In January, a total of €14,092,612 was invested on Bondora. Even though there was a decline of 14.7% from December, it was still an excellent start to the year compared to January 2021, when only €6,186,462 was invested. Read more:

All four product categories decreased on the month:

- Go & Grow – 14.7%

- Portfolio Manager – 12.7%

- Portfolio Pro – 17.4%

- API – 5.3%

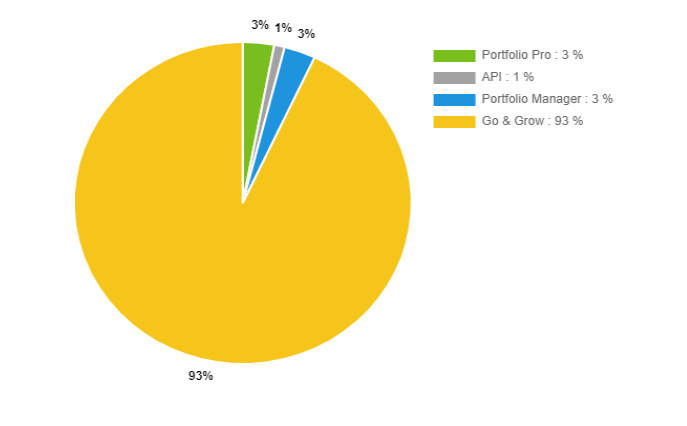

Investment by product

As always, Go & Grow amassed the most funding—€13,089,600. This is a 93% share of all investments. Portfolio Manager still has the 2nd largest, most significant share with €575,936 invested. The Portfolio Pro and API shares remain the same, with 3% and 1%, respectively.

Loan originations

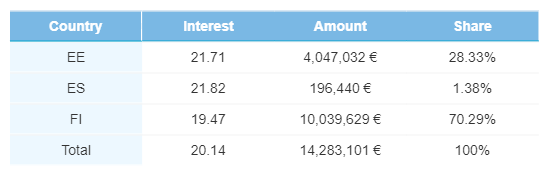

In January, loan originations for 2022 started slightly slow, with €14,283,101 loan originations on Bondora. But, this is a vast improvement compared to just €6,186,462 that was originated in January 2021. Here’s a breakdown of all the origination stats:

Country breakdown

In the first month of 2022, originations decreased by 14.4% to €14,283,101. Finnish loans not only make up the largest share of originations (€10,039,629), but their share skyrocketed from 56.2% to 70.3% of the loan portfolio. Estonian loans now make up 28.3% (€4,047,032) and Spanish loans 1.4% (€187,722).

Spanish growth continues to build as its originations increased by 4.6%. Estonian originations decreased again, although their decline was more dramatic this month, falling by 43.1%. Finnish loans went in the opposite direction, increasing its total origination amount by 7.1%.

We saw an overall drop of 0.8% regarding average interest rates. Once again, this drop comes mainly from the Estonian interest rate, which again fell by 0.3%. The average Spanish interest rate remained unchanged, and again, the average Finnish rate increased by 0.09%.

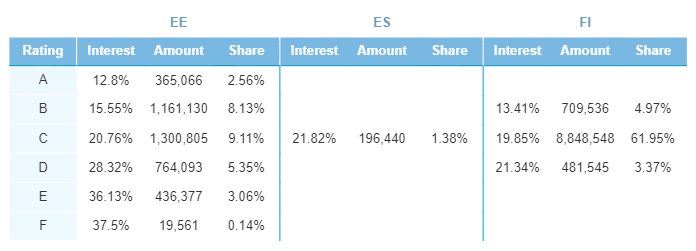

Spain is still only originating C-rated loans, now making up 1.4% of all loans. C-rated loans in Finland nearly doubled their share, going from 35.8% in December to 62.0% in January 2022. Finnish B-rated loans, however, went from having a 19.1% share (the second-biggest share of all loans) to just 5%. In Estonia, C-rated loans increased and now make up the most significant share with 9.1%. D- and F-rated loans increased slightly, whereas A-, B- and E-rated loans decreased in Estonia.

