June 2025 brought strong lending growth and steady returns, marking another solid month for Bondora Group. Loan originations continued their upward momentum, Go & Grow investments remained strong, and thousands more people joined our community to grow their wealth the simple way.

Let’s dive into the numbers!

New investor stats

In June, 2,573 new investors joined Bondora to grow their wealth with ease. Welcome and happy investing!

Whether you joined recently or have been with us for years, thank you for choosing Go & Grow for a simple, reliable, and effortless investing experience.

Do you know someone who could also benefit from investing without hassle? When you refer a friend and they start investing, you’ll both earn a cash bonus.

👉 Refer them using your unique code from your Dashboard today.

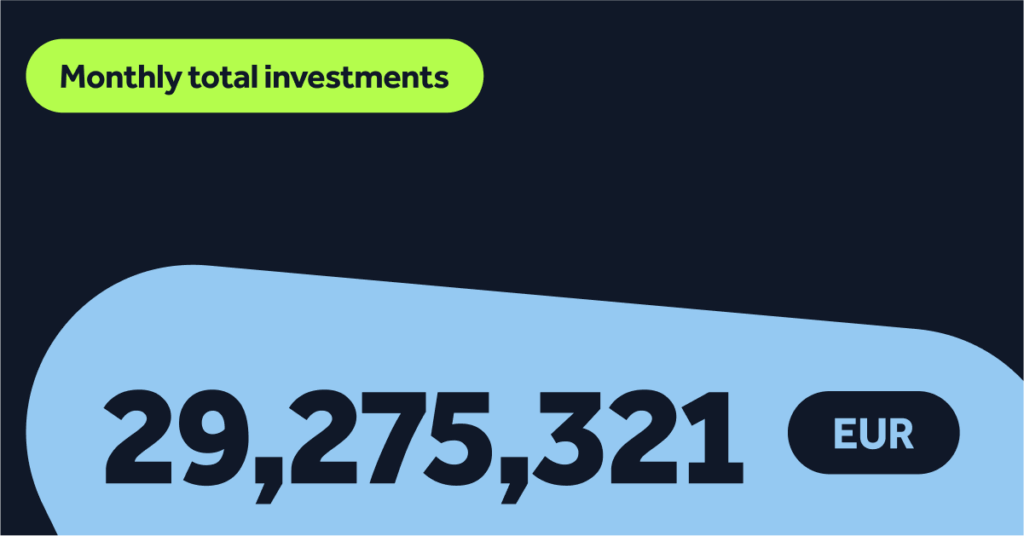

Go & Grow investments in June 2025

In June, investors added €29,275,321 to their Go & Grow accounts. While slightly below May’s record-breaking total, it remains one of the strongest months of 2025 so far.

This consistency shows how more and more people continue to trust Go & Grow to help them reach their financial goals.

☀️ Summer surprise: Double your deposit!

Summer just got even better! With our Double Your Deposit campaign, you have the lucky chance to win your share of €75,000 in prizes.

It’s simple: Every €100 you invest gives you a ticket to the draw, where you could be one of the lucky winners to have your deposit doubled! Read the full details and terms here.

Don’t miss out! This is your chance to make your summer investments even more rewarding.

👉 Invest now and enter the draw >>

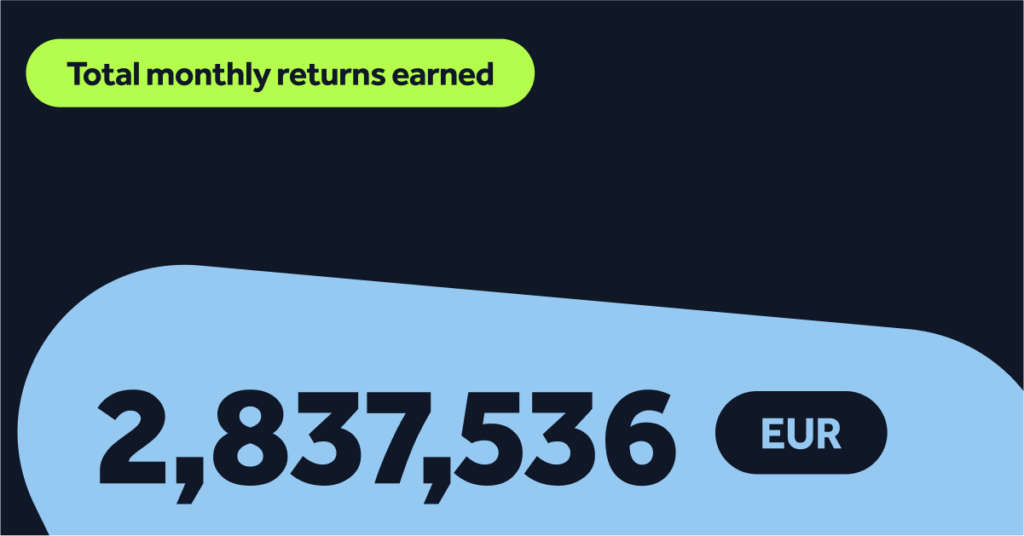

Returns earned in June

Investors earned €2,837,536 in returns across their Go & Grow accounts in June. This is a 1.8% increase over May’s returns and another sign of steady performance.

