The collection and recovery efforts in March set new record highs for 2022. The cash collected increased by a whopping 61.6% from February, totaling €1,249,637. And 77,471 missed payments were recovered, which is the highest number in Bondora’s history! Read more:

February was the first time in 6 months that the number of payments recovered didn’t increase. And so we’re happy to see an increase again—by 3.6%, to be exact. 77,471 missed payments were recovered, the highest number in Bondora’s history!

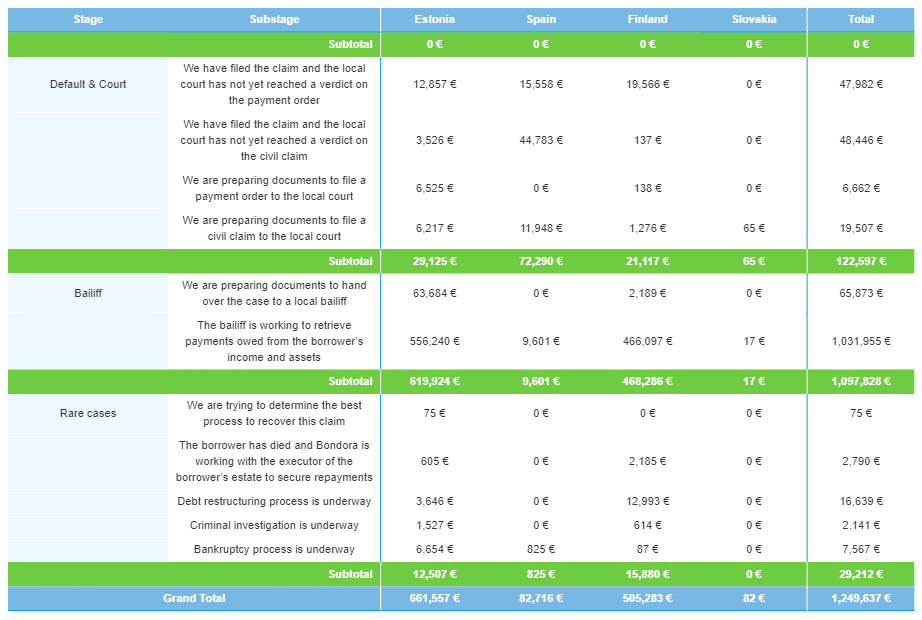

The percentage share among countries and stages remained similar to February’s numbers. As has become standard, most recoveries were made in the Bailiff phase, accounting for 33,917 loans, a majority 43.8% share. And as per the norm, the Default & Court phase had the second-most, with 20,313 recoveries—a 26.2% share.

Cash recoveries

After decreasing in February, we’re thrilled to have a great end to Q1’s cash recovered and a new high for 2022! In March, the total cash recovered amounted to €1,249,637, a 61.6% growth rate.

Although the number of loans recovered from each country remained very similar to last month, the percentage share of cash recovered from countries differed. This month, in contrast to the last, Estonia is responsible for the largest portion of the cash recovered—a 52.9% share. More than half (€661,557) was recovered from Estonia—a massive 127.7% increase from February.

On the other hand, Finland’s share decreased from 55.1% to 40.4%, but this is only due to the growth spurt in Estonia. Finnish cash recovered actually increased by 18.6% from February, totaling €505,283.

Spain’s cash recovered share dropped by a slight 0.7% difference, but the growth rate from February was a whopping 45.6%. Their share of cash recovered increased from €56,794 to €82,716.

And unsurprisingly, the Bailiff stage accounted for the most recovered cash, which was an impressive €1,097,828. This is an even more impressive 71.0% increase from February. The Default and Court stage also increased by 24.0%, accounting for €122,597.

