Bondora returns remain relatively constant, regardless of slight declines compared to April. With economic uncertainty, yet hopeful optimism as European countries relax lockdown restrictions, it should be interesting to see what the future brings.

As always, performance charts by country are broken down by the number of loan issuances over the given period, with Orange representing < 50 loans, Blue 51-200, and White > 200.

Bondora returns remain above targets, despite slight decline

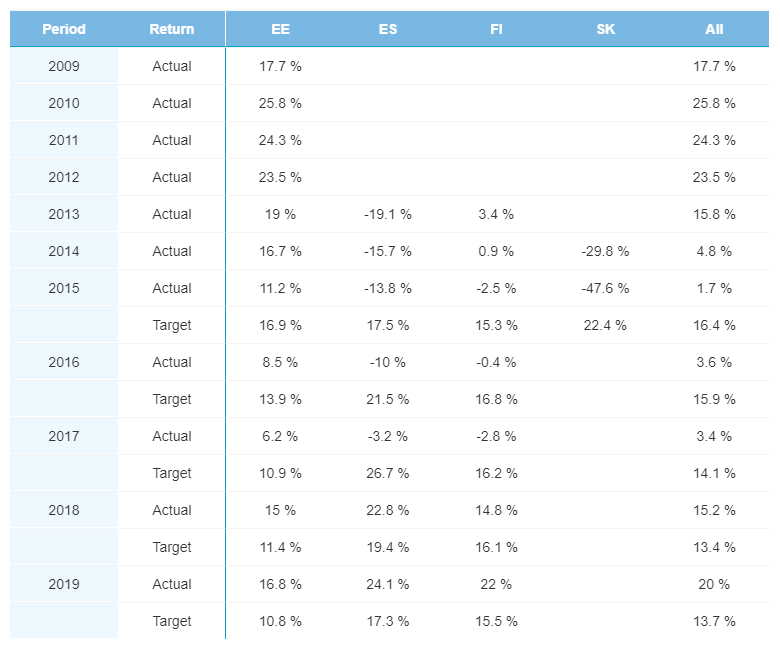

Bondora returns continue to perform well, in spite of the global economy taking a knock. The cumulative return for 2019 originations came in at 20%—only 0.9% less than last month. This remains far above the target of 13.7%. Spanish, Finish and Estonian returns have all taken slight dips in May, with Spain and Finland both lessening with 1.3% and Estonia with .5%. Spain retains their spot as the country with the highest return rates for the past couple of years.

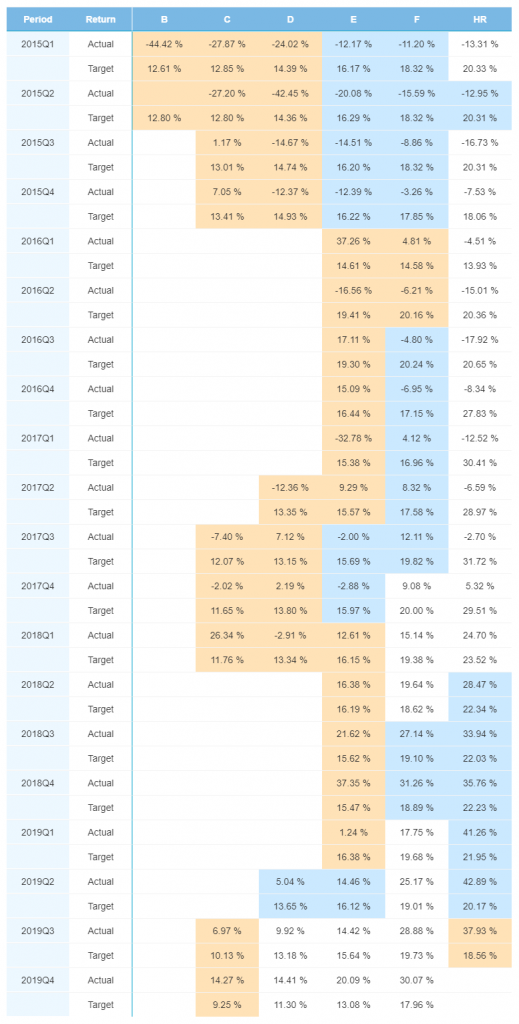

Quarterly Performance

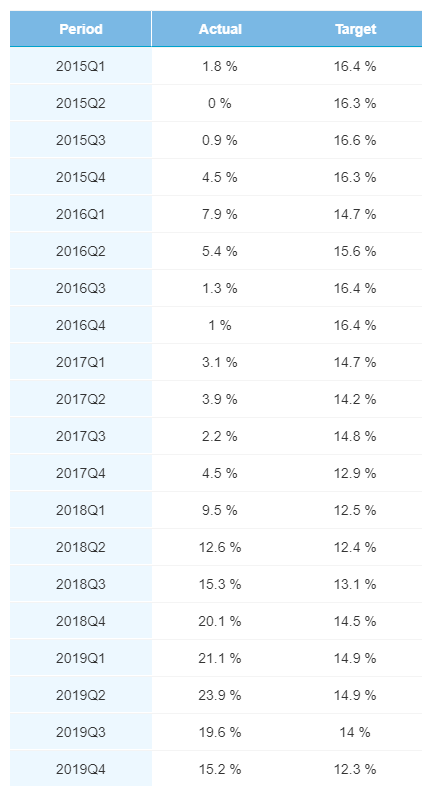

The most recent quarter, 2019 Q4, saw a 0.5% decrease from last month’s 15.7%, continuing the slight decline we’ve been seeing recently. Despite this drop, the latest seven quarters are still above their targets. 2019 Q2 still has the highest return rate, being 23.9%—9% more than its target.