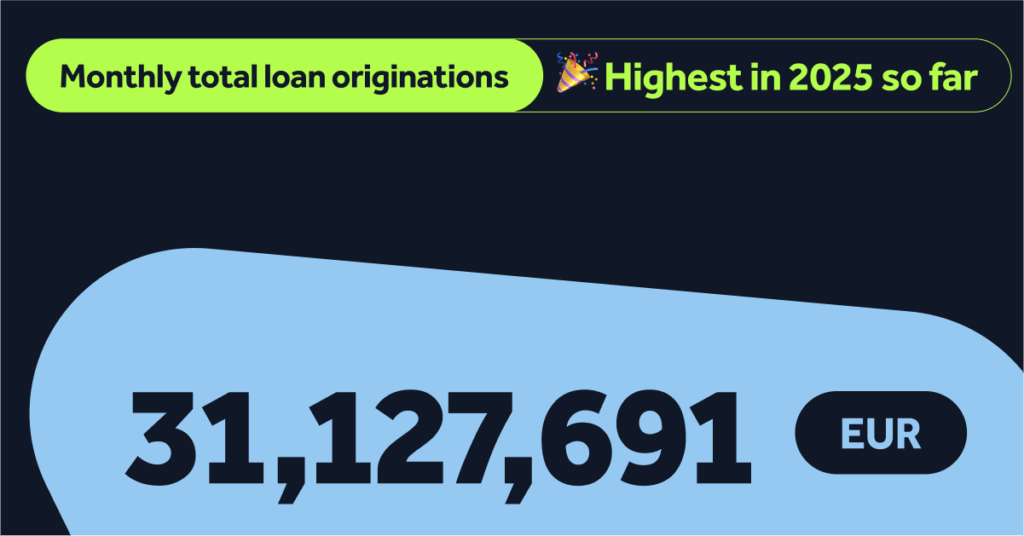

Loan origination stats – June 2025

Loan originations climbed again in June, with Bondora AS issuing €31,127,691 in loans, up 8.4% from May’s €28,700,018. This is our highest origination amount for 2025 thus far.

Here’s a breakdown by country:

🇫🇮 Finland led with €19,929,307 in originations, maintaining its strong position across our credit markets.

🇳🇱 The Netherlands followed with €6,007,144, continuing its growth trend.

🇪🇪 Estonia issued €4,184,878 in loans.

🇱🇻 Latvia remained steady with €485,028 in originations.

🇩🇰 Denmark continued to grow with €521,334. This is its best month since launching in March this year.

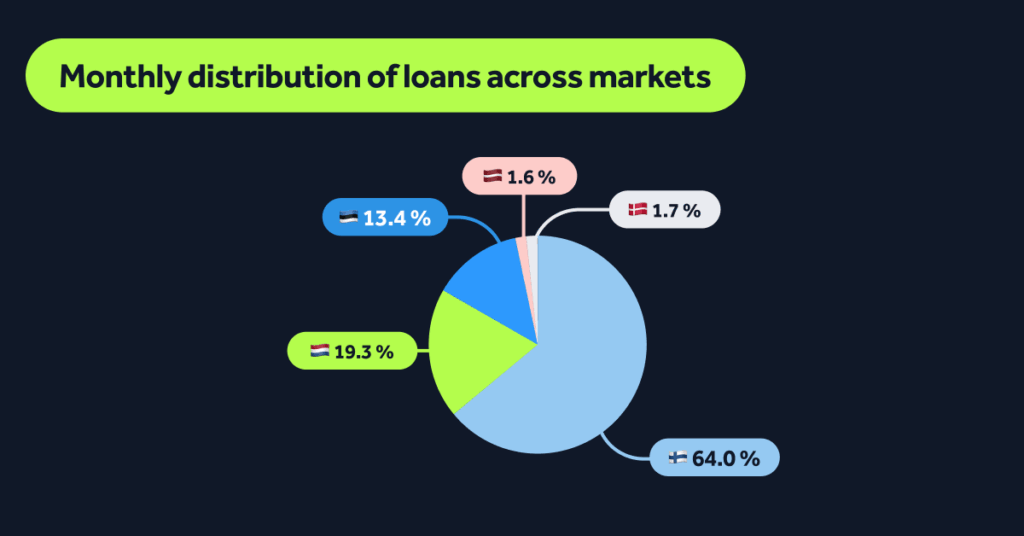

June’s loan origination shares:

- Finland: 64.0%

- Netherlands: 19.3%

- Estonia: 13.4%

- Latvia: 1.6%

- Denmark: 1.7%

💡 Want to learn how we manage loan recoveries?

Curious about what happens when a credit customer stops repaying and how Bondora Group handles recoveries? We’ve just published a clear, transparent article explaining the entire process step by step.

We always approach each case with care and respect, aiming to find solutions that support our credit customers while recovering funds for investors.

📖 Read the full explainer here

Social media communities

Not following us yet on Instagram, Facebook, or LinkedIn? Join us for updates, helpful content, and a peek into life at Bondora!

Join us on Instagram here.

Follow us on Facebook.

Join our LinkedIn community.

Thank you for being part of the Bondora investment community. We’ll be back next month with more updates. Stay tuned!