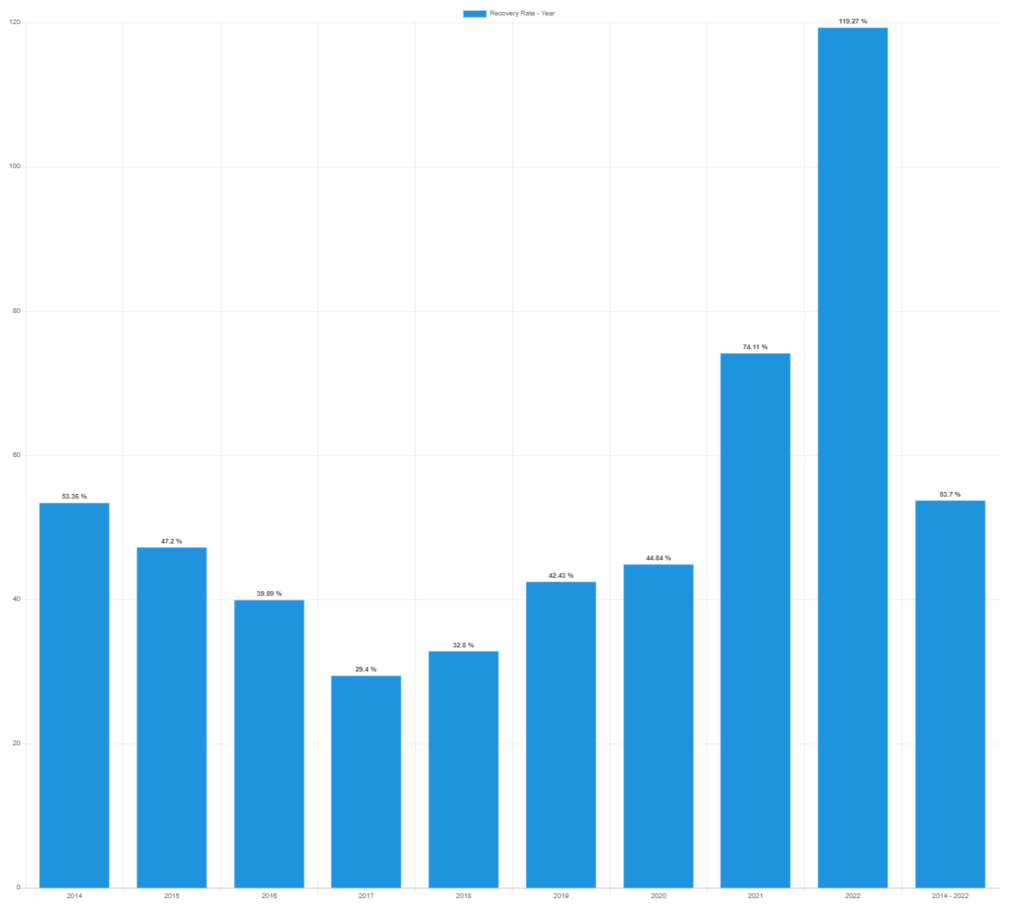

Yearly recovery rate

The 2022 recovery rate peaked at 261.5% in January and started to level out in February to 137.1%. We’re continuing on this path as March’s 2022 recovery rate hits 119.3%.

Changing course from the last two months, 2017-2019, showed slight decreases, and all the other years increased. The lowest rate comes from 2017 with 29.4%, and (apart from the current year), 2021 still has the highest rate with 74.1%. The current cumulative 2014-2022 recovery rate stands at 53.7%., slowly decreasing as we get more data for 2022 recoveries.

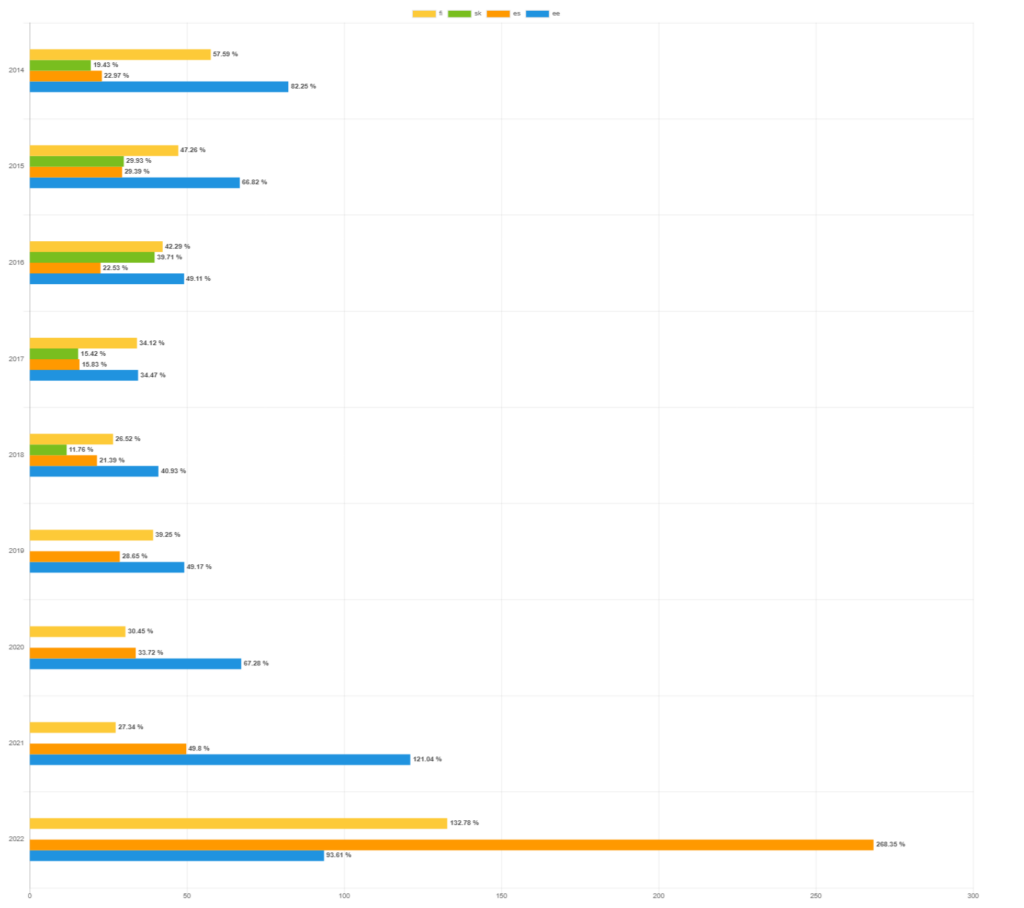

Recoveries by country

This month we’re switching gears. Whereas Finland has been the main outlier for 2022 recoveries, it’s now Spain that has taken over that position. Spain has a 2022 recovery rate of 268.4%, which is more than double Finland’s 132.8%. Estonia trails with 93.6%. As was the case in February, Estonia remains in the lead for all the other years before 2022.

New recovery highs for 2022

As we progress into Q1 of 2022, the recovery rates, which began astronomically high in January, are starting to settle more. But, we do expect it to remain relatively high. Estonia holds the lead in recovery rates from 2014-2021, but Finland charges in first place for the 2022 recovery rate. Although the number of payments and cash amount recovered is less than last month, recovering €773,447 in one month is still work we’re proud of.

You can always view missed payment recoveries and all other Bondora data. Check out our real-time statistics to see recovery data on all Bondora missed payments and loan history, returns data, and more.