Last week, we introduced our newly revamped Statistics page, designed to give you clear, consistent, and up-to-date insights into Bondora’s lending and investment activity. Check it out here in case you missed it.

We promised that more data was on the way, and we meant it. Until the page is fully automated, we’ll keep sharing important portfolio statistics right here on the blog.

So, let’s take a look at the latest updates:

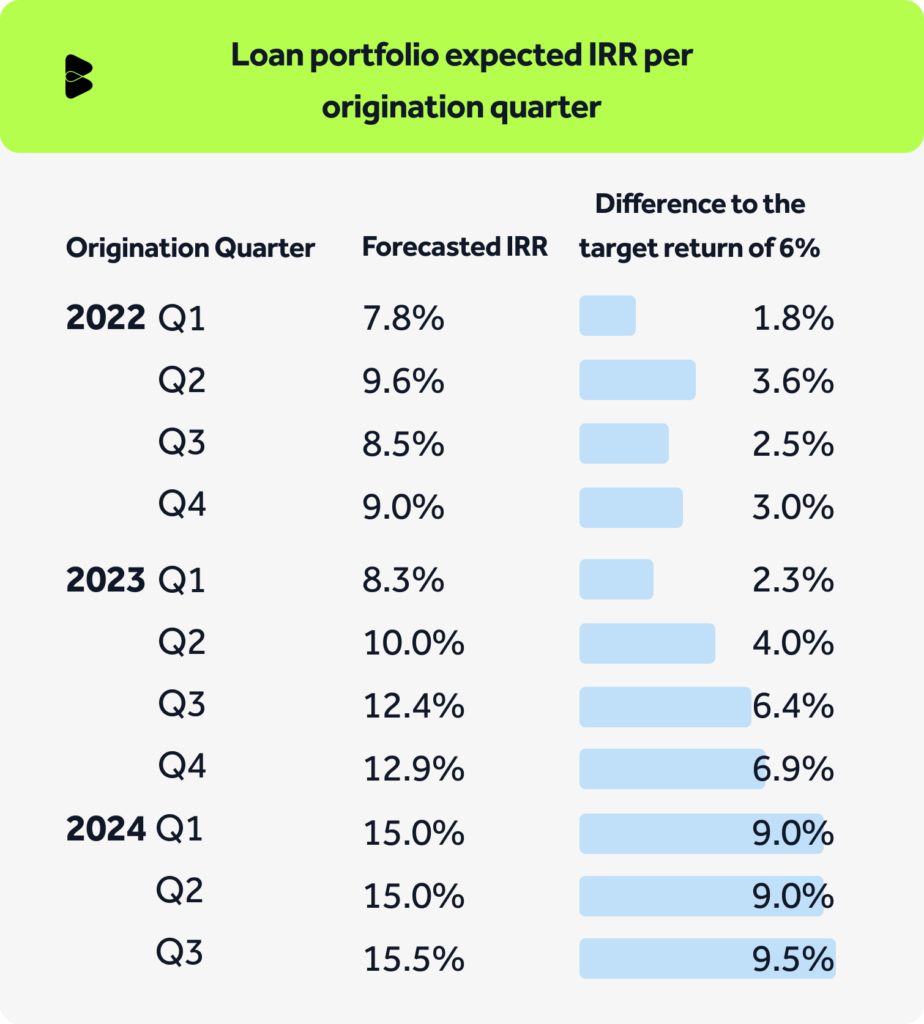

Loan portfolio expected IRR per origination quarter

One of the most valuable indicators of performance is the expected internal rate of return (IRR) on the loan portfolio. These quarterly figures reflect the returns our portfolios are expected to generate and are the foundation from which the Go & Grow target return is delivered.

How do we forecast IRR?

Our forecasted IRR is based on a combination of historical performance data and the current behavior of active loans. Here’s how it works:

- We analyze the IRR from past loans we’ve issued.

