Mortgages. The word itself comes from the French ‘Mort-gage’, which literally translates to ‘death-pledge’. On a lighter note, having a mortgage has for many decades been viewed as the first step into the adult world for many people as you move away from your family home or rented accommodation. While a mortgage is not for everyone (especially those who relocate often or have other commitments), financially it is indeed a fantastic way to reap the rewards of capital growth over time and create a nest egg to leave to your relatives in the future.

So other than finally being able to turn your basement into a miniature bar or build that greenhouse you’ve always wanted, there are a few things you should know to make sure you’re not paying any more than you need to and what to expect over the long-term.

Applying for a mortgage

If you’re reading this, you might not even have a mortgage yet and you’re thinking about how you can get started. While there are several new alternative finance platforms cropping up who offer residential mortgages, it’s highly like that most people will still go to their local bank (for now). Trying to break through the jargon and ancient systems used by the banks can make applying for a mortgage feel like trying to solve a Rubik’s Cube. To get started, try using a comparison site to filter a few potential mortgage providers for you. Enter your income and expenses details as well as the price of the property and your deposit, then most should show you an indication of what interest rate and product you can expect to get.

After that, you can either fill out an application online or set up an appointment either via video link, phone or face to face if there is anything you are unsure about. This is most likely going to be the biggest financial commitment of your life, so make sure you take the time to understand the financial provider you will be using to help you with it.

Repayment type

In general, one of the first things a bank will ask you when applying for a mortgage is what type of repayment option you want. Huh? Don’t worry, in general there are only two separate options that you need to know about:

- Principal and interest (Repayment) – Each month you pay the principal that you borrowed on the property plus the interest that the bank charges, at the end of your loan term you own the property outright with no extra payments due.

- Interest only – Each month you only pay the interest that the bank charges (Meaning you have a significantly lower monthly payment than you would on a principal and interest repayment basis), the whole principal amount is due at the end of the loan term. Overall, you will pay significantly more interest over the loan term with this option.

Over the past couple of decades, a lot of people using the interest only repayment option have got in to financial difficulty at the end of their schedule and ultimately had their home repossessed by the bank. A lot of banks and financial regulators are now imposing much stricter regulations for people who request an interest only repayment due to this. In contrast, it can be an extremely lucrative option for people buying a property to rent it out.

Mortgage Term

Another important thing you need to decide is how long you are going to take out your mortgage for, known as the ‘mortgage term’. 10 years? 20 years? 40 years? The answer really depends on you and your personal and financial circumstances.

If you’re expecting a few life events over the next 5 years, such as getting married or having children, then you might consider extending the mortgage term to keep your monthly repayments lower. Or maybe you are in the middle of a training induction period at work and you know you are going to receive a considerable pay rise in the next 12 months (Lucky you!), in this case you might choose a lower mortgage term with higher monthly repayments.

Bear in mind, the length of your mortgage term has a significant impact on how much interest you will pay overall.

Product

Possibly the most crucial aspect of your mortgage is the product that you choose. In general, this can be separated in to two types of products; fixed rate and variable rate.

- Fixed – Your monthly repayment will remain the same for an agreed period of time, for example, 2 or 5 years. This can be very useful for budgeting and for the risk-averse person who does not want to take any chances with rising interest rates.

- Variable – A variable rate can change on a monthly basis, either in line with the banks own rate, EURIBOR or the rates issued by your national bank. You may benefit from lower rates especially in a booming economic environment, however it can be harder to budget on a monthly basis.

The length of time you can have one of the products for completely depends on your bank, ranging from 1 year to a lifetime product offered by some providers.

If you’re thinking you don’t have either of these products, you may be on the standard default option product issued by your bank. This is usually the rate you roll on to after your fixed or variable rate ends (and if you don’t arrange a new one), it is usually much higher than the other products available and most people see their payment increase once and completely forget about it. If this sounds familiar, check with your bank immediately because you have the potential to save yourself €100’s per month!

Overpayment

One of the most valuable tips we can give you is to make the occasional overpayment on your mortgage, it has the potential to save you a colossal amount of interest over the term of your mortgage. Money Saving Expert has a fantastic overpayment calculator you can use to test the impact of making an overpayment, we’ll add an example below for you.

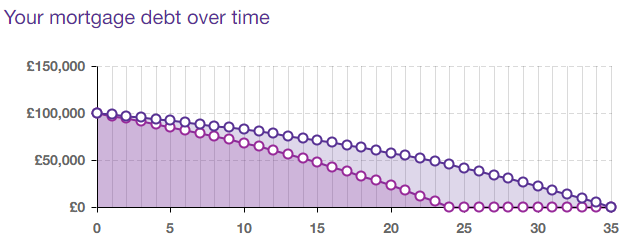

Let’s say you have a mortgage of €100,000 on a repayment basis with a 35 year term at 3.5% interest. Each month, you give the bank €413 which pays back the principal and interest. Let’s also say that from your investment portfolio, you are generating a very realistic minimum figure of €100 per month in interest for yourself. You then decide to put this €100 to use and make a regular overpayment each month on your mortgage, this is what happens:

- Overpaying would save you €25,594 in interest alone

- You will pay off your mortgage in full 10 years and 11 months earlier than originally planned

Wow! For some, that means retiring from work over a decade earlier and having a nice amount of savings each month to spend on whatever you want. Go ahead, test it yourself and play around with the figures.

Remember, this is all realistically possible by generating a cash flow from your investments and setting yourself a goal.

Now you know

Hopefully this guide will be of use to anyone who has a mortgage or is looking to get one in the near future, make sure to read over these points a few times and take it all in, it could save you €€€’s.

If you would like us to write a guide on another financial topic, let us know at investor@bondora.com