September was another month that will be recorded in the Bondora recovery and collections hall of fame. Over €2.3 million was recovered in missed payments, a new all-time high for Bondora. This was an incredible cross-team effort – thank you to everyone who made it happen.

Bondora experienced a considerable divergence in the number of loans recovered and the amount of cash recovered. While total loan recoveries dipped, the Bondora team recovered more than twice as much cash from missed payments compared to August.

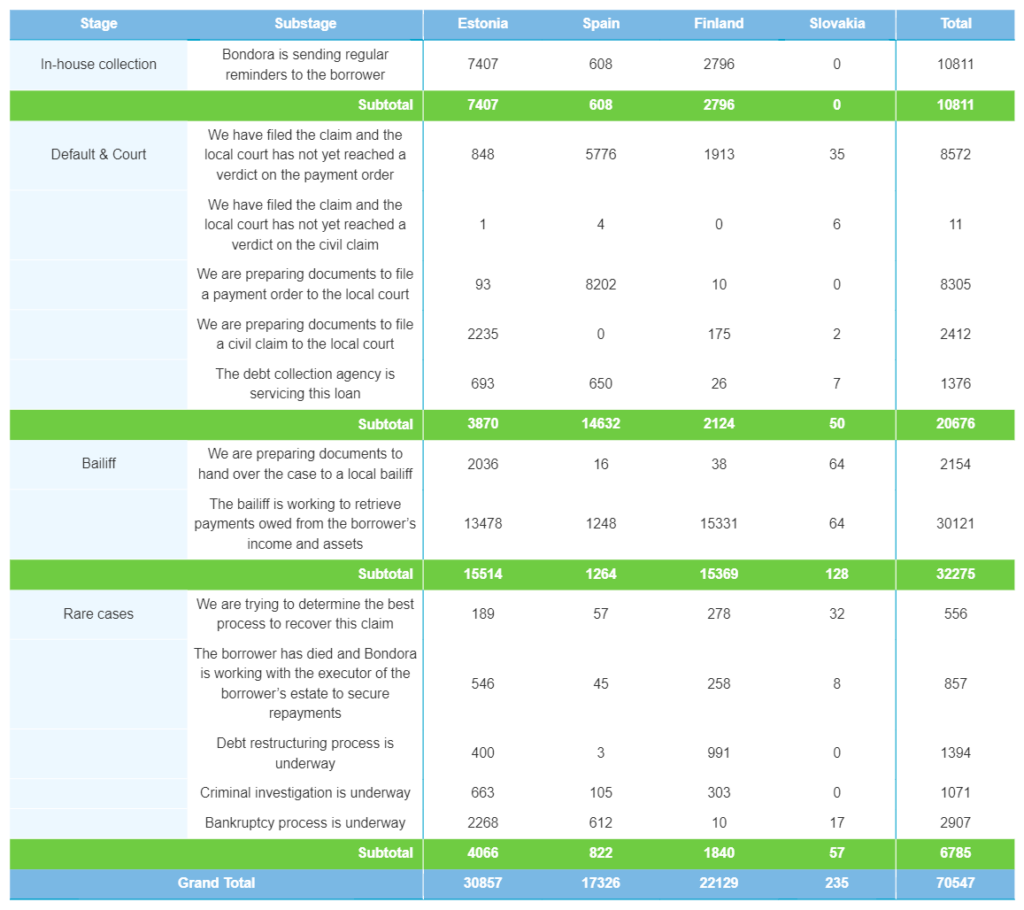

In total, 70,547 missed loan payments were recovered in September, representing a 5.0% month-over-month decline. Rare case recoveries were the only category to grow, up by 2.4%.

On the flipside, in-house collections fell the most, down to 10,811—a 21.3% monthly decline. While Spanish and Finnish recoveries were slightly higher, Estonian recoveries led to the decline in missed payment recoveries, down by 11.1% on the month.

