Hi there, I’m Kairi from Bondora’s Investor Associates’ team. Every month we round up all the most-asked questions we received from investors in one blog post. You can find all the answers to these top questions right here. It’s just another way we provide first-class customer service. Let’s go through the top 5 questions we received from our investors this month.

1. Payment limits: «I’m new to Bondora and created a Go & Grow account. Does the monthly payment limit apply to my first investment too?»

At the moment, there is a €400 payment limit on Go & Grow investments. This limit applies to new and old investors. So, if you recently created a Go & Grow account, you can’t add a starting amount for your Go & Grow investment plan that exceeds €400.

But don’t worry! The monthly payment limit won’t last forever. We can’t say when it will end, but we’ll keep you updated via our blog and social media channels.

You can read more about the Go & Grow payment limits here.

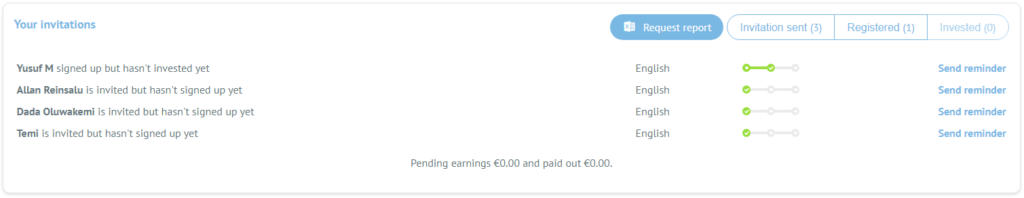

2. Referral program: «I have a pending referral bonus. How can I determine when approximately the bonus will be paid out?»

The cash bonus will be credited to your account within 90 days of the bonus calculation date if the referral program terms and conditions have been met.

You can view the bonus calculation date by generating your invitation report via the Invite friends page. Click on the ‘Request report’ button, and then the Excel report will download.

3. Taxes: «I downloaded my Go & Grow Tax Report, but the data appears to be incorrect. Why is the profit realized 0?»

With Go & Grow, you only pay tax on the money you withdraw over the total amount you’ve invested in the account. If you have withdrawn less than what you’ve invested or haven’t withdrawn from Go & Grow at all, the profit realized on the tax report will be 0.

You can find more information about how you will be taxed here.

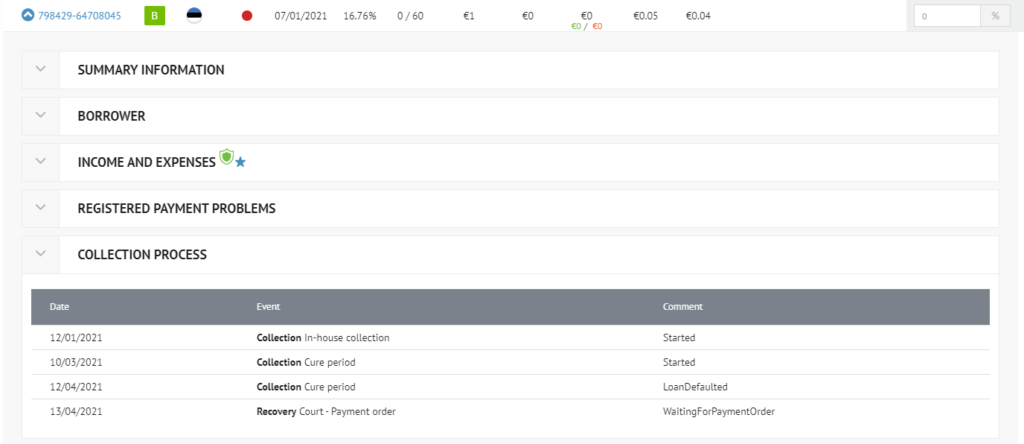

4. Collection & recovery: «Where can I see what stage my loan is at in the collection and recovery process?»

You can find this information on the Investments page. Select the loan that is overdue to expand it and click on the Collection Process tab.

Here you can view the stage (Event) and substage (Comment).

Bondora receives regular updates on the status of the collection process, and if there are any new developments, the stage will be updated accordingly. You can learn more about our 3-step collection and recovery process here.

5. Account verification: «I don’t have a personal bank account, but I have a joint account with my spouse/partner/friend. Can you verify a joint bank account?»

Yes, if you are an account holder on a joint bank account, we can verify it.

When we receive a payment from a joint bank account, sometimes an account holder’s name may be missing or is incomplete. We will contact you via email if we need additional proof to complete your bank account verification.

Read more on how to verify your bank account here.

And that’s it for this month! We hope we’ve answered all your questions. If you have other Bondora questions, you can find the answers on our online support site.