at least for now.

In contrast, Finland continues to grow slowly, increasing by 1% to a 45% Go & Grow portfolio percentage share. Finland could soon make up the largest portion of the Go & Grow portfolio distribution.

Spain continues to grow, with a steady share of loans at 6.9%. Spain originated over €1M worth of loans in September, the highest amount since relaunching the Spanish market one year earlier. It has shown constant and consistent growth, and we expect this trend to continue.

The Netherlands, having only launched at the end of September, makes up a 0.2% share of the Go & Grow portfolio.

Go & Grow Portfolio Distribution per Country

Rating and country

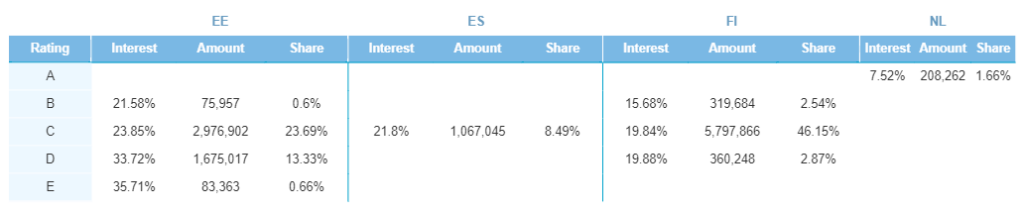

Below is the total distribution of originations across Bondora (not only for the Go & Grow portfolio) in September 2022 (the end of Q3).

In the most exciting news, we opened our Netherlands loan market on 23 September. In just one week from the launch, customers in the Netherlands received over €200,000 in loans. This makes us very excited about this new market. We will continue to monitor this market in the coming months.

Across the three pre-existing markets, C-rated loans still make up the largest share of loan ratings. The Netherlands is currently only open to A-rated loans.

Finland’s C-rated loan category still makes up the majority in the country and across all our loans, with an increased share of 46.2%.

Estonia’s C-rated loan category is the 2nd largest across all our loans, with an increased 23.7% rating. D-rated loans take up the 3rd biggest share with 13.3%. In contrast to last quarter, the Estonian B-rated loan category diminished from 13.5% at the end of Q2 to 0.6% in September.

We are still only originating C-rated loans in Spain, but they are skyrocketing. We have exceeded the €1M origination mark and are pleased with the growth we see in the Spanish market. At the end of Q3, it had an 8.5% share, a significant increase from the end of Q2 when it only had a 2.8% share.

If you want to read more about our portfolio stats, follow the regular updates on our blog.

Investment goals

Go & Grow Unlimited does not have a goal-setting function. However, you can still invest towards any goal and use the forecast tool to calculate your returns.

If you joined Bondora before 24 August 2022, you would have a classic Go & Grow account with a customizable goal. The goal doesn’t affect your returns, but is a cool way to personalize your account.

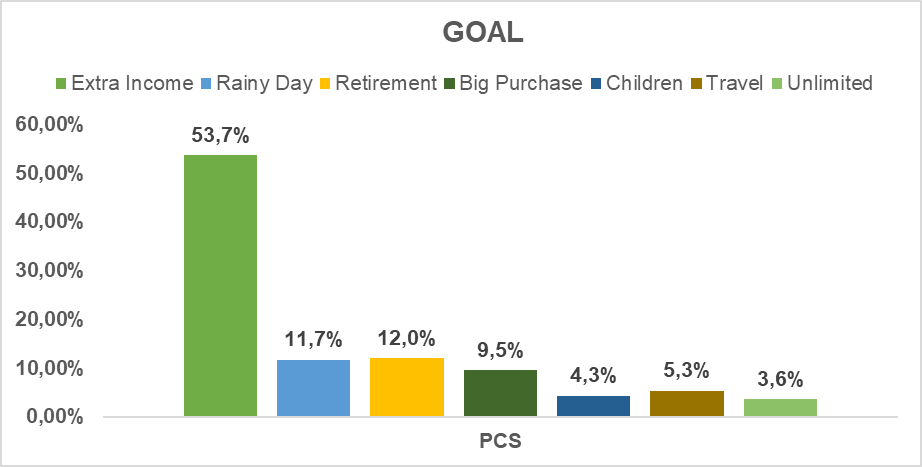

As with every quarter, Extra Income (53.7%) has the clear majority, despite a 2.5% drop. But keep in mind this is the default selection.

Retirement (12.0%) decreased by 0.3% and remained the 2nd most popular goal. Rainy Day (11.7%), also dropped by 0.3%. Big Purchase (9.5%) declined by 0.3% as well.

Once again, Travel (5.3%) remained the same, as did Children (4.3%). The Unlimited tier garnered a 3.6% share.

Go & Grow Unlimited – our easiest way to invest

We like to keep things simple and effective. And we believe that’s what makes Go & Grow so great. There’s nothing complicated; it’s super easy to use and our simplest way to help you grow your money online.

5 reasons to invest with Go & Grow Unlimited:

🌱 Up to 4%* p.a. net return

🌱 Incredibly easy to use

🌱 Start with as little as €1

🌱 Zero annual management fees

🌱 Invest ANY amount – no limits!

Unlimited is the latest tier of Go & Grow where you can invest with no monthly or overall limits and earn a competitive net return of up to 4% p.a.* If you joined Bondora before 24 August 2022 and have a pre-existing Go & Grow classic tier, it will continue earning up to 6.75% p.a. independently.

Once activated, you can add money directly to your Unlimited tier from your bank account using your unique Go & Grow Unlimited reference text.

Go & Grow on the go

If you haven’t downloaded the new Go & Grow app, you’re missing out!

The app allows you to create and update your unique goals, make instant payments, check your investment growth, withdraw your money anytime, and so much more.

It has all the core features of the web-based Go & Grow, but with the convenience of fitting into your pocket. It also makes transferring money from Wallet into your chosen Go & Grow or Go & Grow Unlimited even easier. Nearly 40,000 people have already downloaded it. So, try it today!

We release new features regularly, so make sure you download the app from the Google Play store or the Apple app store today.

Are the Go & Grow and Go & Grow Unlimited return rates guaranteed?

While it’s great to say we’ve delivered on our promises to investors so far, we want to ensure you’re aware of possible risks.

The return rates for Go & Grow and its Unlimited tier are not guaranteed; however, with our solid 14-year track record, we believe the return rates are achievable.

Liquidity

The plan for Go & Grow, and its Unlimited tier, was always to have a product with fast liquidity for investors.

So, if Bondora cannot fulfill all withdrawals from Go & Grow and the Go & Grow Unlimited tier, two scenarios will follow (and will be decided by whichever occurs first). We have simplified them into two points below; however, please see your Terms of Use for a full description.

- The investor will receive their entire withdrawal once there’s enough money available in the Go & Grow portfolio, generated via further returns or investments.

- The investor will receive partial payouts of their withdrawal each banking day until the entire withdrawal has been fulfilled.

Want to know more about Go & Grow Unlimited? Click here.