In July, we continue to see the downward trend of fewer transactions taking place on the Secondary Market. A total of €162,695 was transacted—a 12.9% month-over-month decline compared to June. This is, however, notably less than the 22.9% decline from May to June. So perhaps the Secondary Market rebound is imminent? We’ll have to wait and see. But first, let’s dive into the statistics for July:

The declining transaction trend we’ve been seeing these past few months is due to the smaller number of investors using Portfolio Manager, Portfolio Pro, and the API. As more and more investors opt for the easy, hands-off investing experience that Go & Grow offers, it’s natural for there to be fewer transactions on the Secondary Market.

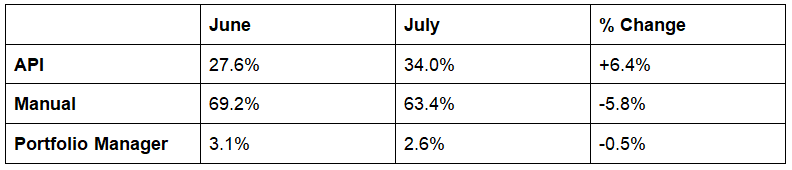

Here’s a quick comparison of the percentage share each category held in June v July.

Off the bat, we can see that the API continues to reign supreme, as it did in June. It was the only category that had an increase in transactions—climbing 7.0%. Both Manual and Portfolio Manager transactions declined, with 28.3% and 20.2%, respectively. Manual transactions, however, still have the largest portion of transactions by far.

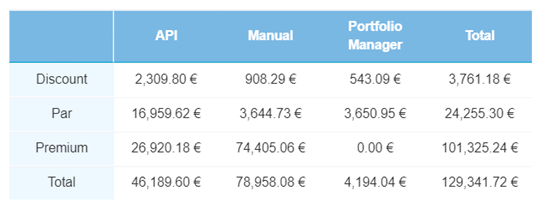

Current Loans

Total current loan transactions were lower by 10.5% in July. This is much less of a decrease than the 27.2% decline in June. The only category that grew in July was again API transactions, which totaled €40,526 in June and €46,189 in July. Manual transactions at a premium remain the largest category for current loan transactions, although they did fall from €86,258 to €74,405.

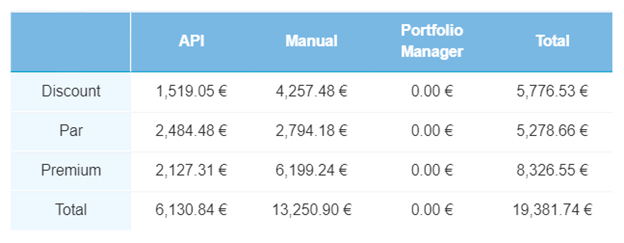

Overdue Loans

After growing for 2 months, overdue loans have now declined again slightly in July. €19,381’s worth of overdue transactions took place last month, which is a 13.5% decline from June. Discount, Par, and Premium categories all saw slight declines on the month. But API transactions on Par increased by 8.3%.

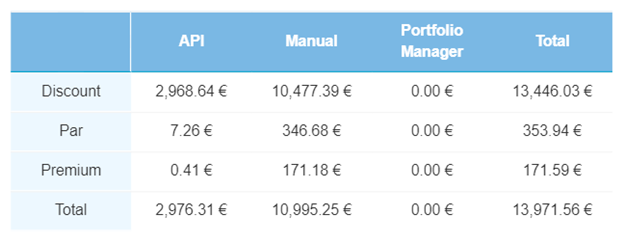

Defaulted Loans

Defaulted loan transactions mirrored the downward trend seen across the Secondary Market as transactions for this category dropped 30.0% to €13,971.56 in total. Manual transactions continue to make up the most transactions, with transactions at a discount increasing from June to July. It garnered €13,567.73’s worth of transactions, increasing by 29.5%.

Secondary Market become less important to passive investors

A continued decline in Secondary Market activity simply proves that more and more investors are opting to grow their money the hands-off way with Go & Grow, rather than hands-on. The API category is still experiencing a growth spurt and reigning supreme for the 2nd month in a row. But this growth spurt is not enough to surpass Manual loan transactions, that still garner the most value by far.

Remember, investors should not seek higher returns from buying and selling loans on the Bondora Secondary Market.

You can learn more about Bondora’s Secondary Market here.