Led by strong returns from Estonian originations, Bondora saw another month of stability, proving the strength of our loan originations. The first figures for Q2 2020 were solid, and previous numbers maintained similar levels to last month.

As always, country-specific performance charts are broken down by the number of loan issuances over the given period, with Orange representing < 50 loans, Blue 51-200, and White > 200.

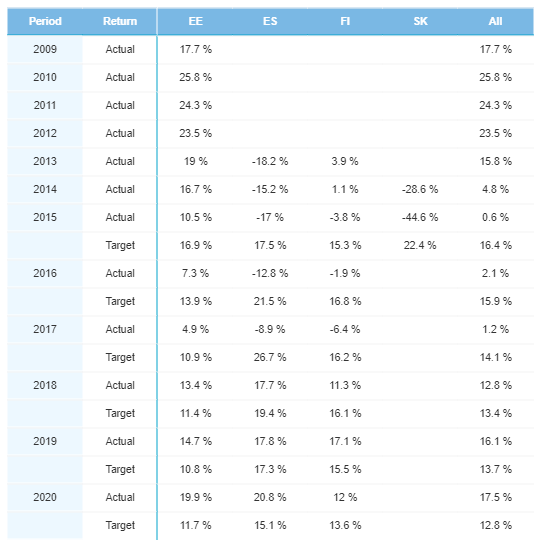

Yearly Performance

Even amidst the global economic crisis caused by the coronavirus, Bondora originations for both 2020 and 2019 are still above their target rates. Returns on Estonian originations rose 1% to 19.9% on the month. This helped to lift the current year’s total return rate to 17.5% from 17.1% in September. The ongoing temporary pause on Spanish and Finnish originations expectedly caused returns in those two countries to fall, albeit only slightly from a month ago.

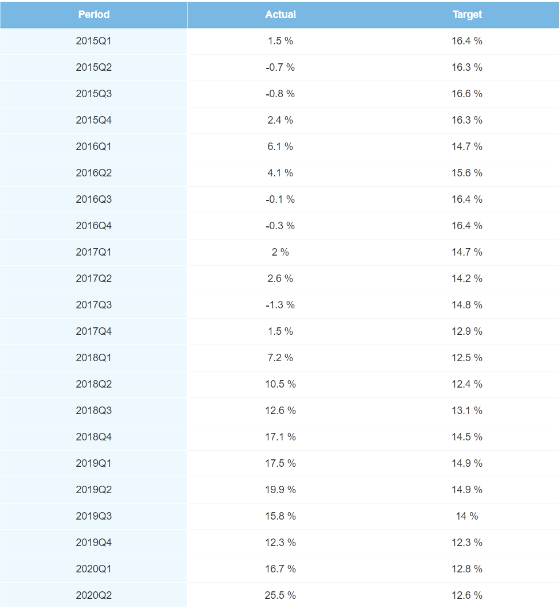

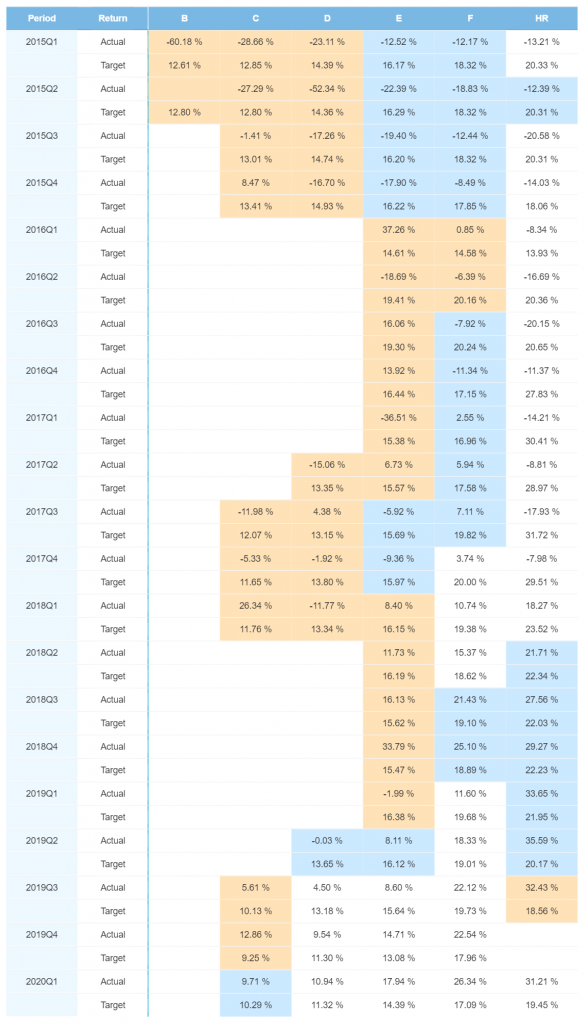

Quarterly Performance

The quarterly return for Q2 2020 started off with a bang, with the first reported numbers coming in at 25.5% compared to a 12.6% target rate. The previous two quarters were slightly down, which continues the trend from previous months. Returns for Q1 came in at 16.7%, which is 3.9% ahead of their target, and Q4 2019 returns were in-line with the target rate of 12.3%.

