Since 9 September, you can earn up to 6.75%* p.a. on your entire Go & Grow portfolio, plus any extra amount you invest over the monthly limit. And our investors have certainly made use of this return on their investments, as they added nearly €30M to their Go & Grow accounts in September.

Discover more exciting information about our September numbers and statistics.

Monthly new investors

In September, 2,047 more people created investor accounts with us. We’re thrilled that more people are joining us to break the limits and reach their financial goals.

Do you have friends who could also benefit from simple online investing? Refer them using your unique code from your Dashboard so you and your friends could each get an investment bonus.

Investments

In September, our investors added €29,544,644 to their Go & Grow accounts. We’re thrilled to see so many of you working towards reaching your long-term financial goals.

Returns earned by investors

Our investor community earned a total of €2,539,822 in returns in September. That’s the beauty of compound interest hard at work!

Investor question of the month

“I relocated to another country. Can I add my new phone number?”

If you have moved to another country within the EU/EEA, you can simply update and verify your new phone number from the Settings page on your Dashboard.

At this time, we don’t offer our investing services outside of the EU/EEA. If you have relocated our of the EU/EEA, you unfortunately cannot invest with us anymore.

If you find yourself in this situation, please write to our support team and provide them with the details below.

— Your new country of residence:

— Your new address:

— The date when you relocated there:

They will guide you on how to proceed and assist you further.

Loan originations

In September, Bondora Group originated €23,884,403 in loans. Although it is 13.3% lower than last month, it is still one of the highest amounts for the year so far.

In Finland, loan customers originated €13,780,977 worth of loans, an 11.2% decrease from August.

In the Netherlands, €5,225,688 worth of loans were originated. This is a 23.8% decrease from August.

In Estonia, there were €4,587,542 in loan originations—a 5.5% decrease from August.

Similarly, Latvian originations also dropped slightly, decreasing less than 5% to €290,196 in September.

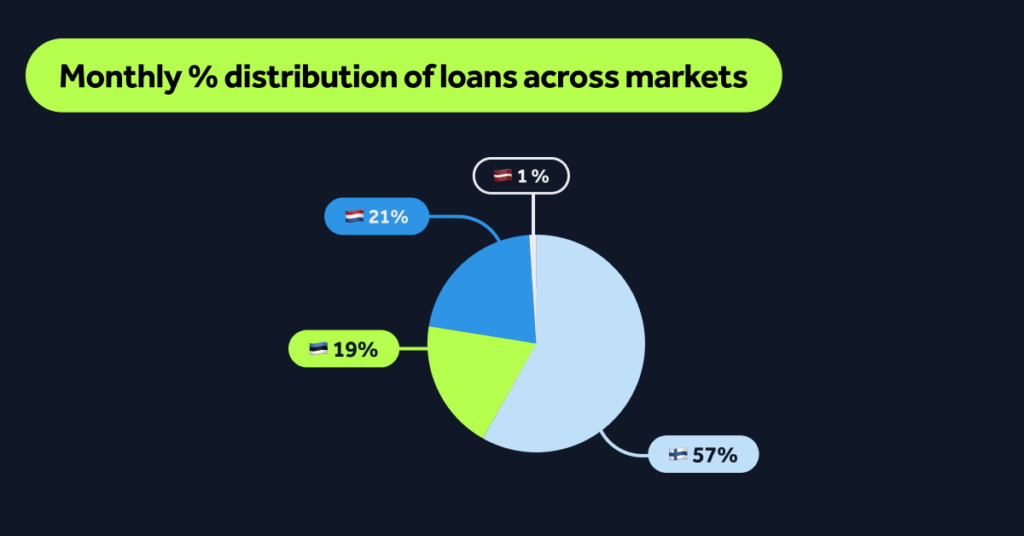

See from which markets the most originations came in September:

Finland continues to hold the title as the market with the largest share of loan originations, 57.7%.

Despite the large decline this month, the Netherlands remains the second-largest credit market, with 21.8% of all originations.

Estonia has a 19.2% share, increasing by 7.9% from August – its largest share to date!

Latvia continues to be in fourth place with a 1.2% share of originations.

Instagram community

Are you following us on Instagram? If not, you’re missing out on updates, fun and educational content, exclusive behind-the-scenes moments, and more!