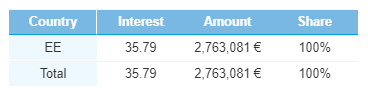

August saw Estonian loan originations total €2,763,081—a bit lower than July’s €3,037,495 mark, but still higher than June’s €2,010,847. Ups and downs are normal and this small fall was predictable after originations skyrocketed before with 51.1% growth from June to July. The €3M mark is still close though and we fully expect originations to rise again in the next few months.

Estonian loans have increased their interest rate in August, averaging 35.8% on the month. This is an increase from the 34.9% we experienced in July and breaks the downwards trend after two months of consecutive decline.

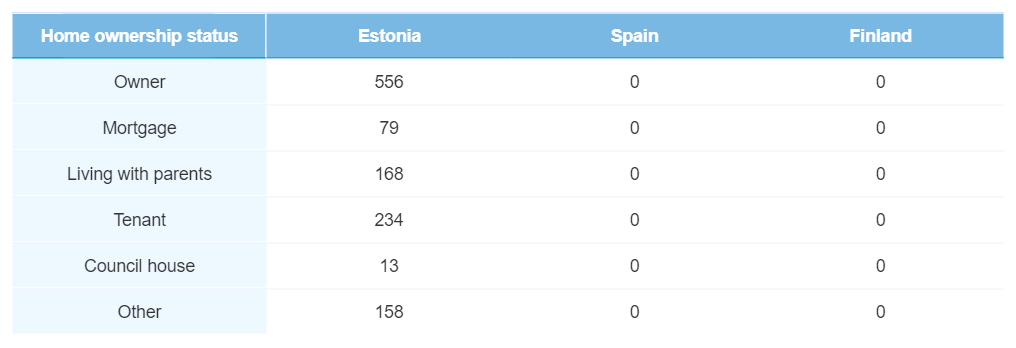

Originations are being done only in Estonia for the time being. The decision to possibly restart loans in Finland and Spain is expected to be reviewed in September.

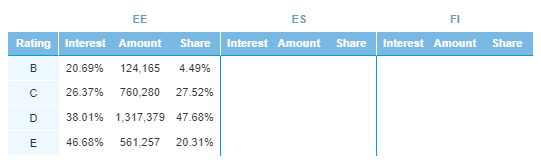

C-rated loans go down

The decrease in originations came accompanied by a low turnout in the C and D rating categories. While D-rated loans totaled €1,317,379 (-2.4%), it was C-rated loans that lost the largest share in August, coming down to €760,280 (-25.4%). B- and E-rated loans went the opposite direction and saw growth on the month.

Changes on interest rates were minimum as they stayed rather stable and very close to July’s numbers. The biggest climbers were E-rated loans, reaching 46.7% in August, only a 0.3% rise from the previous month.

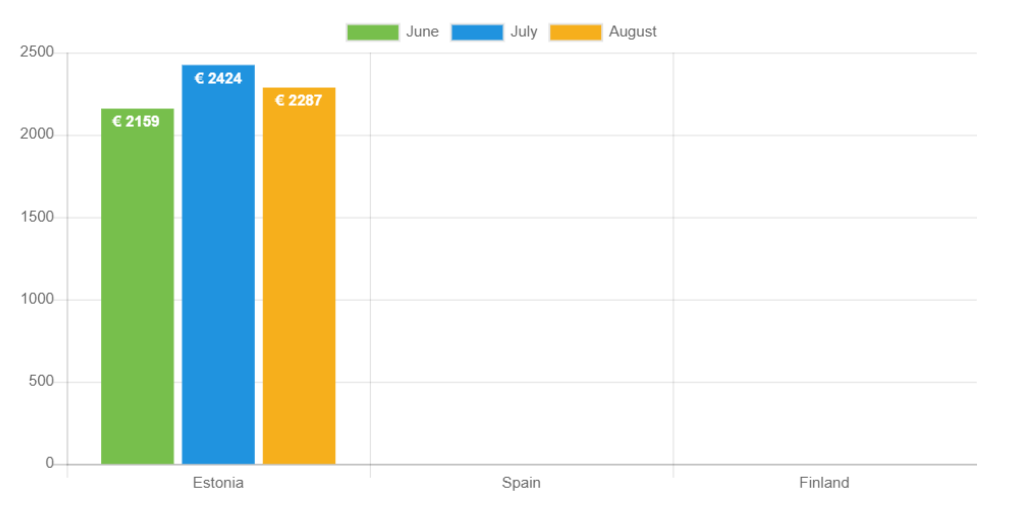

Average loan amount decreases in August

After increasing for 3 months in a row, the average loan amount has decreased for the first time since April. The decline was 6.7% to €2,287.

