Welcome to another data blog post from Bondora, below we take a look in to the actual and targeted net returns from P2P investments by country, year and quarter. It’s important to note that the most recent quarter will nearly always show a higher return as the P2P loans have only recently been issued and at this point the interest element accounts for a high percentage of the total payment, this is why we discuss data that is specifically over 12 months old below.

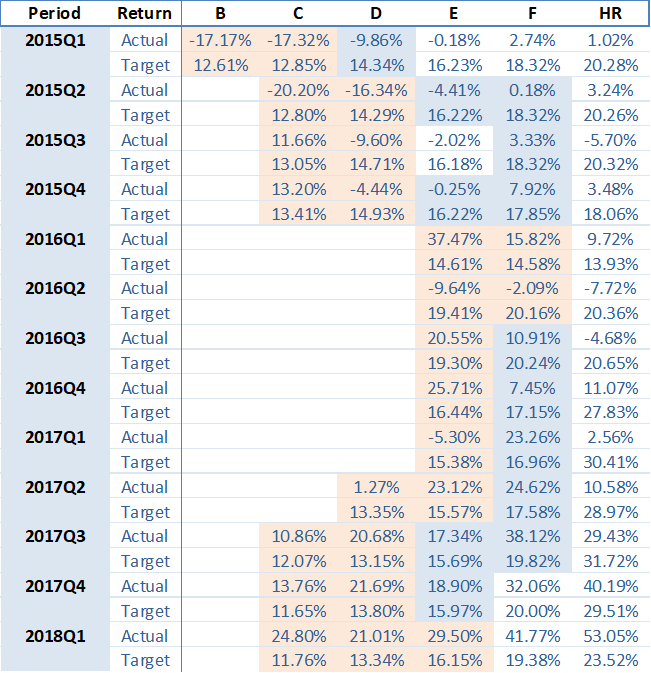

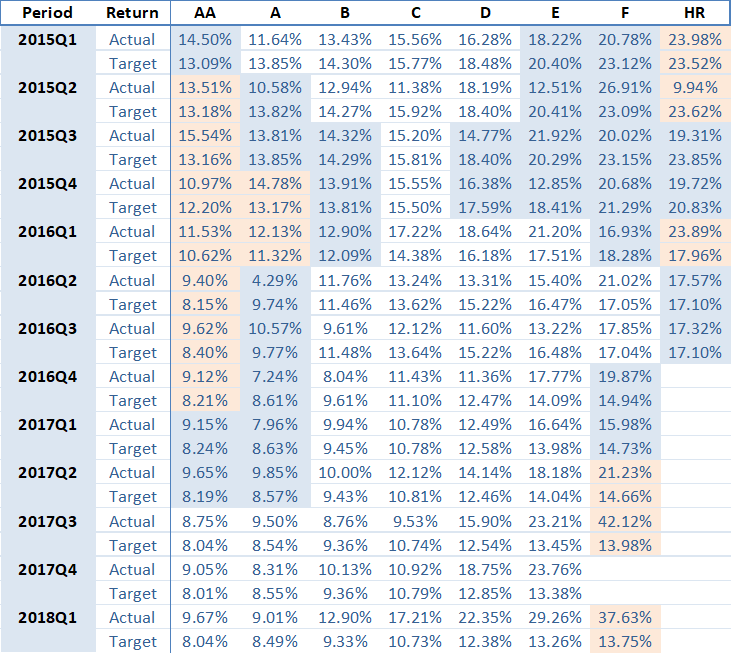

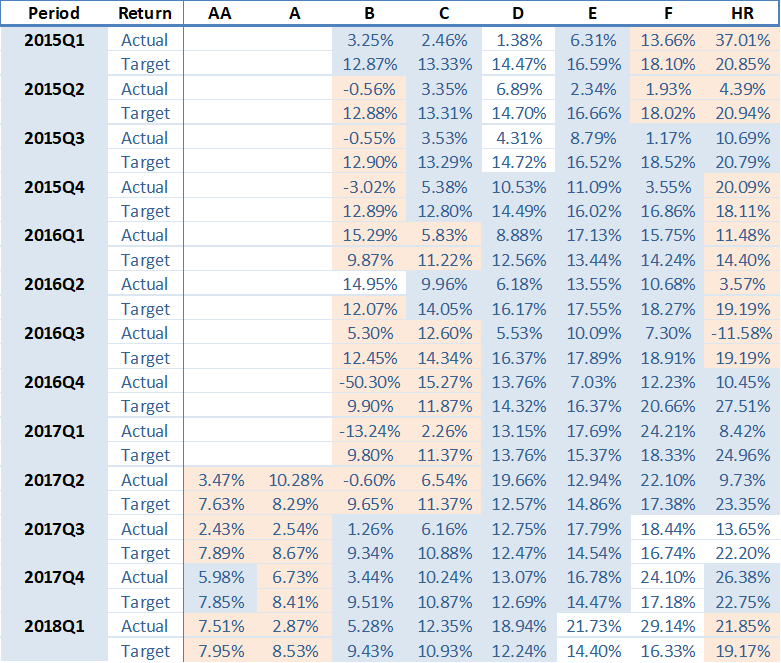

We have marked the figures with three different colors, firstly light orange to represent 50 or less loans issued, light blue for 51 – 200 and white for 201+. This is a great way to spot anomalies, such as high volatility in low risk ratings.

