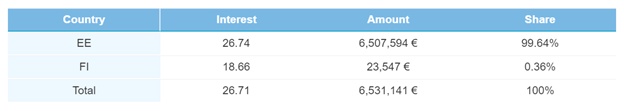

Estonian originations continue to climb higher and higher. This time, originations grew 109.0% from October to €6,507,594. Unlike previous months, Estonia wasn’t the only country with originations. After extensive review, we’ve decided to re-open the Finnish market.

A small value of Finnish loans—€23,547 total—originated in the month, the first time since March. This brought the total value of November originations to €6,531,141. The overall interest rate did fall once again, this time down to 26.7%.

Estonian B-rated loans soar

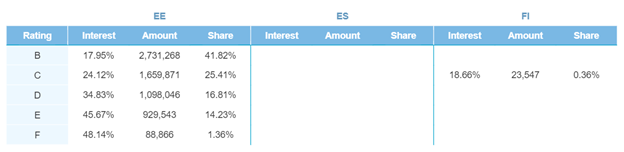

The biggest difference between this month and the last was Estonian B-rated loans. In October, €256,833 B-rated loans were originated, compared to €2,731,268 this month, a whopping 963.4% increase! Estonian C-rated loans were also higher, up by 59.9% to €1,659,871. Additionally, €88,866 in F-rated loans were issued in Estonia after no such loans originated in that category last month.

Finnish loans had €23,547 worth of originations of C-rated loans at an 18.7% rate of interest. This is a solid start considering it’s been 9 months since Finnish loans were originated.

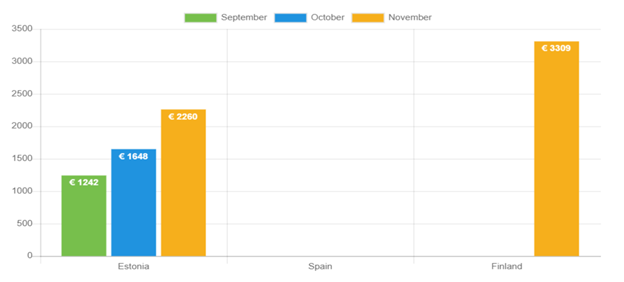

Loan amounts and duration

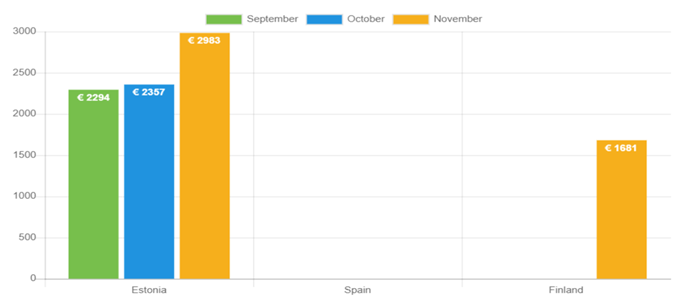

After rising 2.7% in October, Estonian average loan amounts grew once again in November. This month, the average Estonian origination came out to €2,983, a growth of 26.6%.

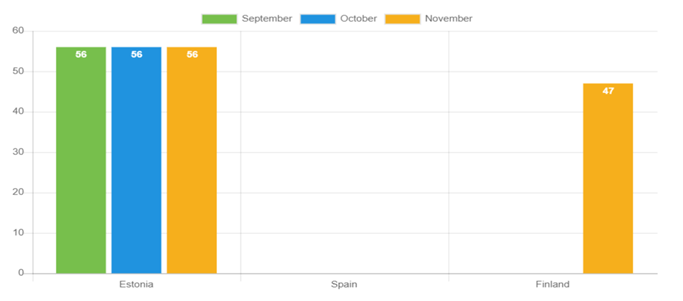

For the second straight month, Estonian loan durations stayed at 56 months. Durations for Finnish originations averaged 47 months, one month lower than their previous level seen in March.

Estonian originations with 60-month durations totaled 1,682 in November, representing 77.1% of all originations. This is slightly higher when compared to last month’s 74.9% for the same category. Meanwhile, half of all Finnish loans also had 60-month durations, with the remaining having durations of 9 months or less.

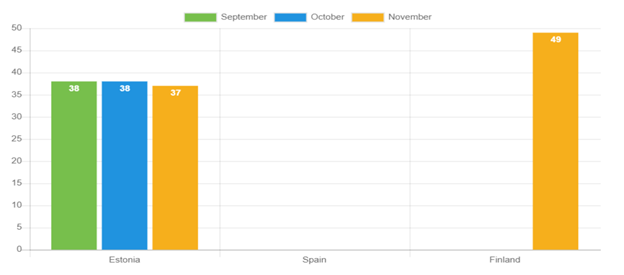

Average age

The average age of Estonian borrowers dropped slightly to 37 years old. New borrowers in Finland were older, averaging 49 years of age, which is also older than the 47-year-old age of Finnish borrowers the last time loans were originated in the country in March. Meanwhile, the €3,309 average income for Finnish borrowers was a 30.0% increase from last March’s numbers.

Income

For the second consecutive month, the average income of Estonian borrowers grew. This time, borrowers averaged €2,260 in monthly income, a 37.1% increase from last month.

Education

Maintaining the previous month’s trend, most Estonian borrowers (897) had a high school degree, accounting for 41.1% of all borrowers in the month. This was again followed by vocational school education (548 borrowers) and junior high borrowers (408), respectively.

All seven Finnish borrowers in November had a vocational school degree.

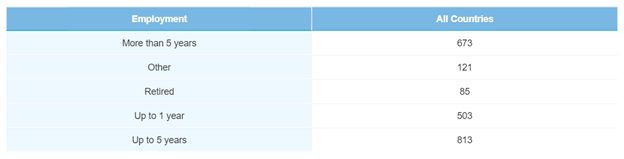

Employment

Employment durations for November also held their ground. 30.7% of borrowers have been employed for more than 5 years, while 37.0% have been employed for up to 5 years. This makes a total of 67.7% of November’s borrowers having secured long-term employment, even during an economically challenging year.

Home-ownership status

This month, a lower percentage of Estonian borrowers (42.0%) were homeowners than last month (44.0%). The same goes for borrowers who were tenants, which totaled 19.7% of all borrowers. On the flip side, the number of borrowers’ living with their parents increased, totaling 375, or 17.2% of all borrowers. Borrowers with a mortgage remained more or less the same as last month (6.7%).

Verification Status

In October, 91.0% of all Estonian borrowers were verified, compared to 98.3%—or 2,143 total borrowers—in November. Additionally, all Finnish borrowers in November were verified by Bondora.

Originations on the rise again

Bondora originations are continuing to climb higher toward pre-pandemic levels. For the first time since March, originations outside of Estonia were issued, albeit in a small sample size in Finland. Bondora has been able to weather the economic storm of 2020 and provide sizable loan originations to its customer base.

Learn more about Bondora investment products here.