In June, transactions on Bondora’s secondary market decreased in line with a decrease in overall originations. A total of €595,774 was transacted on the secondary market, an 18.9% reduction compared to May. Current loans at par value saw the highest volume this month at €381,374.

Current Loans

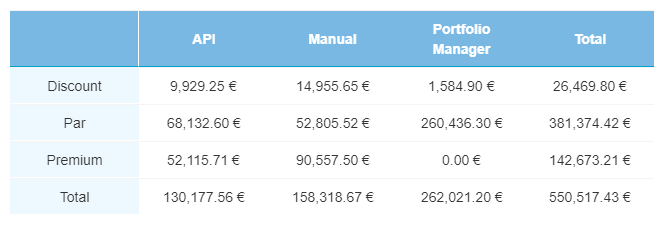

Purchases of current loans fell by 23.8% to €550,517. Interestingly, more current loans were purchased at a discount, although the total discounted purchases, €26,469, was still not sizable. The remaining categories all changed in June, with transactions at par value standing at €381,374. Once again, current loan transactions accounted for the overwhelming majority of secondary market transactions, garnering 92.4% of all.

Overdue Loans

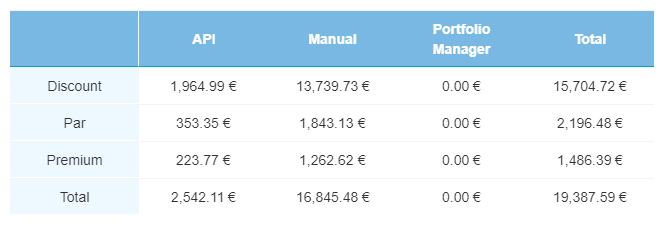

Overdue loan purchases fell by 23.8% to €19,387. 81% were completed at a discount, with 86.9% of all being manual.

Defaulted Loans

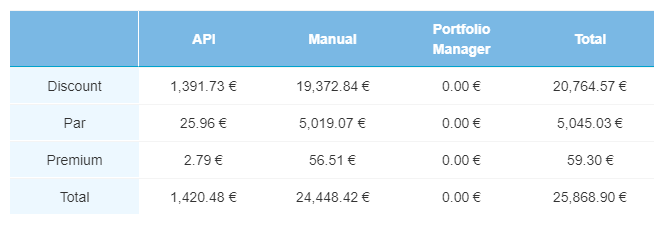

Defaulted loan purchases fell less than in other categories. Defaulted loan transactions came to €25,868 in June, down only 6.3% from last month. Contrary to other trends this month, more defaulted loans were purchased at par value, totalling €5,045 on the month.

Secondary Market Transactions Overall

With summer underway, it is possible that investors are holding off on making as many Secondary Market transactions, which require more research and time to conduct successfully.

As always, investing in the secondary market can be risky, and you should always learn as much as possible before attempting to buy and sell loans on the secondary market. Investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at investor@bondora.com.