Ever wondered what happens when a credit customer goes into default, doesn’t repay their loan, and what that means for your returns? Well, today, that’s exactly the topic we’re diving into.

As part of our investor community, you deserve clear, honest insights into how your money is performing, including when it comes to the more complex topic of defaults.

Bondora Group is in its strongest position ever, with a clear strategy for continued growth. A key sign of that progress is the steady improvement in our default rate. But what does “default” actually mean? How do we measure it, and how does it relate to the health of our current portfolio and your investment?

Let’s take a look behind the numbers.

What is a default?

A loan is considered in default when payments are more than 90 days overdue, and the contract with the customer is terminated because the account is in arrears for an overdue period.

But a default doesn’t mean money lost. It’s the point where our recovery efforts begin, with the aim of recovering as much of the outstanding amount as possible. On average, in some countries, we’re able to recover up to 70% of the defaulted amount, something we’ll explore more in an upcoming blog post.

It’s vital to recognize that our goal is to treat every credit customer with respect and fairness throughout the recovery process. We understand that financial challenges can happen, and our recovery strategy balances responsible lending with compassionate debt management.

To better understand the potential impact of defaults, we also examine Loss Given Default (LGD), which reflects the remaining loss after expected recoveries. This helps assess the portfolio’s long-term health.

PD12: A key risk metric

In a previous article, we explained how we forecast our internal rate of return (IRR) and shared some key details. Now, we’d like to go further by presenting our forecasted IRR over a more extended period and offering insights on PD12, a key metric used in IRR calculations.

PD12 measures the actual default rate within 12 months of when a loan is issued. It acts as a leading indicator of credit risk and is a key factor in calculating our forecasted internal rate of return (IRR).

We’re encouraged to see that our PD12 results have steadily improved, reflecting better risk models and more thoughtful borrower evaluation.

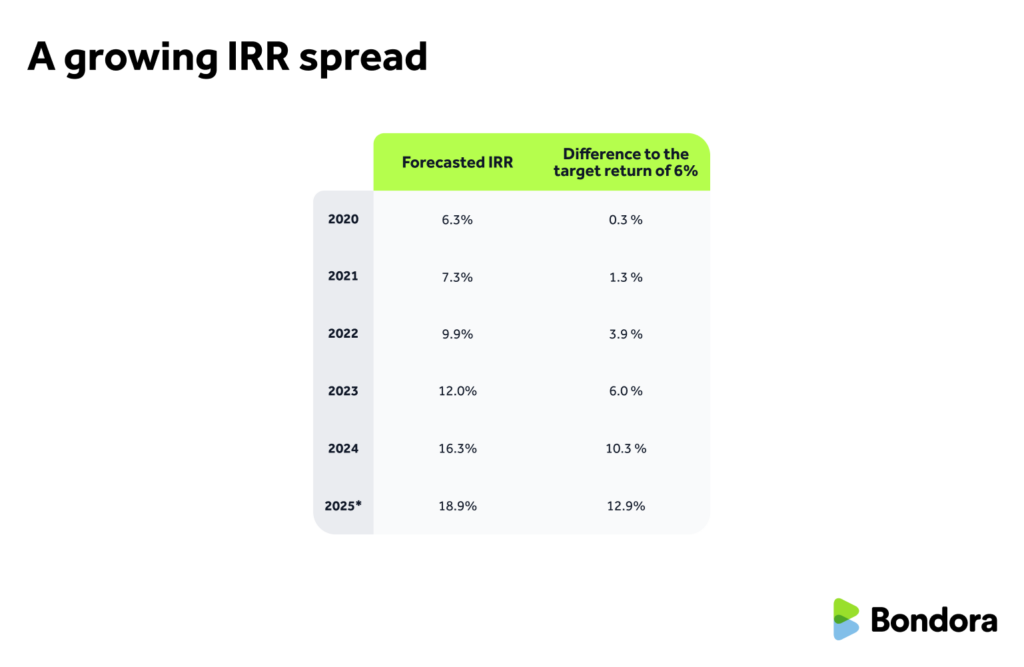

A growing IRR spread

Even when accounting for defaults and recoveries, our forecasted IRR continues to show a healthy spread above the 6% Go & Grow target return.Here’s how that forecasted IRR has evolved over the past five years:

*Forecast based on current loan performance and assumptions of the partial year’s data.