Cash recoveries

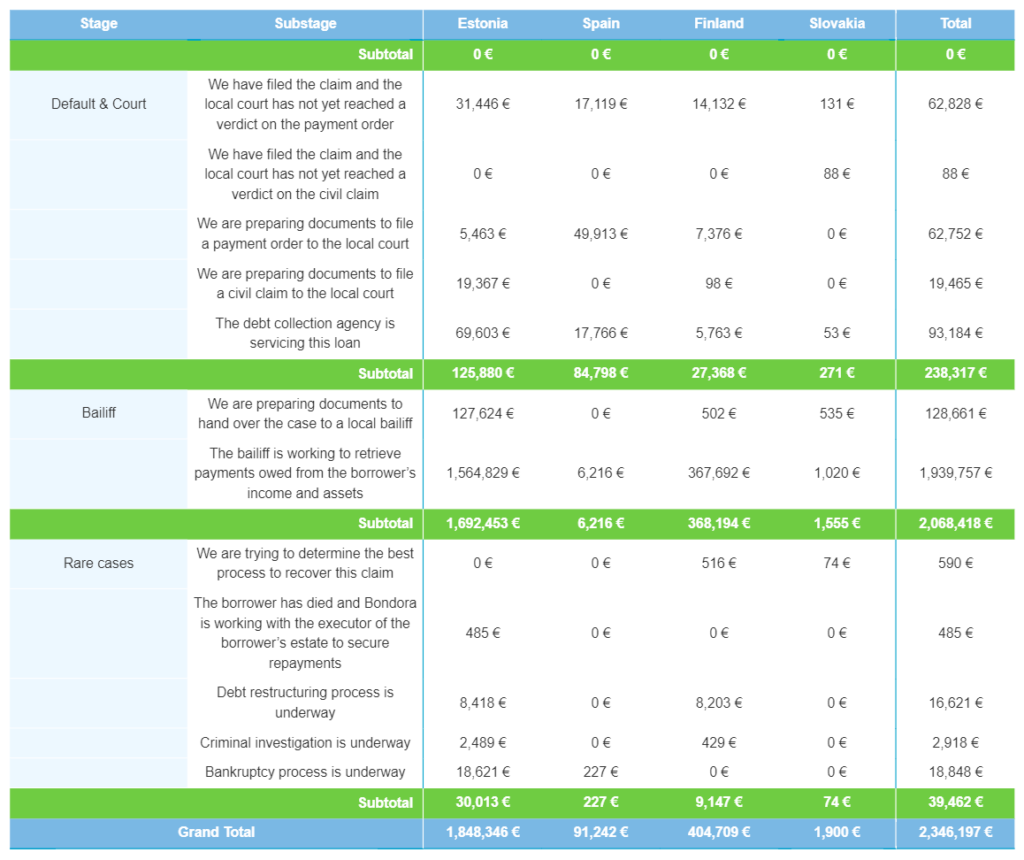

Bondora recovered a whopping €2,346,197 in September. This is a significant 130.0% jump from August. It’s also the first time in history that we passed the €2M mark.

This significant increase was led mainly by a 138.2% growth in bailiff recoveries, totaling €2,068,418, accounting for 88.2% of all cash recovered in the month. However, there was a large difference in cash recovered by originating country, with Estonian cash recoveries up by 311.3% and Finnish recoveries falling by 16.2%.

With such a large divergence in origination recoveries and cash recovered, the average missed payment grew significantly, from €13.74 in August to €33.26 in September.