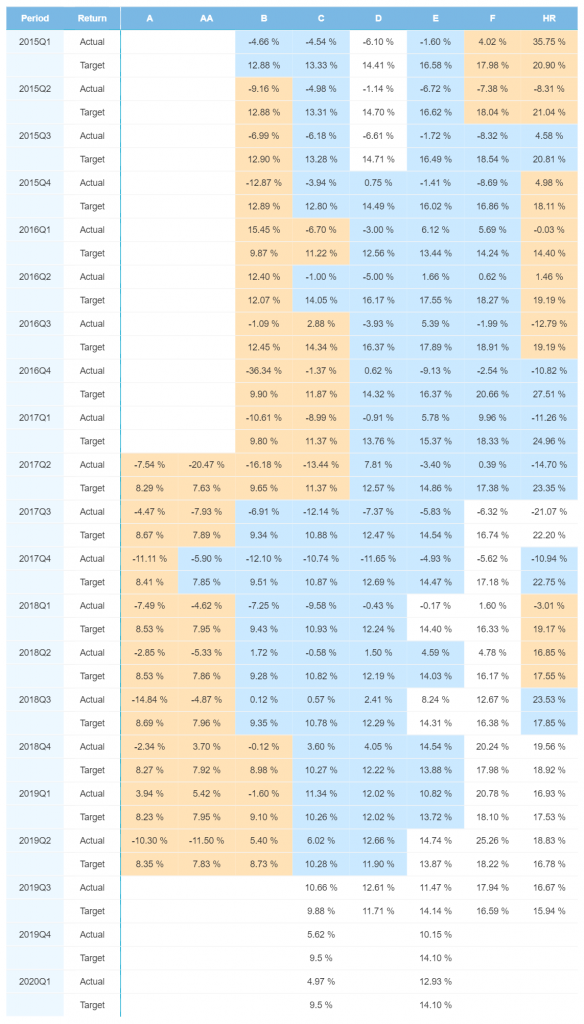

Finland

As previously mentioned, there were no Finnish loan originations over the second quarter. Quarterly rates remained relatively stable in Finland, as return rates decreased by an expected amount, with all rates for the previous three quarters coming in within 1% of their returns last month. Meanwhile, E rated loans continue to be the best performers, with returns of 12.93% and 10.15% for the Q1 of 2020 and Q4 2019 respectively.

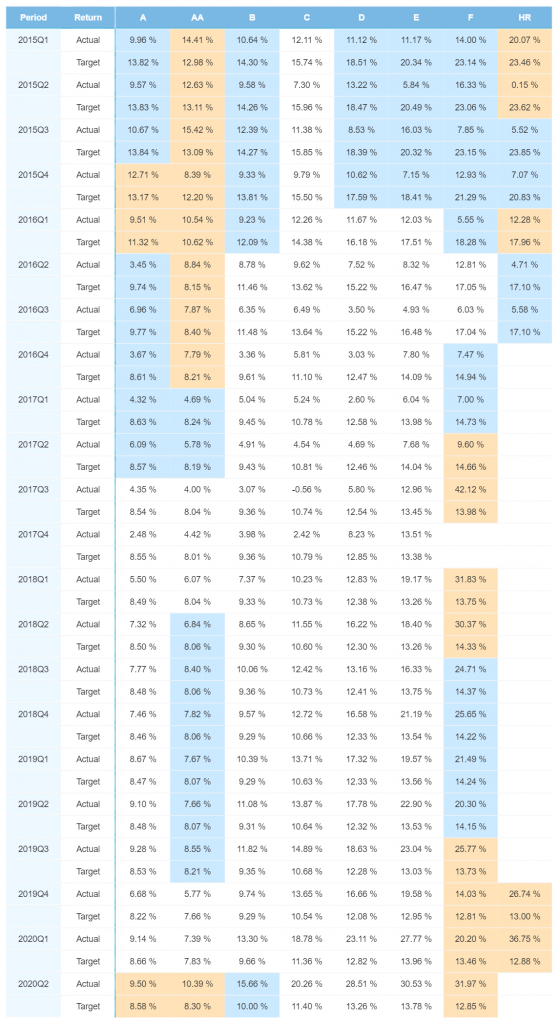

Estonia

Estonian originations shifted away from A and AA rated loans in October, and instead focused on C, D, and E rated loans. Additionally, there were no HR rated loans originated over the course of the month. F rated loans performed the best in Q2, coming in at 31.97%, followed closely by E rated loans at 30.53%. All but AA rated loans held adobe their target rate for Q1, and 6 out of the 8 rating categories for Q4 2019 are also higher than their targets.

Spain

C and D rated Spanish loans fell below their target rates in October. Yet, E, F, and HR originations are still well above their targets, with HR rated loans performing the best at 31.21%. In fact, HR rated loans are above their target rates for each quarter dating back to Q3 2018.

Key takeaways:

- 2019 and 2020 returns are still well above their target rates.

- The yearly return for Estonian originations grew a full 1% to 19.9%.

- The first numbers for Q2 2020 came in strong, exceeding their target by 12.9%.

- Estonian rates continue to be mostly above their targets dating back to Q4 2019.

- HR originations in Spain continue to exceed expectations dating back more than two years.