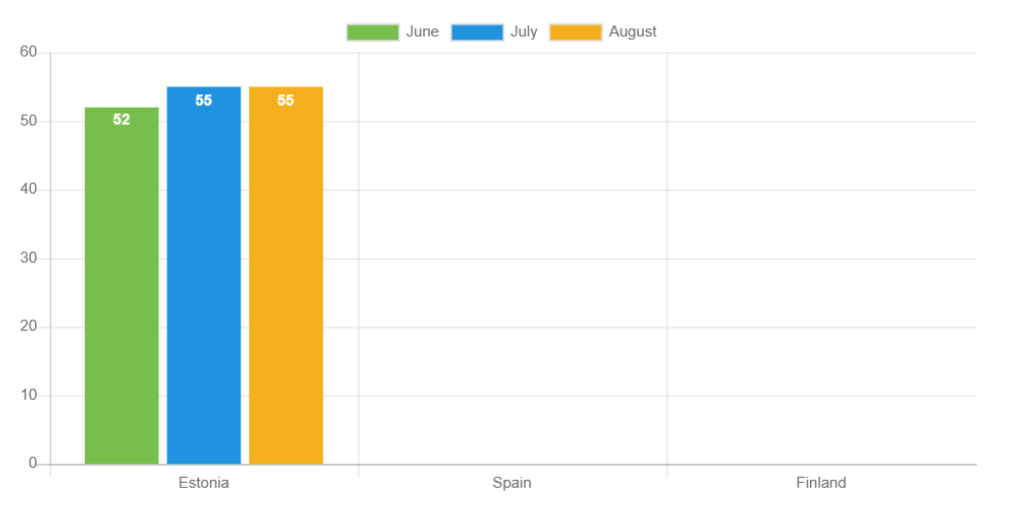

Loan durations weren’t affected by the slight decline in originations, averaging 55 months. This is the same we saw in July and interrupts a growing trend that lasted for 3 months.

In contrast to July, in August we saw shorter-term loans gaining popularity, with 44 originations when adding together 6-, 9- and 12-month loan periods.The longer duration loans of 60 months took a dip to 902 loans, falling 2.9% from the previous month.