Finland

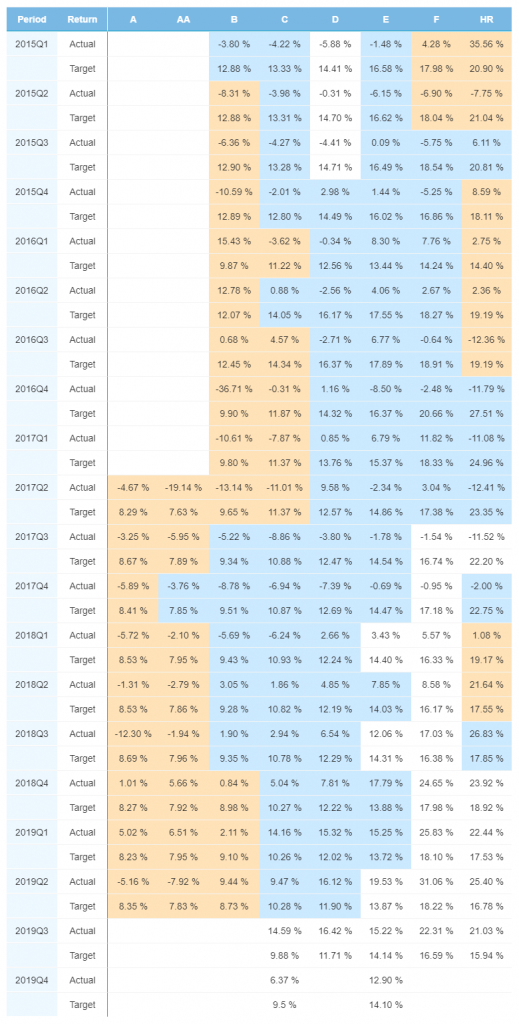

Finland’s latest quarter returns are slightly lower than the previous two months, coming in at 6.37% for C rated loans, and 12.90% for E rated loans. Both ratings still continue the trend of having more than 200 loan originations since Q3 2019.

Estonia

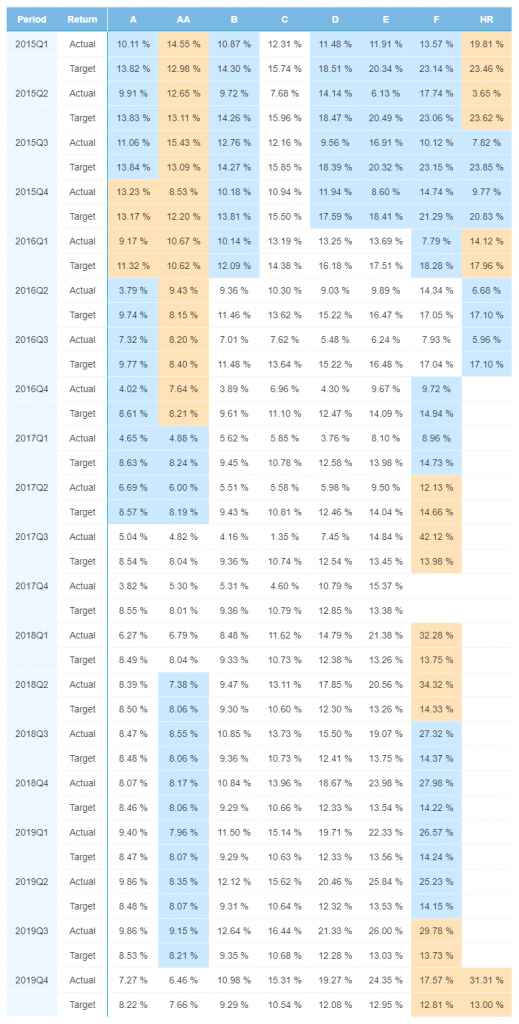

After being introduced in Q4 2019, High Rated (HR) loans in Estonia remain more than double the target, coming in at 31.31%, only 3.49% less than last month. As in April, six of the loan categories outperformed their targets, with A and AA categories coming in less than 1% below their targets.

Spain

There were still no HR rated loans issues in Spain in this quarter. As the highest return rating country, it’s no surprise that all the categories far outperformed their targets. F rated loans still perform the best, coming in at 30.07%. This return is in-line with the category’s return from the previous two quarters.

Economic news

The so-called ‘travel bubble’ in the Baltics continues to grow and now extends to the Nordic countries, as Finland will allow tourists from neighboring countries, except Sweden, into the country from mid-June. For the first time since the travel ban was implemented in March, Finnish and Estonian residents can travel to and from each other without having to quarantine. It is expected that Poland and Lithuania will soon follow suit, expanding the travel bubble even further.

Italy finally approves the long-awaited economic stimulus plan, coming to a total of €55 billion. This comprehensive stimulus package will help battered businesses in the form of grants and tax breaks, as well as childcare subsidies for families hardest hit by the virus. Those with no income and who are excluded from current welfare programs, will also be offered relief. Italy is expected to see at least an 8% decrease in their economic growth prospects.

In a bid to re-open societies and restart economic growth, most European nations have gradually relaxed their lockdowns since May. Countries have their own phased approaches with different regulations, but for most, life will start to be less restrictive, with a sense of normalcy returning, albeit with masks, social distancing and working from home policies.