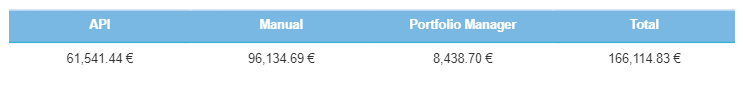

After 3 months’ decline, the Secondary Market had an upturn in activity. A total of €166,114.83 was transacted on the Secondary Market. This is an increase of 8.9% from February. Let’s take a more detailed look:

The driving force behind this month’s increase is the API’s growth rate of 26.9%. This increase is a welcome sight after the 43.5% decline in February. It now has the 2nd highest value with €48,479’s worth of transactions, which is a 37% share of all Secondary Market transactions.

Portfolio Manager transactions also increased by 9.5%. This is the first increase for Portfolio Manager transactions since November. It now totals €8,438’s worth of transactions.

In contrast, Manual transactions declined by 0.2%, which is significantly less than February’s 20.4% decline. But, despite the drop, Manual transactions still have the majority share of transactions—57.9%. This totals €96,134 in transactions.

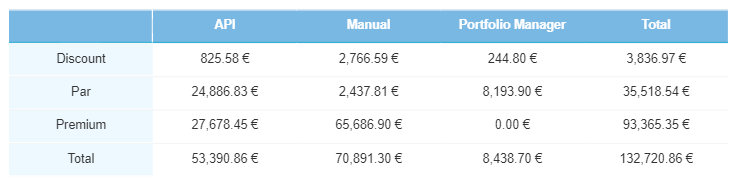

Current loans

Current loan transactions increased by 8.2%, with a total of €132,720 transacted. Mimicking the trend from January, transactions at premium proved to be the most popular, making up 70.3% of all current loan transactions. This is a 7.4% increase from February and totals €93,365. Loans sold at par increased by 20.8%, while loans at a discount decreased dramatically by 39.9%.

Overdue loans

March’s overdue loan transactions totaled €17,248, a 10.5% decrease from last month. In an unusual turn of events, loans sold at a discount, at par, and at a premium, all had a relatively equal share of transactions, with loans sold at par taking the top spot by just €19.09.

Manual transactions accounted for 71.7% of all overdue loan transactions, despite a 13.0% drop. The API accounts for the remaining 28.3%. This category, too, had a negative growth rate, but it was a less drastic 3.6%.

Defaulted loans

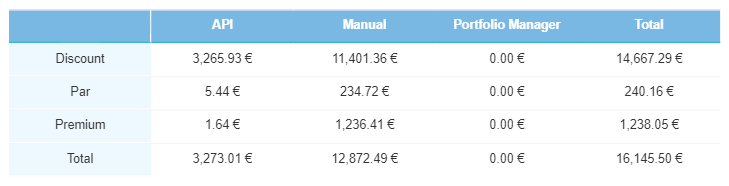

For the first time in 3 months, defaulted loan transactions increased. This resulted in a total of €16,145.50 being transacted in this category. In March, it grew by a mammoth 52.3%.

In February, loans transacted at a discount were the most popular. And, as was the case last month, sales at a discount remained the strongest category, making up 90.8% of all current loan transactions. Once again, transactions at par and a premium are no match for the discount category.

Manual transactions had a 79.7% share, and API transactions’ share was 20.3%.

Secondary Market ends Q1 on a high note

After 3 months of declines, the Secondary Market rebounded in March to end Q1 on a high note. It’s become the norm to see activity on the Secondary Market rise and fall. So, after all these decreases, it was a welcome sight to see an 8.9% increase, which led to a total of €166,114.83 being transacted on the Secondary Market.

As more investors opt for the hands-free Go & Grow investment method, it’s natural to see a drop in manual buying and selling of loans on the Secondary Market. But, as the Secondary Market activity is known to go up and down, let’s see if the activity will pick up again.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.