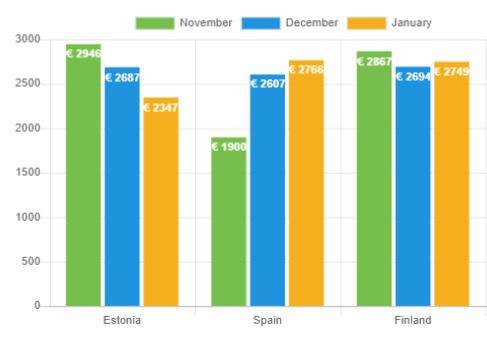

Loan amounts

The average loan amount increased in January for all countries except Estonia. The Baltic state decreased its average loan amount by 12.7% to €2,347. This is the 4th month in a row that Estonian originations have decreased. In contrast, this is Finland’s first increase in 4 months, growing by 2.0%.

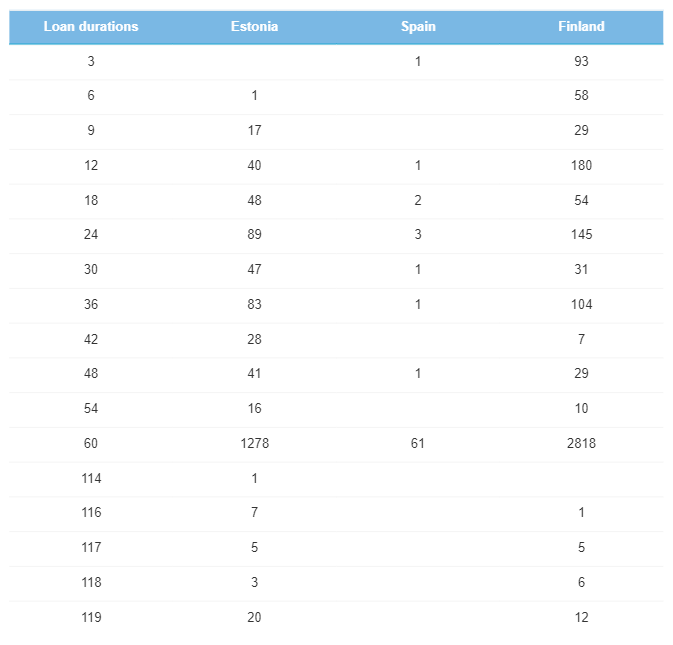

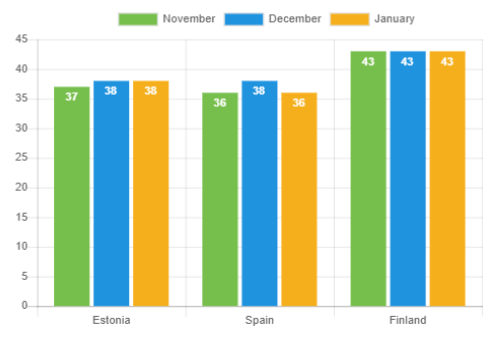

Loan duration

We started the year on a different course compared to December. Estonia and Finland hold the same position, but Spain’s average loan duration dropped by 2 months. All in all, these three markets have very similar loan duration lengths.

As we’ve seen over the last couple of months, 60-month loans enjoy significant popularity across all our markets. This duration consistently has the overwhelming majority in each country. In Estonia, 1,278 loans were issued in this category, in Spain 61, and Finland 2,818 loans.

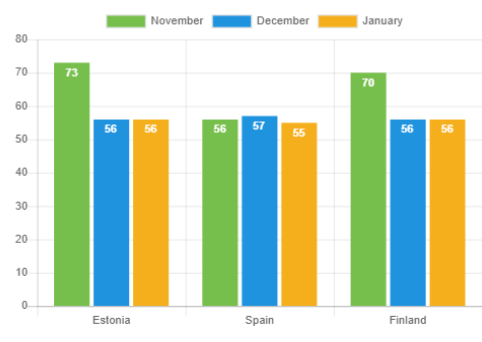

Average age

The average age of borrowers tends to be relatively stable, with Estonian and Finnish borrowers noting no change in age. In Spain, however, the average borrower is now 2 years younger than in December. There they are aged 36, in Estonia aged 38, and in Finland, they tend to be 43-years old.

