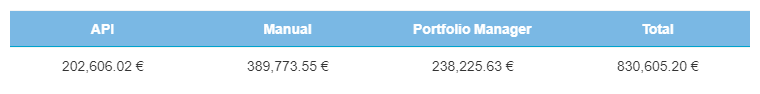

The Bondora secondary market continued its upswing in activity for the second consecutive month. Total secondary market transactions came to €830,605 in August, an increase of 10.6% on the month. Bondora users were much more apt in August to transact manually, with manual transactions up a staggering 54.8% to €389,733. Meanwhile, both API and Portfolio Manager transactions fell on the month.

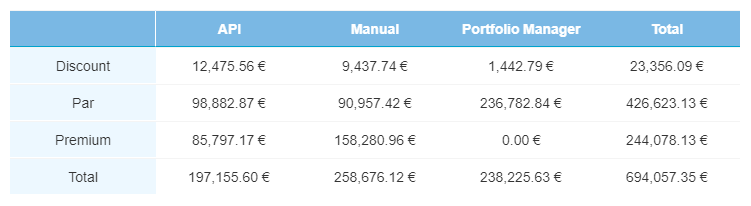

Current Loans

While current loans did make up the majority of the secondary market (83.6% of all transactions), there was actually a decrease in transactions of current loans in August. A total of €694,057 was transacted in current loans, a reduction of 1.0%. Leading the decline was Portfolio Manager transactions which declined by 15.3% from July.

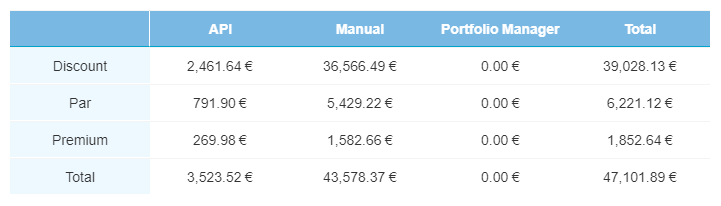

Overdue Loans

Overdue loan transactions total €47,101, an increase of 80.6% from July. All-told, overdue loans accounted for 3.5% of all secondary market transactions. As usual, no transactions were done via Portfolio Manager.

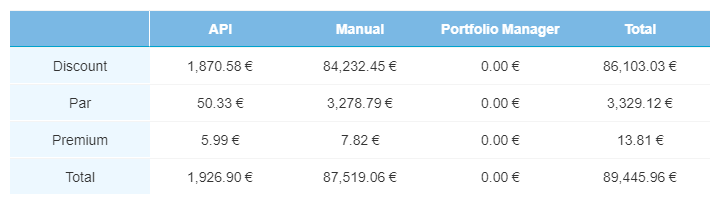

Defaulted Loans

In what’s a rarity, defaulted loan transactions jumped in August, and exceeded transactions of overdue loans on the month. Defaulted loan transactions rose by an astonishing 279% compared to the previous month, coming in at €89,445.

Defaulted loans transactions on the move

The increase in total secondary market transactions were driven in large part by defaulted loan transactions which rose 279% on the month. It is unclear why this jump occurred and if it will result in a long-term trend of more defaulted loan transactions. Regardless, investors should keep an eye on the secondary market in the coming months to see what trends emerge.

Always remember, investors should not seek higher returns from buying and selling loans on the Bondora secondary market.

You can learn more about the Bondora secondary market here, or contact an experienced Investor Relations Associate at investor@bondora.com.