2022 Q1’s portfolio performance continues to build on last month’s momentum. We’re seeing solid growth in all three markets. The yearly return rates for all three markets continue to exceed their target rates. The majority of quarterly rates for 2021 decreased from last month, but they remain ahead of their targets. Read more:

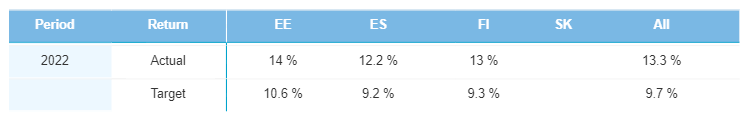

Yearly performance

The yearly portfolio performance for 2022 continues to paint a positive picture. The actual rate increased from 11.2% in March to 13.3—3.6% above the target. On an individual level, all three markets increased their standing and exceeded their targets: Spain by 3.0%, Estonia by 3.4%, and Finland by 3.7%.

Similar to March 2020 originations are still on a slight path of decline, this month by 0.2%. But, despite the decline, it exceeds its target rate by 2.9%. The Estonian portfolio outperforms its target by 8.4%. It carries the rest of the portfolio, as Spain and Finland both underperform due to the origination pause we had put in place for those two markets during the initial phase of the pandemic. The 2021 yearly return rate remains above target by 5.6%—falling just 0.1% from March. All three markets exceed their targets, but again, Estonia leads the pack with a 7.5% excess.

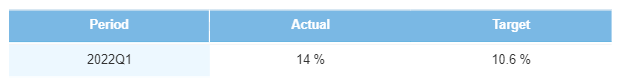

Quarterly performance

2022 Q1 enjoyed quite a jump from 11.6% to 14.0%. If this monthly growth is any indication, then the rest of the year should also bring positive figures.

All quarters from 2020 Q1 – 2022 Q1 continue to exceed their target rates. Despite falling slightly from March’s figures, the 2021 quarters are all performing well. 2021 Q4 is the exception and actually increased by 0.2%.

Despite dropping by 3.0%, 2020 Q3 remains the quarter with the highest rating of the past couple of years. It has an actual rate of 24.2% vs. a target rate of 12.5%.

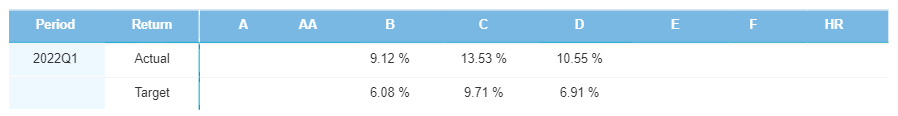

Finland

Overall, the performance in recent quarters is continuing to exceed expectations. The last 5 quarters of the Finnish portfolio are still exceeding their targets. B-, C-, and D-rated risk categories for 2022 Q1 increased. C-rated loans still perform the best, exceeding their target by 3.8%—2.6% more than in March. D-rated loans exceed their target by 3.7%, and B-rated loans by 3.0%.

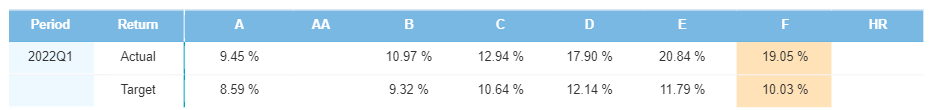

Estonia

The last 7 quarters of the Estonian portfolio are all overperforming and exceeding their targets.

This month is the first time that all 6 of the risk-rating categories of 2022 Q1 are exceeding their targets, which is certainly something we’re happy to see. The F-rating category performs the best, exceeding the target by 9.1%.

The newly relaunched 2021 Q4 HR-rated category continues to increase and has the highest performance rate in recent years (41.4% compared to 5.0%). Overall, things are still looking good for the Estonian portfolio.

Spain

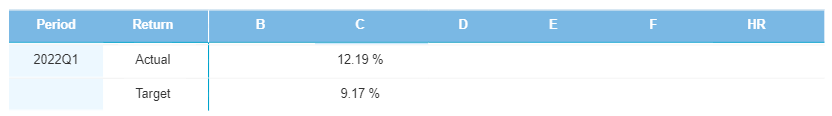

The Spanish market’s performance continues to grow steadily. We are still only originating C-rated loans in the Spanish market, and they are performing well ahead of target in 2022 Q1. The target rate is 12.2%, and the actual rate is 9.2%. In March, the actual rate was 11.5%, indicating strong growth.

2021 Q3 and Q4 are exceeding their target rates by 5% and 4.2%, respectively. The HR-rated category in 2021 Q3 continues to decline significantly from -0.4% to -3.0, but it still outperforms its target of -16.6%. This negative target is because we weren’t origination loans in the Spanish market for most of 2021.

Conclusion

We see a positive increase across all three of our loan markets for 2022 Q1. This sets the tone for a positive year. The yearly return rates for all three markets were outperforming their targets and increased their excess growth rates from March. The quarterly return rates from 2020 Q1 to 2022 Q1 continue to exceed their target rates. All three countries are performing well, and we’re seeing strong growth in all of them.