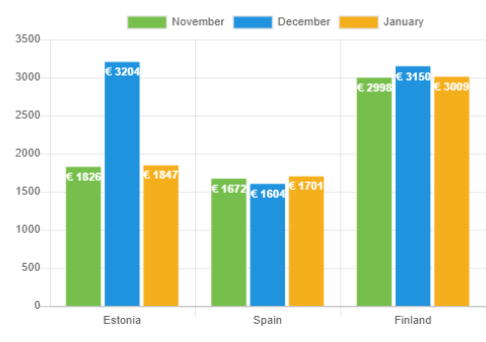

Income

In Spain and Finland, the average net income of borrowers remained more or less the same when compared over the 3 months. The former increased slightly, and the latter decreased somewhat. But in Estonia, the last three months have had far more dramatic shifts, falling 42.4% in January after jumping 75.5% in December.

Education

In Spain, high school education makes up most of the borrowers (46.5%), followed by those with a university degree (39.4%). The remaining 14.1% fall into the Junior high category, with 0% having Vocational school qualifications. In Estonia, things remain similar to last month. Most borrowers have High school (43.3%) and Vocational school qualifications (24.6%). As in December, more than half of all Finnish-based borrowers have Vocational school qualifications (52.3%), followed by University degrees (25.0%).

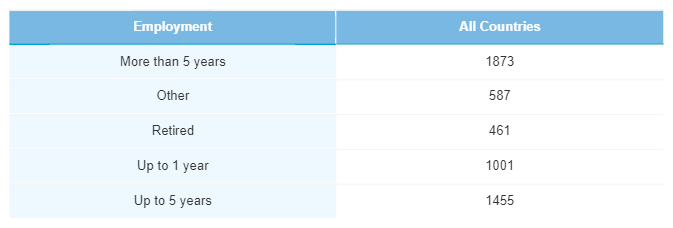

Employment

The statistics regarding borrowers’ employment remain consistent with previous months. The majority of borrowers (1,873) are employed for more than 5 years. Those employed for up to 5 years accounted for the 2nd largest share of all borrowers (1,455). Retirees remain the least populated segment, accounting for just 461 borrowers.

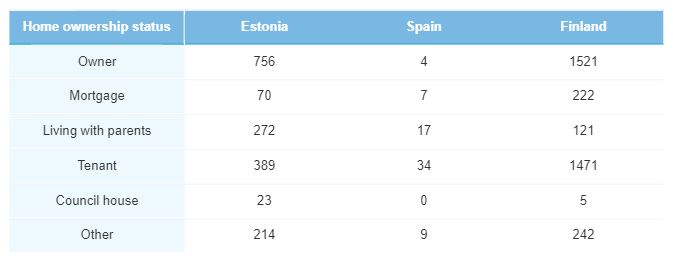

Homeownership status

In Finland, borrowers who own a home (42.5%) are almost equal compared to those who rent (41.1%). In Estonia, the homeownership trend is similar, with 43.9% of borrowers owning their homes. However, the share of borrowers renting (22.6%) is much less than their Finnish counterparts. In Spain, most borrowers are tenants (47.9%). This percentage rose by 13.2% from December. Homeowners only make up 5.6% of all Spanish borrowers. The second-biggest category in Spain is ‘living with parents’ (23.9%).

Verification status

Spain maintained its 100% verification rate for the 5th month, and Finland rejoined this category after breaking its streak last month. Estonia increased its verification rate by 0.5% to 99.7%. This brings the total verification rate to 99.7%—up 0.1% from December.

Investments and originations are off to a good start

We started 2022 with originations and investments topping €14M, which is a solid start to the new year. Even though there was a decline from December, it’s a far better position than what we were in at the start of the previous year. This puts us on the road of growth for 2022.