Transparency has never been more important for the future of marketplace lending. The growth of the industry depends on the trust of investors. However, earning this trust will not come easily. A recent study from the CFA Institute found that “financial services remains in the bottom tier of trust relative to other industries.” In fact, trust in the industry falls below banks and pharmaceuticals.

At Bondora we strive to earn this trust through transparency. Regulatory agencies such as the U.S. Department of the Treasury have defined transparency as “clear, simple, and consistent terms that borrowers and investors can understand,” and continues that some P2P firms “are neither clearly nor systematically disclosing information to borrowers and investors.” Financial regulators in Europe have expressed similar concerns. As the P2P industry grows at an accelerating pace the necessary regulatory framework struggles to keep up.

At Bondora we’re taking the initiative rather than waiting for the development of oversight rules.

We want investors and borrowers to be comfortable today, not later. Therefore, we offer analytics and details to our users. The result of this “open book” approach is a culture of visibility; you’ll always have all the data necessary to make informed decisions. For example, Bondora was the first marketplace in Europe with a public API and granular performance data. Additionally, we were the first marketplace to make loans across markets comparable. Today we offer:

- Monthly Recovery Performance Reports

- Monthly Portfolio Performance Reports

- Individual Returns Compared to Other Investors

- Net Interest Received

- Cumulative Cash on Cash Returns

- Loan Ratings

- Planned vs. Received Payments

- Cash Flows From Recoveries

- Cumulative Recovery Rates

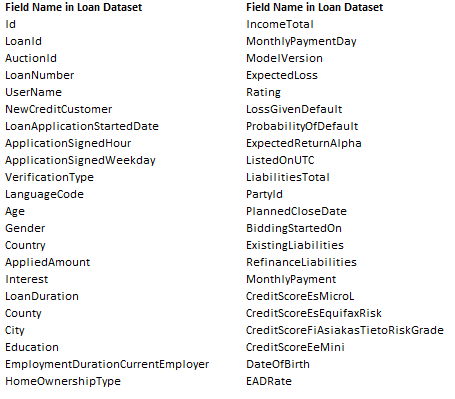

When examining a loan, users can drill down to learn more about the borrower than what is published on most other P2P sites. We offer information like age, location, employment duration, education level, income, liabilities, home ownership type etc. This granular level information coupled with other loan specific data provides a dimensional picture of the borrower so the investor can decide for themself if they’re comfortable with the risk/reward profile.

While some firms have addressed transparency by forming special organizations we’ve responded by sharing more information.

We believe not only in sharing data but making it more accessible and clear. For this reason we have developed a refreshed statistics page which presents users with performance and risk metrics in easy to understand graphics. These characteristics of the Bondora platform are what our users want. How do we know this? We asked them. We’ve conducted interviews with users over the phone or web to better understand their questions and made that feedback into a reality.

These discussions have helped us develop proprietary credit scoring models which helps users assess the risk profile of loans. As our CEO Pärtel Tomberg explained, this feature brought “simplicity and transparency to investing by assigning each loan application that comes to the market a standard rating, from AA to F.” Investors appreciate knowing the range of possible outcomes.

These ratings have become part of other transparency efforts like our monthly recovery performance summaries. Here, we offer a clear and direct analysis of our efforts to recover funds from late borrowers and defaulted loans. These regular posts on our blog work in conjunction with our portfolio performance summaries which detail realized net returns.

At Bondora, what you see is what you get (and you’ll see a lot).

Not only do we make data accessible, we promote it. With our weekly posts we invite users to explore the easy ways they can get and use data. Unlike other providers we keep information right in front of our investors with regular blog posts and videos.

Transparency is what makes Bondora different from most other P2P firms in Europe, the UK and the U.S. Some industry watchdogs have discovered that some marketplace lenders have mislead investors with false loan performance data. In these cases the firm has intervened and made payments on faltering loans to artificially improve performance metrics. By making all necessary data public and accessible, you add another layer of trust and security for the investors on your platform. This is what Bondora aims for.

The concept is simple: More transparency means more trust.