- We closely monitor how current loans are performing, especially key indicators like default rates at different stages of the loan lifecycle.

- Based on this data, we project how the current loan portfolio is likely to perform and draw our expected IRR.

Why it matters:

These statistics give you direct insight into the underlying strength of the portfolio.

Because most of the loans we’ve issued recently fall within low-risk levels (as shared last week), and current performance indicators are strong, we’re optimistic about the expected IRR going forward.

In fact, our current forecasted IRR shows a strong outlook, with a comfortable buffer above the 6% target return. This positive spread helps reduce investor risks and reflects ongoing improvements in portfolio performance.

A note on IRR: What does it include?

We’ve received a great question from our community: Does the forecasted IRR include defaults?

The answer is yes, it does.

The IRR figures we’ve shared are after defaults and recoveries. So, they represent the fully risk-adjusted forecasted net return of the loan portfolio.

This means that:

- Defaults are treated as losses

- Recoveries are added back in as gains

- The result is the net return investors can expect

So, when you see a forecasted IRR figure, you’re getting a realistic, risk-adjusted view of what the loan portfolio is expected to return over time.

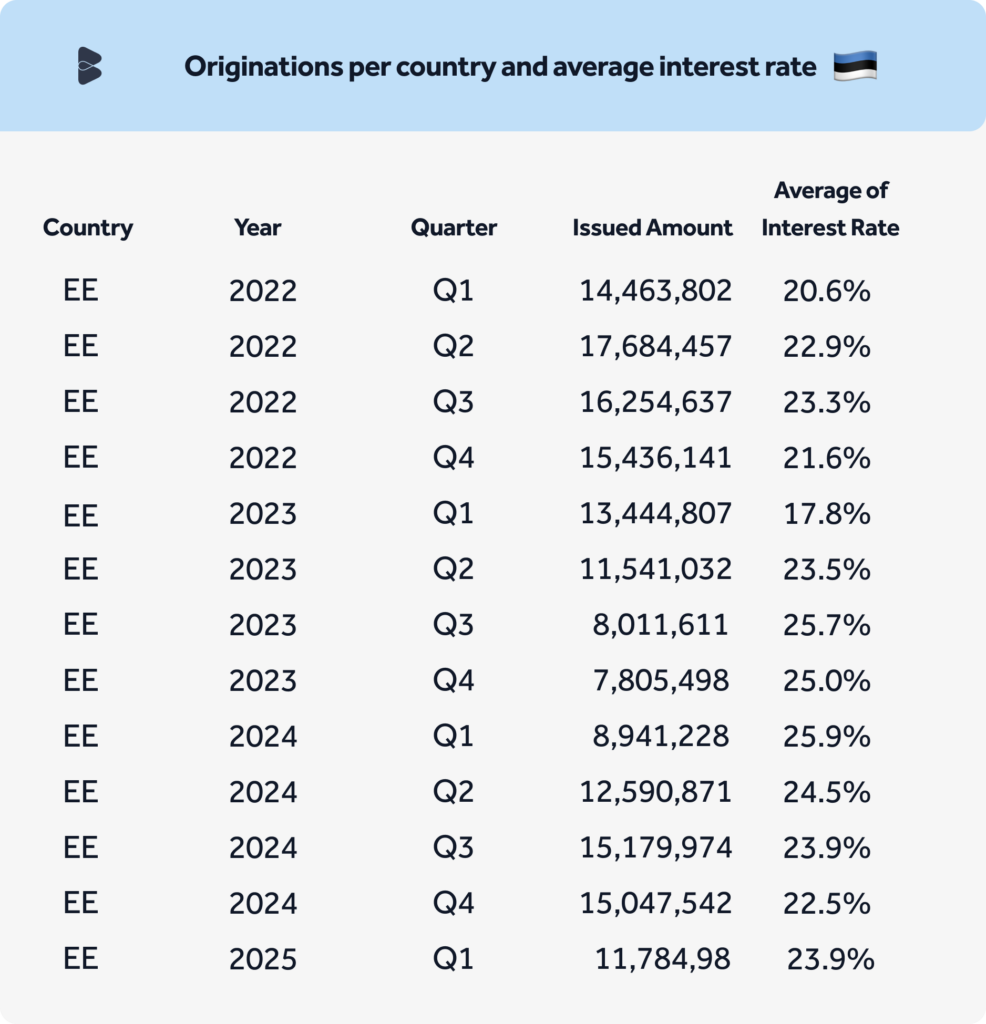

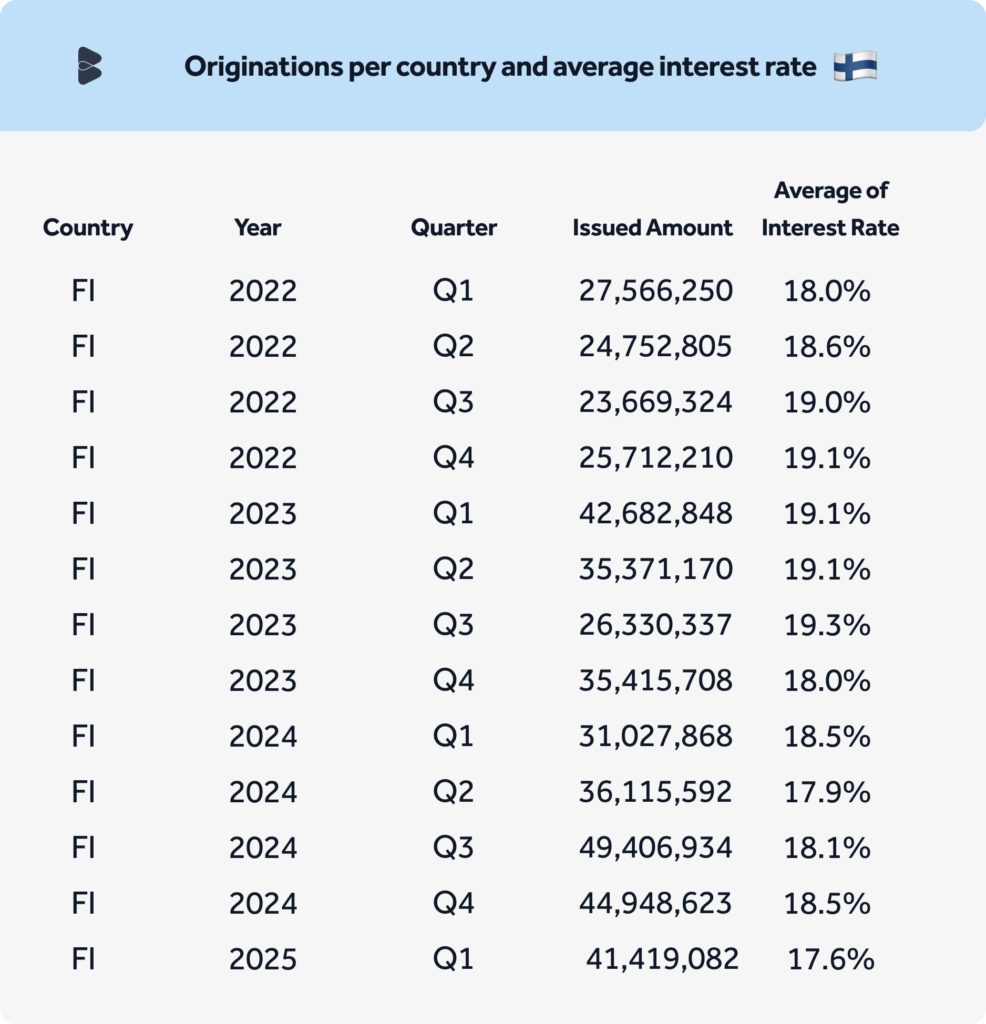

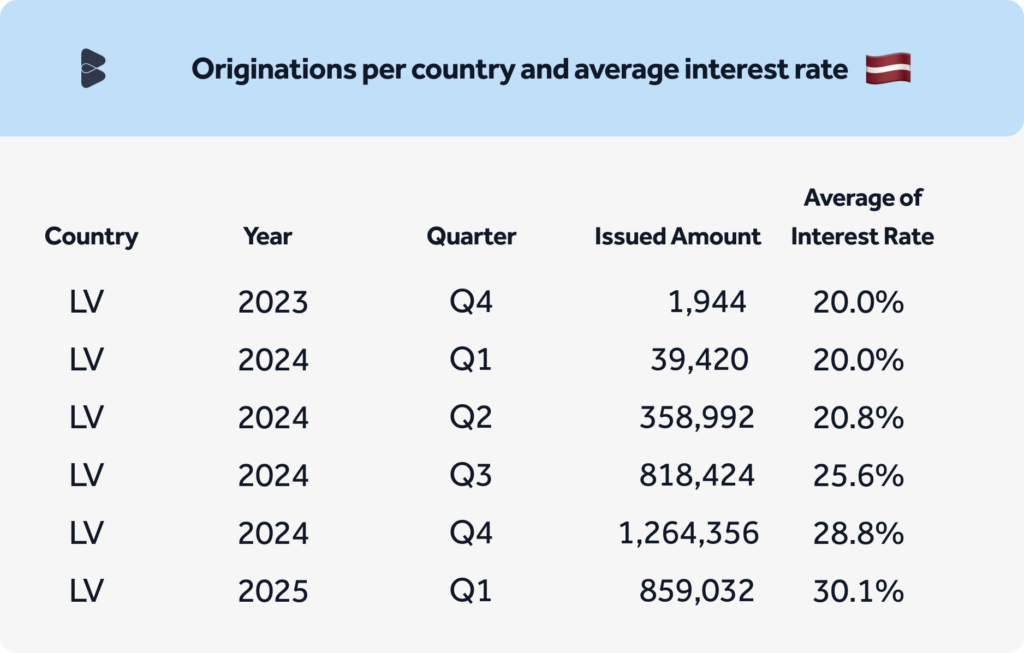

More statistics: Originations and interest rates per country

Another important factor for understanding portfolio health is where loans are being issued, at what average interest rate, and how that aligns with European banking regulations.

What you should know:

- Bondora Group’s loan originations are diversified across several EU markets, helping to spread and manage risk.

- Interest rates are tied to Central Bank regulations. For example:

- In the Netherlands, borrower rates were at 10.5% in 2024 but dropped to 9.7% in 2025 due to lower regulatory limits.

- In Finland, average rates on Go & Grow-linked loans have also slightly reduced from over 18% to 17.6%.

- In the Netherlands, borrower rates were at 10.5% in 2024 but dropped to 9.7% in 2025 due to lower regulatory limits.

- Our rates reflect fair, regulated lending – not excessive or opportunistic practices.

What this means for our investors

When you consider these new data points alongside the ones shared last week, a clear picture begins to emerge:

Bondora’s profitability and portfolio performance have continued to strengthen over time. This progress is a result of continuous refinements in our risk management, pricing models, and market diversification.

We want you to feel confident in your investment decisions, so we’re committed to keeping you informed every step of the way with transparent, timely, and meaningful updates.

More statistics updates are coming

We’ll continue rolling out new data to the Statistics page and through blog posts like this one.

At the bottom of the Statistics page, you’ll find a survey where you can share your feedback and let us know what additional data would be most valuable to you!

Haven’t seen the revamped Statistics page yet? Explore it here »

P.S. Our audited annual financial report will be published soon, giving you a broader look at Bondora’s financial performance in 2024. Stay tuned!