🎉June was a record-breaking month for loan originations, thanks to astronomical growth in Finland and the Netherlands. Overall, Bondora Group’s loan originations totaled €24,567,566 – the highest origination amount ever!

Read on to discover more exciting information about Bondora Group’s June numbers and statistics.

New investors

In June, 1,507 more people created investor accounts with us. Do you have friends who could also benefit from simple online investing? Refer them using your unique code from your Dashboard so you and your friends could each get an investment bonus.

Investments

Bondora investors added €13,023,021 to their Go & Grow accounts in June, which is nearly the exact amount as in May.

Returns earned by investors

Our Bondora investor community earned a total of €2,257,573 in returns in June. Of course, investing is a long-term journey, but it’s extra motivating to see your gains as you work to achieve your financial goals.

Loan originations

NEW RECORD: In June, Bondora Group’s loan originations totaled €24,567,566, our highest amount ever. This is due to increases in all our markets, and specifically astronomical growth in Finland and the Netherlands. It is humbling and motivating to see more and more people choosing us as their trusted financial partner to enhance their lives through our accessible and secure credit solutions.

In Finland, loan customers originated €15,300,339 worth of loans, a mammoth 37.6% increase from May.

In the Netherlands, €4,235,920 was originated, the highest origination amount for this credit market since launching in September 2022. It is very encouraging to see this new market grow and sustainably contribute to Bondora Group’s portfolio.

Our most recently launched credit market in Latvia is also growing, increasing by 7.7.% to €147,636 worth of originations in June.

The Estonian credit market originated €4,883,671 in loans—an 8.2% increase from May.

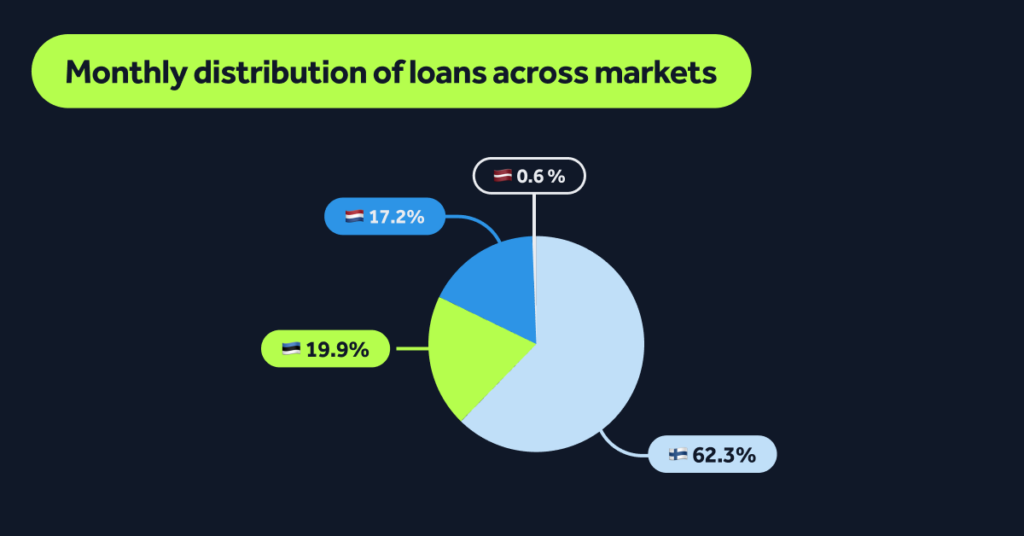

See from which markets the most originations came in June:

As always, Finland reigns as the market with the largest share of loan originations.

Estonia remains in second place, but for how long? The Netherlands is growing strongly and is hot on the heels of our home market, with only a 2.7% difference between them.

Latvia, our most recent new market, follows in fourth.

Do you want to compare these stats to last month’s? Use this link to our May stats post.

Investor question of the month

“Can I invest more than €1,000 at once? If so, how will the returns be calculated?”

You can invest any amount into your Go & Grow. However, only the first €1,000 you deposit every month will earn returns up to 6.75%* p.a. Any amount exceeding this will earn up to 4%* p.a.

Then, on the 1st of the next month, thanks to our Auto-transfer feature, your investment earning up to 4%* p.a. will automatically start earning up to 6.75%* p.a. (up to the monthly €1,000 Go & Grow limit).

Here is an example:

Laura invests €1,200 in July. €1,000 immediately starts earning up to 6.75%* p.a. The €200 exceeding the monthly Go & Grow limit starts earning up to 4%* p.a.

Then, on 1 August, the €200 that was earning up to 4%* p.a. automatically transfers and starts earning up to 6.75%* p.a.

If Laura then adds another €1,200 to her Go & Grow in August, €800 will start earning up to 6.75%* p.a., and the €400 exceeding the Go & Grow monthly limit will earn up to 4%* p.a.

See you next month

We hope you enjoyed this exciting entry into our monthly stats series. Look out for the July stats and data article next month!

Want to see more? Follow us on Instagram for more updates, fun and educational content, and exclusive behind-the-scenes moments.