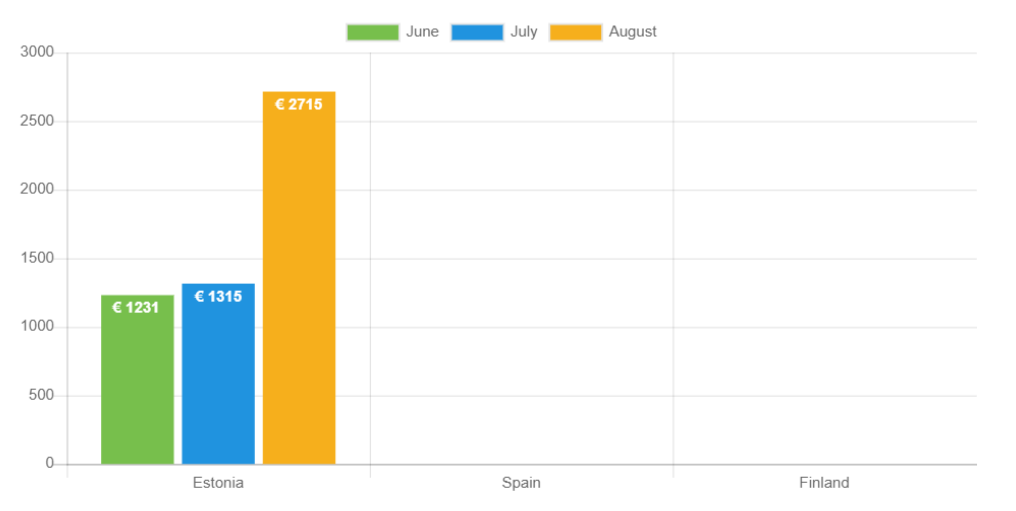

Borrower net income surges in August

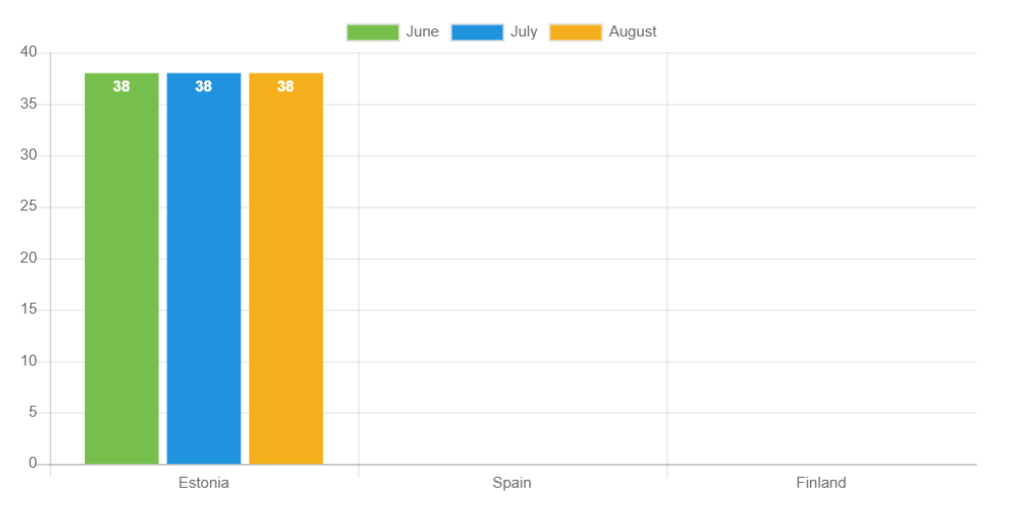

Recent months have seen the average age of the Estonian borrower swing between 39 and 38, with the latter being the number for August. This has been a steady average that has been held for three months now.

Net income skyrocketed in August. After a slight increase in July, when it grew by 6.8%, it saw tremendous growth last month with a 106.4% increase to €2,715.

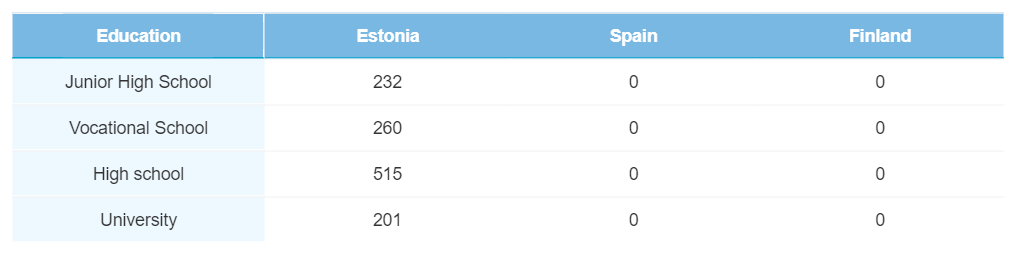

Majority of borrowers are high school graduates

High school education remains the biggest percentage among Estonian borrowers, accounting for 42.6% of the total borrower population—roughly the same level from the numbers seen in July. The biggest change was in the Junior High category, which rose by 2.4% on the month, accounting for 19.2% of the total now.

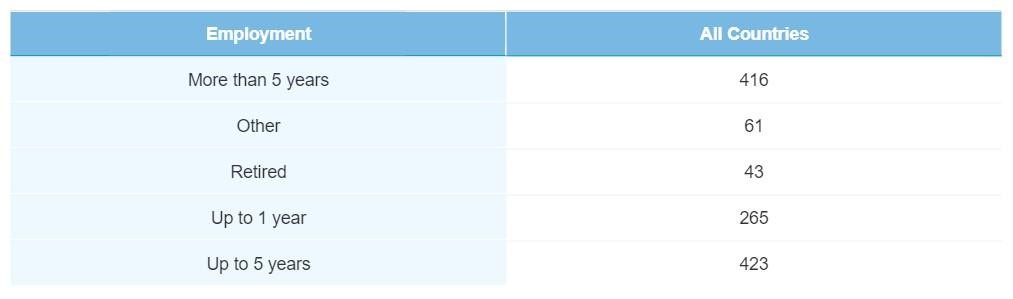

Long term employees grow even more

There wasn’t a massive change in the duration of employment for Estonian borrowers in August. However, we saw borrowers employed from 1 to 5 years losing 3.9% of the total share, while people employed by more than 5 years took 34.4% of the pie—up 2.3% from July’s numbers.

Stability trend on home ownership

The steady trend remains for borrower home ownership in Estonia. Homeowners still take the lead with a 46.0% share, 2.1% more than in July, while Tenants rose slightly to 19.4% of the total share.

Verification status

The percentage of verified originations continues its growth trend, now rising from 91.4% to 92.3% of the total share. This number breaks the July record and it’s now the largest verification percentile rating achieved for Estonia in 2020 to date. Unverified Estonian borrowers account for only 7.7%.

August is a settling month

After July’s incredible growth, originations took a slight dive in August, which was a predictable movement. Nonetheless, Bondora continues to hold tight to its goal of providing a stable and consistent performance to all investors, even in times of uncertainty.

Start investing today! Read more about the different Bondora investment products here.