This spread has been steadily growing, reflecting improvements in credit risk control and the overall strength of the portfolio. These factors reinforce Bondora’s ability to deliver two things you value greatly: stable, sustainable long-term returns and near-instant liquidity.

Portfolio overview

The consolidation of Go & Grow, our flagship product, and the unique challenges of the COVID years shaped our current portfolio approach. Despite headwinds, like Finland’s restrictive interest ceiling, we strengthened our underwriting models and refined our portfolio strategies.

Bondora’s evolution is a story of growth through learning. Challenges from earlier years have led to better systems, smarter risk models, and stronger performance. Lower default rates and a robust risk framework now define our operations.

As our Chief Credit Officer Juris Rieksts-Riekstiņš explains:

“Since Q3 2023, we’ve achieved our widest-ever spread between loan defaults and interest charged across all our markets, a clear win for credit risk control.”

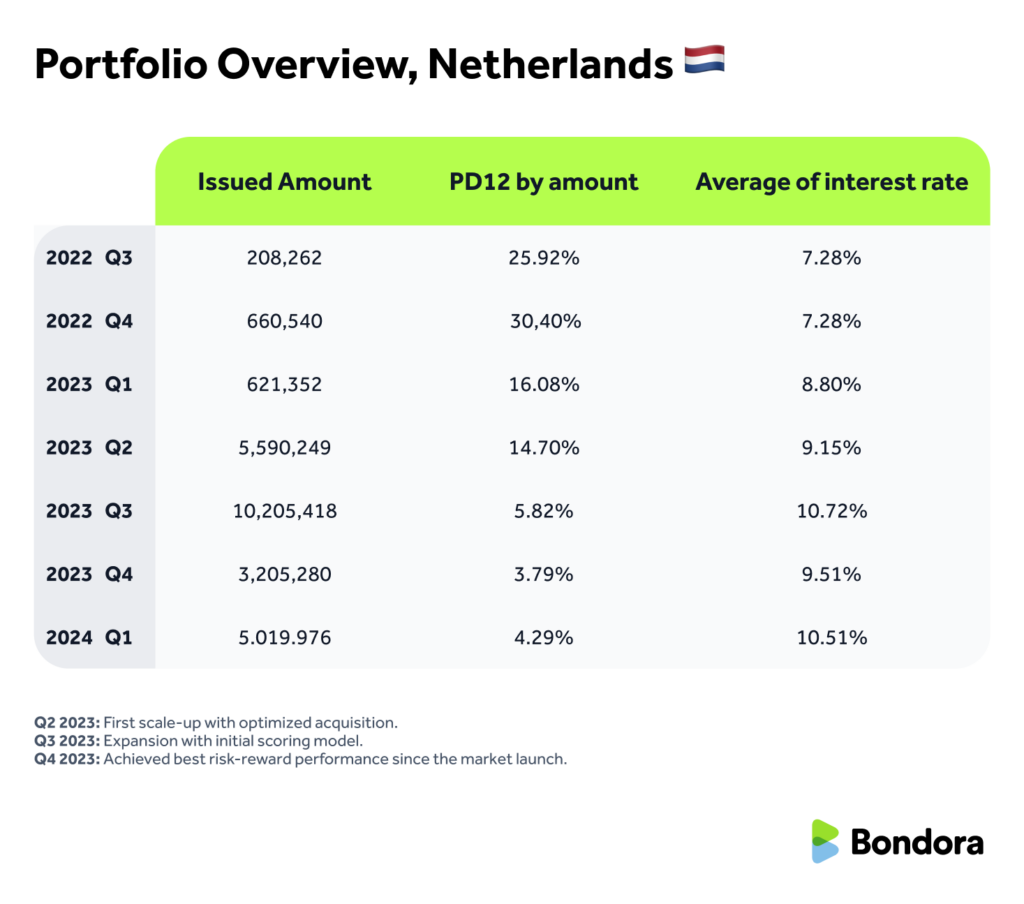

A shining example of this adaptability is the Netherlands, where we reached high-performance risk metrics within just a few quarters. More on that below.

Market-specific performance trends

Here’s a snapshot of how our performance is evolving across key markets.

