It’s always great to share extra special statistics with you. And this month, we can celebrate a brand-new loan origination record in Latvia. Despite it being a slightly slower month, overall loan and investment figures remain in the €20M ballpark.

Discover more exciting information about our October numbers and statistics, here:

Monthly new investor stats

In October, 1,970 more people created investor accounts with us. We’re thrilled that more and more people join Bondora to break the limits and reach their financial goals.

Have you referred your friends yet? Once they’ve completed the easy signup process and started investing, you and your friend can each earn a cash bonus! Refer them using your unique code from your Dashboard, and you and your friends could each get an investment bonus.

Investments in October

In October, our investors added €26,489,015 to their Go & Grow accounts. It is encouraging and rewarding to see so many of you stay committed to reaching your long-term financial goals.

Haven’t added to your investment this month yet? Log in and add money to your Go & Grow via the button below.

Returns earned by investors

Our investor community earned a total of €2,932,767 in returns in October. That’s compound interest working hard to help you get more out of your investment with less effort.

Investor question of the month

‘How much can I deposit to earn the 6.75% return during the campaign?’

Since 9 September, you can earn up to 6.75%* p.a. on your entire Go & Grow portfolio, plus any extra amount you invest over the monthly limit.

So whether you deposit €250 or €2,500, every euro you invest into Go & Grow until at least 2 January 2025, will earn up to 6.75%* p.a.

This higher return rate for investments over the monthly Go & Grow limit is valid until 2 January 2025. If the return rate changes after that, you will receive a 30-day advance notification.

Should the rate change after this time, any amount you have previously invested over the €1,000 monthly limit and that has not been auto-transferred will start earning the adjusted return.

If you want to read the original blog announcement with all the information, you can find it here.

Loan origination stats

In October, Bondora AS, part of Bondora Group, originated €22,850,923 in loans. It’s a slight 4.3% decline from the previous month.

In Finland, loan customers originated €12,869,397 worth of loans, a 6.6% decrease from September.

In the Netherlands, there was a 7.4% decrease from the previous month, but still, a substantial €4,840,576 worth of loans were originated.

In Estonia, loan originations were virtually the same as in September, with a total of €4,559,262 – a mere 0.6% decrease.

🎉We have a new record in Latvia! Latvian originations more than doubled to €581,688 worth of loans. This is the highest-ever loan origination amount for Bondora Group’s youngest credit market.

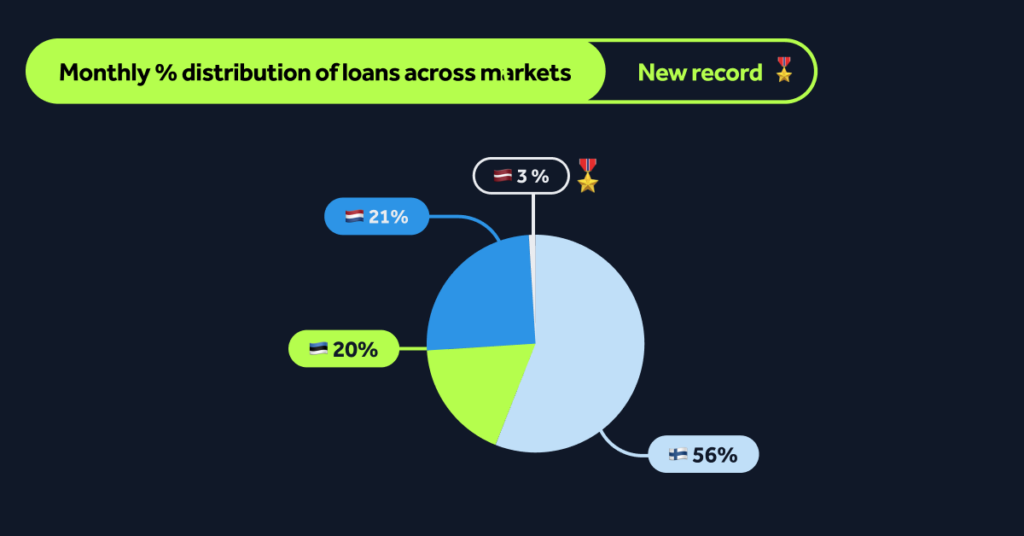

See from which markets the most originations came in October:

Despite a slight decline this month, Finland continues to hold the title as the market with the largest share of loan originations, 56.3%.

With 21.2% of all originations, The Netherlands remains the second-largest credit market.

This month, Estonia has a 20.0% share, increasing by 3.9% from September.

Thanks to the massive increase, Latvia has its largest share to date: 2.6%!

Instagram community

Are you following us on Instagram? If not, you’re missing out on updates, fun and educational content, exclusive behind-the-scenes moments, and more!

Thanks for following along with our October statistics. Stay tuned for more interesting numbers and stats coming soon.