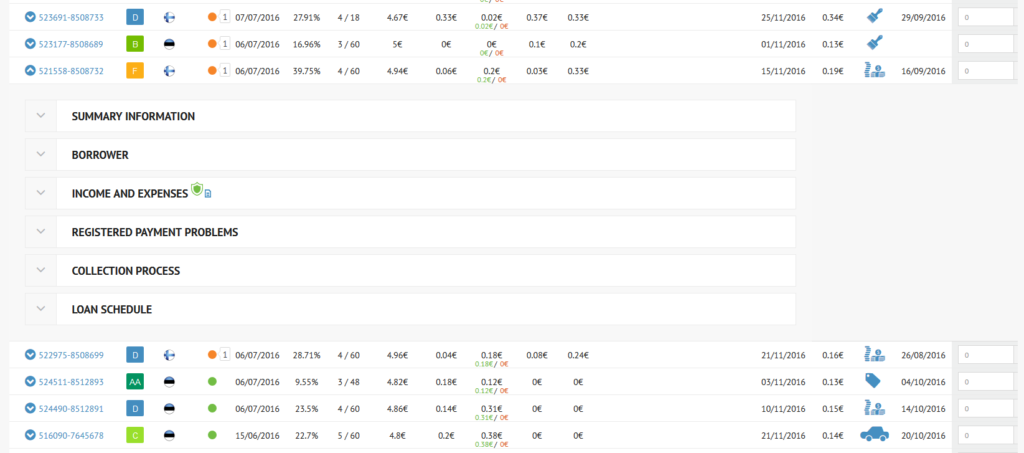

Investors using Bondora have access to incredible amounts of information on borrowers and loans. The user interface displays the important information about the borrowers responsible for making repayments. In this post we’ll provide a brief overview of the borrower/loan data in “Investments” and “Secondary Market” pages and how to use this information to better understand your investments. These two pages summarize the same data about the investments. The “Investments” page details where your money is currently invested. The “Secondary Market” page lists available investment opportunities.

Each investment is represented in a single line showing information like the investment number, Bondora rating, country, date of purchase, interest etc. Investors seeking more detail can add more columns from the table settings (on the top right corner) or expand the investment line and explore data in the following categories:

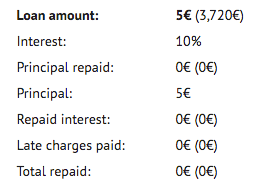

Summary Information:

Investors can see their portion of the borrower’s total loan amount here. The borrower’s total loan amount is represented in parenthesis. The portion of the loan owned by the investor is in bold to the left of this number. Other information includes final payoff date and principal and interest repaid. In the example shown the investor has a claim of 5€ on a total loan amount of 3,720€ which the borrower owes.

Borrower:

This section shows the borrower profile with information about the job history, age, dependents, marital status, education and homeownership status etc.

Income and Expenses:

This tab gives the investor an idea of how well the borrower will be able to meet their repayment obligations given their listed net salary. The debt to income ratio and verified income and expenses also helps the investor understand the risk profile. Any additional liabilities are also listed here.

Registered Payment Problems:

For many of the higher rated borrowers there are no existing payment problems, therefore this section is blank. In case when a borrower has had or still has issues with payments, this information will be displayed here. Data here is provided by external databases.

Collection Process:

The Bondora rating system illustrates the minimum and maximum expected losses for each borrower. Therefore, an investor seeking a higher return with a lower rated borrower will want to monitor the collection process for past due payments and defaults. More information about Bondora’s collection process can be found here.

Loan Schedule:

This section lists the repayments and dates scheduled for the investor’s loan. The amortization table tracks progress as each payment is satisfied. All changes to the repayment schedule are also shown here (for example when borrower reschedules the loan).

More loan data from Public Reports

For those comfortable using spreadsheet data Bondora offers complete transparency so that every loan can be viewed in a CSV file. This enables a broad view of the detail behind every borrower in the Bondora system. This information can be accessed our Public Reports page (file «Loan dataset»).