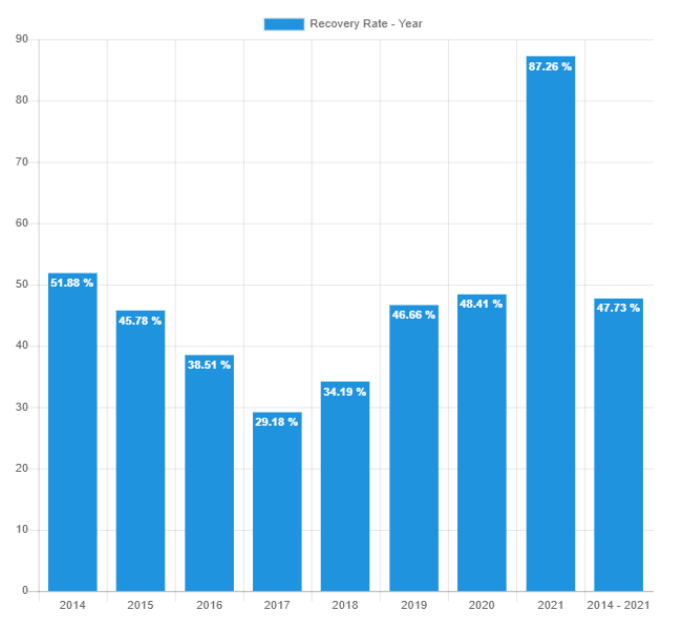

Yearly recovery rate

Recoveries for 2021 are showing strength never seen before. The 2021 recovery rate exploded from 53.6% in August to 87.3%. This was the driving factor in the growing cumulative recovery rate from 2014-2021, climbing higher by 4.3% to 47.7%. The recovery rate for 2020 was also strong, growing by 4.5% to 48.4% in September.

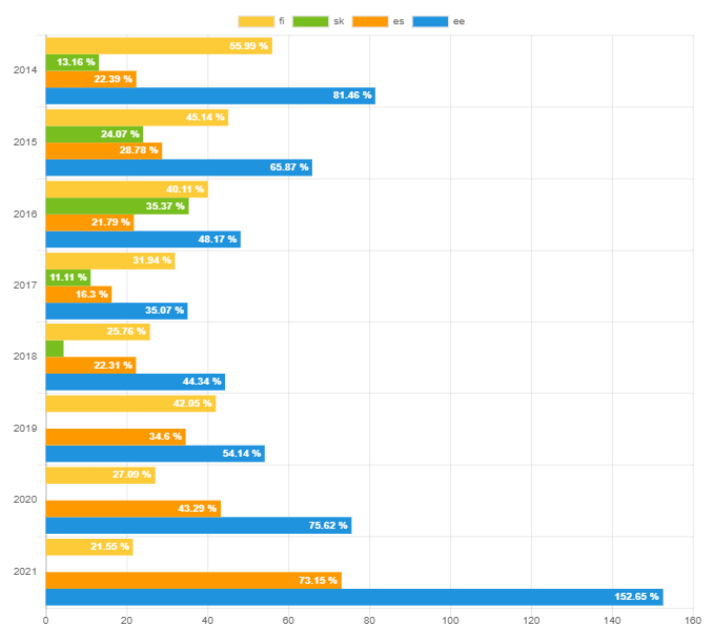

Recoveries by country

The driving force behind the major growth in the 2021 recovery rate came from Estonian recoveries, where the rate grew from 73.6% to 152.7% in September. In fact, Estonian recoveries also performed well for loans originated over the previous few years, with the recovery rate for 2020 and 2019 originations growing 12.0% and 3.2%, respectively.

The Spanish recovery rate was also higher in 2021, up by 10.9% to 73.2%, as was the Finnish recovery rate, which was a marginal 0.6% higher.

Cash recovered outpaces missed payment recoveries

It was a topsy-turvy month for Bondora recoveries. While there was a 5.0% decline in the number of missed payments recovered, the amount of cash recovered from those missed payments grew exponentially by 130.0%. The result was an average missed payment recovery of €33.26 and a yearly recovery rate for 2021 at 87.3%. These figures represent quite the outlier from previous months. Therefore, investors may be curious to see if these statistics are an anomaly or a sign of changes in Bondora recoveries.

You can always view missed payment recoveries and all other Bondora data at any time. Check out our real-time statistics to see not only recovery data on all Bondora missed payments, but loan history, returns data, and more.