February brought exciting developments for us! While the total Go & Grow investments and returns dipped slightly compared to January, we also saw a significant milestone: launching our latest credit market, Denmark!

Let’s dive into the numbers for February.

Monthly new investor stats

In February 2025, 2,761 new investors joined Bondora to grow their wealth with ease. Welcome aboard!

Referring friends is still one of the best ways to get more out of your investment. Share your unique referral code from your Dashboard, and you and your friend can both earn a cash bonus once they start investing.

Go & Grow investments in February 2025

In February, our investors added a strong €26,978,893 to their Go & Grow accounts. While slightly lower (15.5%) than January’s record-breaking total of €31,944,532, this figure remains impressive, showing the continued trust in Bondora’s investment platform.

Whether you contributed last month or are looking to invest more, you can add money to your investment at any time.

Returns earned by investors

Investors earned a total of €2,703,704 in returns this February. This steady performance reflects the strength of our platform in helping investors grow their wealth over time.

Question of the month

‘I closed my Bondora account earlier on. Can I still get my Tax Report?’

We’re sorry to hear that you no longer invest with us. But yes, we can help you get your tax report.

Please contact our Customer Support team here. They will be happy to help you.

Loan origination stats – February 2025

Bondora AS, part of Bondora Group, issued €23,902,951 in loans during February. This represents a 6.8% decline from January’s total of €25,633,747 but remains in line with market expectations.

In Finland, loan customers originated €14,826,204 worth of loans, a 6.7% decline from January.

The Netherlands remained relatively stable, with €4,154,592 issued—representing a slight 10.5% decrease from last month.

For the third month in a row, the Estonian market also saw a small decline of 6.1%, bringing the total to €4,501,006.

Latvia showed immense growth, issuing €363,960 in originations—a 22.1% increase compared to January.

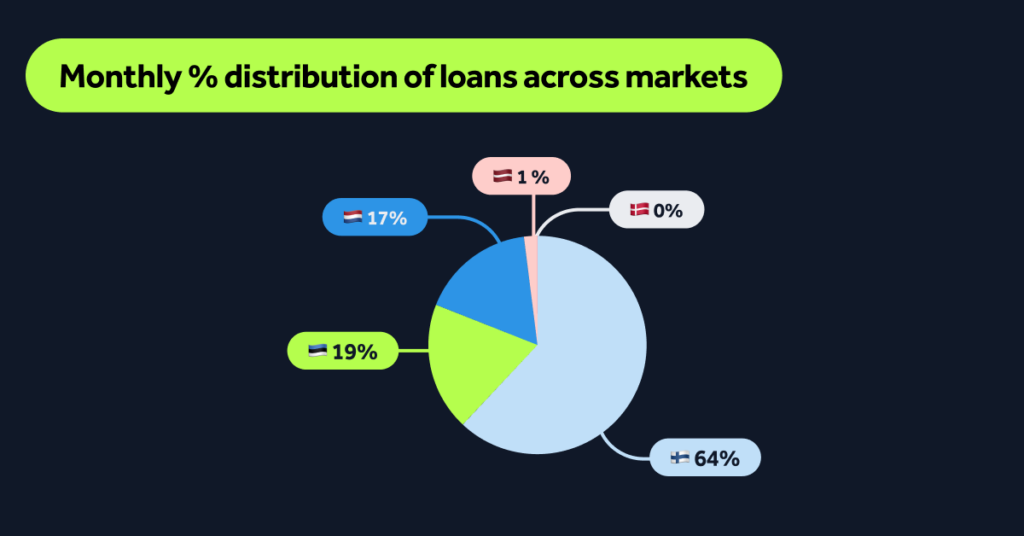

Our country breakdown is as follows:

🇫🇮 Finland: €14,826,204 (62%)

🇪🇪 Estonia: €4,501,006 (19%)

🇳🇱 Netherlands: €4,154,592 (17%)

🇱🇻 Latvia: €363,960 (2%)

🇩🇰 Denmark: 0%

🎉Denmark officially joins our roster of credit markets, and we’re excited to see its growth in the near future.

Instagram community

Haven’t followed us on Instagram yet? Join us for updates, tips, and behind-the-scenes content, and more!

Thank you for being part of the Bondora investment community. We’ll be back next month with more updates. Stay tuned!