Key takeaways

- Across all countries, the best performing quarter so far was seen in Q1 of 2016 at 14.34%, 0.6% above the target return.

- C rated loans in Estonia are the only credit grading which have been issued over 200+ PCS each consecutive quarter since 2015. This is true for B, D, E and F rated P2P loans since 2016.

- In Q4 of 2017, all credit ratings issued in Estonia had over 200 PCS – ranging from AA – E. Data from Q1 of 2018 shows the same, other than F rated loans.

- Q1 of 2018 was the first quarter that saw more than 200 PCS issued in E credit ratings in Finland.

- The best performing year overall was in 2010 at 25.76% actual net return.

- Q1 of 2018 was the first quarter that saw less than 50 PCS issued HR rated loans in Finland since Q3 of 2016.

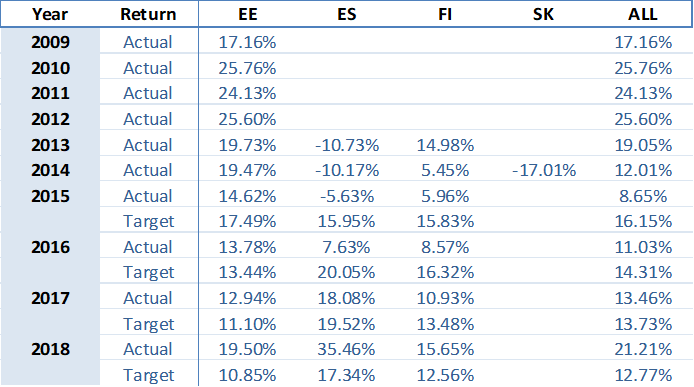

Actual and targeted net returns across the board by year

Across all countries and risk ratings, the highest actual net return was seen in 2010 at 25.76%. Whilst this is significantly higher than the most recent figures, it’s important to note that this is from a much smaller sample of P2P loans (1,126 to be exact). Compared to the most recent year, a total of 17,933 P2P loans were issued in 2017.

As mentioned in previous posts, the most recent data will nearly always show a higher return as the loans have only recently been issued and at this point the interest element accounts for a high percentage of the total payment. Older data, for example 2009 – 2013, has the highest return as loans from this period may still receive a cash flow from recovery payments. This reinforces how you can maximize your absolute return in P2P by taking a long term view with your investments.

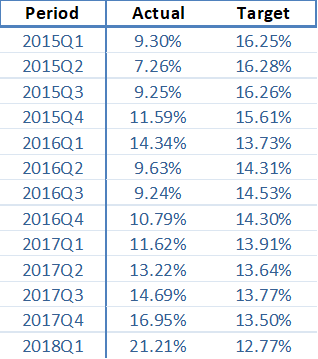

Actual and targeted net returns across the board per quarter

- Overall, the average actual net return across all quarters comes in at 12.32%, slightly below the target average of 14.44%.

- The best performing quarter in 2015 was Q4 at 11.63%, in 2016 this was Q1 at 14.22%.

Estonia

- Q1 of 2018 was the 6th consecutive quarter where no HR loans were issued and the first since Q3 of 2017 where F rated loans were issued.

- For data over 12 months old, the best performing quarter is Q3 of 2015 (16.86%), this quarter saw over 200 PCS issued in C rated loans only.

- The highest number of PCS issued in Estonia was in Q4 of 2017 at 3,600, however the highest amount was in Q1 of 2018 at €6,179,959 and 3,411 PCS.

Finland

- Only a small percentage of Finnish loans issued total over 200 PCS per credit grading, most recently in Q1 of 2018 this was seen in E & F ratings.

- The highest total actual net return across the board (over 12 months old) was in Q1 of 2016 at 12.39%.

- The actual net return figure for Q4 of 2016 B rated loans shows a rate of -50.3%, however the data is significantly skewed due to less than 5 loans being issued.

- In Q1 of 2018, the highest number of loans issued were in F rated loans (352).

Spain

- Q1 of 2018 saw nearly 50% less HR loan PCS issued compared to Q4 of 2017 and approximately 80% less than Q3 of 2017.

- The highest total actual return figure over 12 months old was seen in Q1 of 2016 at 21%.

- The highest number of loans were issued in Spain in Q3 of 2017 at 1,955 PCS and €1,409,944, this figure was only 591 PCS and €734,537 in Q1 of 2018.

- Volatility is expected in credit ratings with a higher expected default rate, which is why we always encourage a diversified portfolio of investments.