Note: Q2 2024 stats will be available after Q2 2025, due to the required 12-month observation period to classify defaults accurately.:

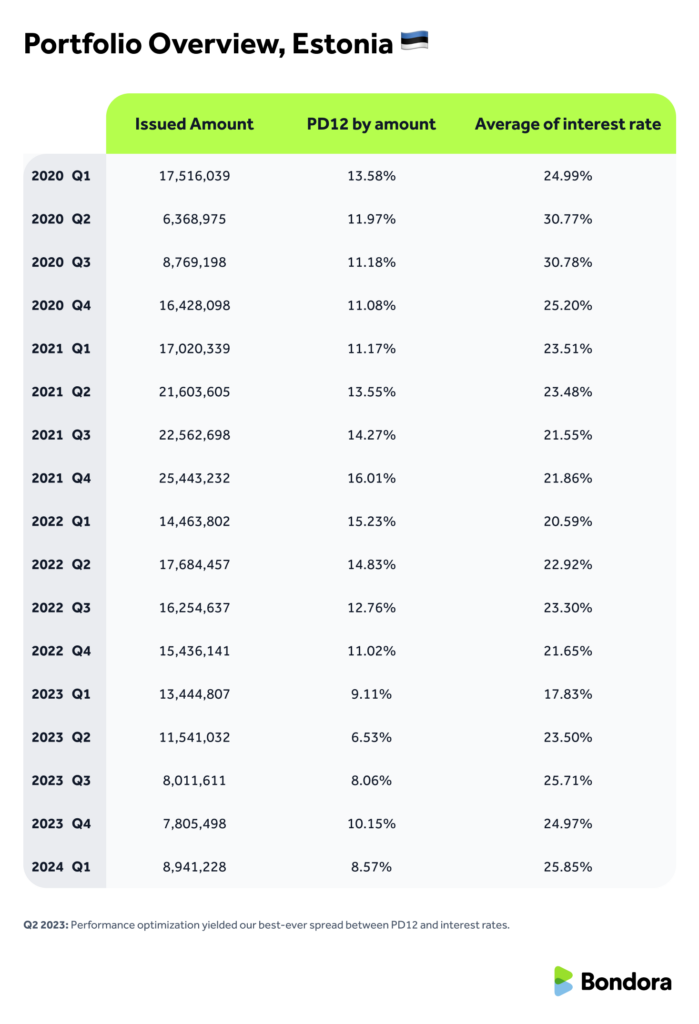

🇪🇪 Estonia

- Q2 2023: Performance optimization led to our best-ever spread between PD12 and interest rates.

- Today’s Estonian portfolio is more stable and predictable than in earlier years.

