We’re excited to share Bondora Group’s 2023 financial results, with the greatest highlight being our seventh consecutive year of profitability. Last year was a prosperous chapter in our financial journey, showcasing what’s possible when you put your customers first. We’ve not only sustained growth but also delivered reliable returns to our investors. Thank you for being a part of our journey, and let’s dive into the details!

Key highlights from our 2023 financial results

- Revenue reached €44,4 million

- Net profit was €3,4 million

- Loans issued totaled €202,5 million

- €139 million of loans were issued in Finland and €40,2 million in Estonia

Bondora Group’s 2023 in review

At Bondora Group, our mission is simple: to help people live the life they want with less financial stress. We offer user-friendly, secure solutions that make lending and investing accessible and simple. Our services are fully online, making it as convenient as possible for our customers to achieve their financial goals.

2023 also marked the sixth year in a row that our Go & Grow investors have enjoyed a stable return of up to 6.75%* p.a. on their investment. We’re proud of our growth and consistent profits, which have empowered us on this sustainable growth track.

With over 16 years of experience, we provide credit services to customers in Estonia, Finland, the Netherlands, and Latvia. Most of our loans in 2023 came from Finland.

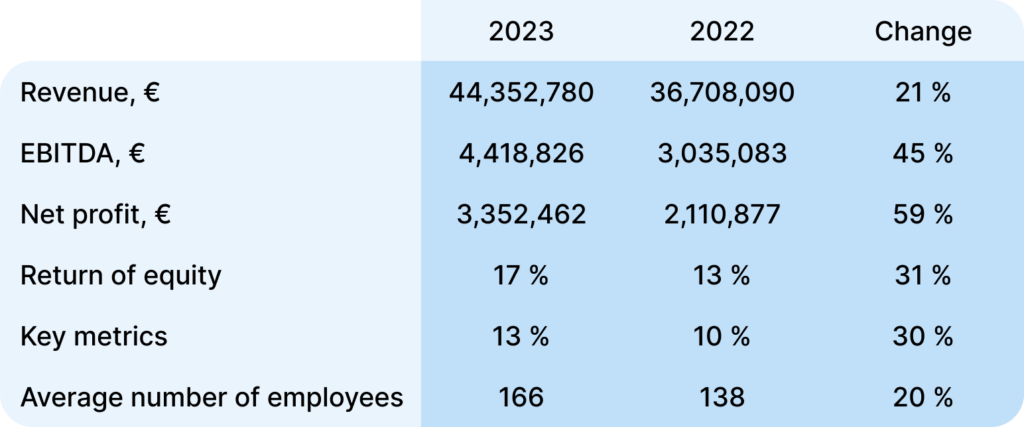

Bondora Group 2023 Financial Results Table

EBITDA – earnings before interest, tax depreciation and amortization

Return on equity (ROE) = net profit or loss for the period / total equity

Return on assets (ROA) = net profit or loss for the period / total assets

We’re continually expanding and improving our products to reach more people. Our goal is to have 1 million active customers in the coming years. Despite challenges in the global fintech market, Bondora Group has continued to hit its growth targets.

In 2023, we issued €179 million in loans in Estonia and Finland. We also expanded in the Netherlands and entered the Latvian market. Our loan origination fees were €7 million, loan administration fees totaled €23.1 million, and revenue from additional products reached €133 million.

To support this growth, we increased our team by 28 people in 2023, bringing our total employee count to an average of 166. Despite these additional expenses, we ended the year with a net profit of €34 million.