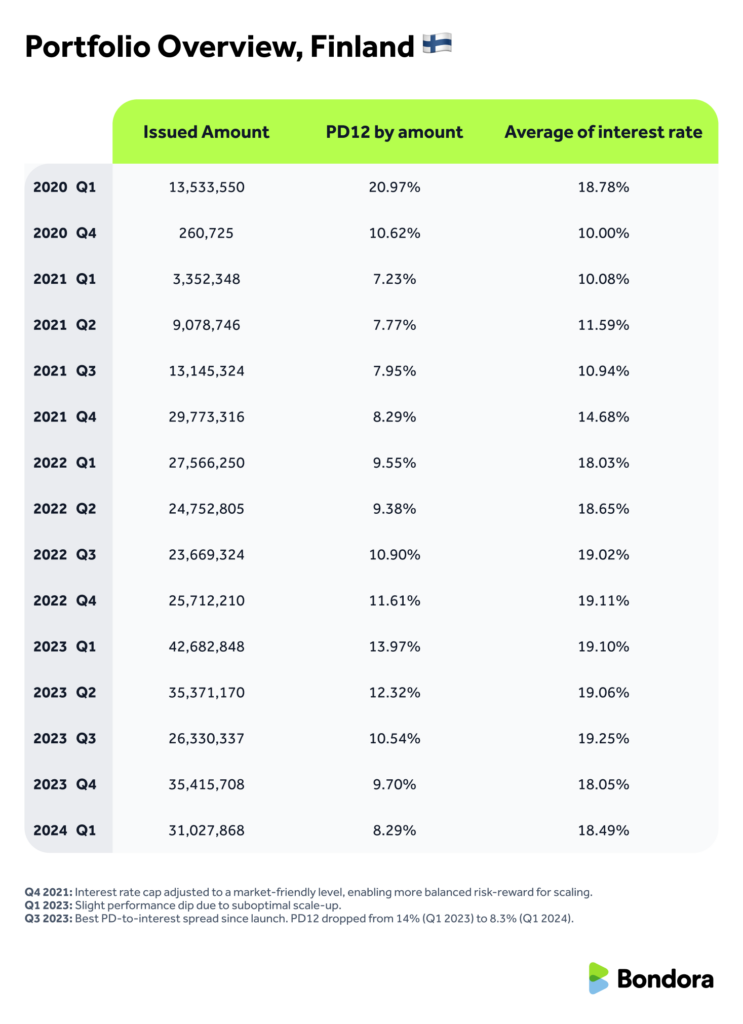

🇫🇮 Finland

- Q4 2021: Interest rate cap adjusted, creating a healthier risk-reward balance for scaling.

- Q1 2023: A slight temporary dip as we scaled operations.

- Q3 2023–Q1 2024: Significant improvement when PD12 fell from 14% to 8.3%, the best spread since market launch.

- Finland now consistently represents nearly 70% of our total portfolio, making these improvements especially meaningful.

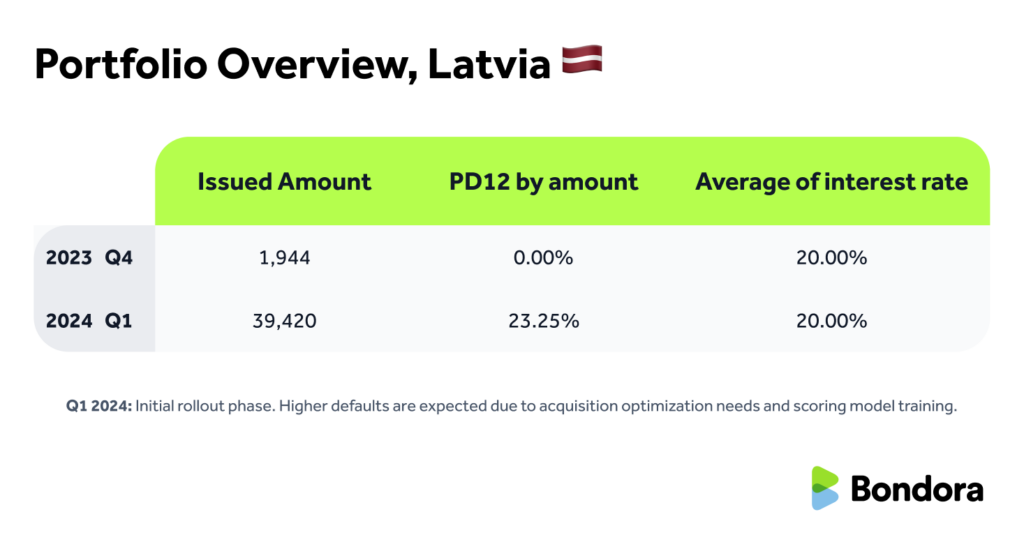

🇱🇻 Latvia

- Q1 2024: Early-stage market. Higher default rates are expected in this phase as we optimize acquisition and improve scoring accuracy.

🇳🇱 Netherlands

- Q2 2023: First scale-up with optimized acquisition.

- Q3 2023: Expansion with initial scoring model.

- Q4 2023: Achieved best risk-reward performance since the market launch.

Across all markets, our portfolio continues to improve, with the share of defaulted loans steadily decreasing. This trend reflects the impact of our ongoing efforts to enhance portfolio health through better risk management.

Looking back to move forward

Reflecting on past results and analyzing historic data allows us to learn from real experience and make the necessary adjustments for an even better future.

At the core of our data sharing lies our commitment to transparency. We’ll continue to share key insights with you in our regular monthly stats blog posts, real-time updates on our revamped Statistics page, and in more in-depth articles like this one, which breaks down the numbers even further.

In a future blog post, we’ll explore how we manage the recovery process, from respectful communication with borrowers to the systems we use to recover funds fairly and responsibly.

📣 Have a question about defaults or our statistics?

Share your thoughts via the feedback form and help shape what we share next.